Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to a third party at a discount, improving liquidity without increasing debt. Asset-based lending allows companies to borrow funds secured by assets such as inventory, equipment, or accounts receivable, often offering higher credit limits and flexible repayment terms. Explore the key differences and benefits to determine which financing solution suits your accounting needs best.

Why it is important

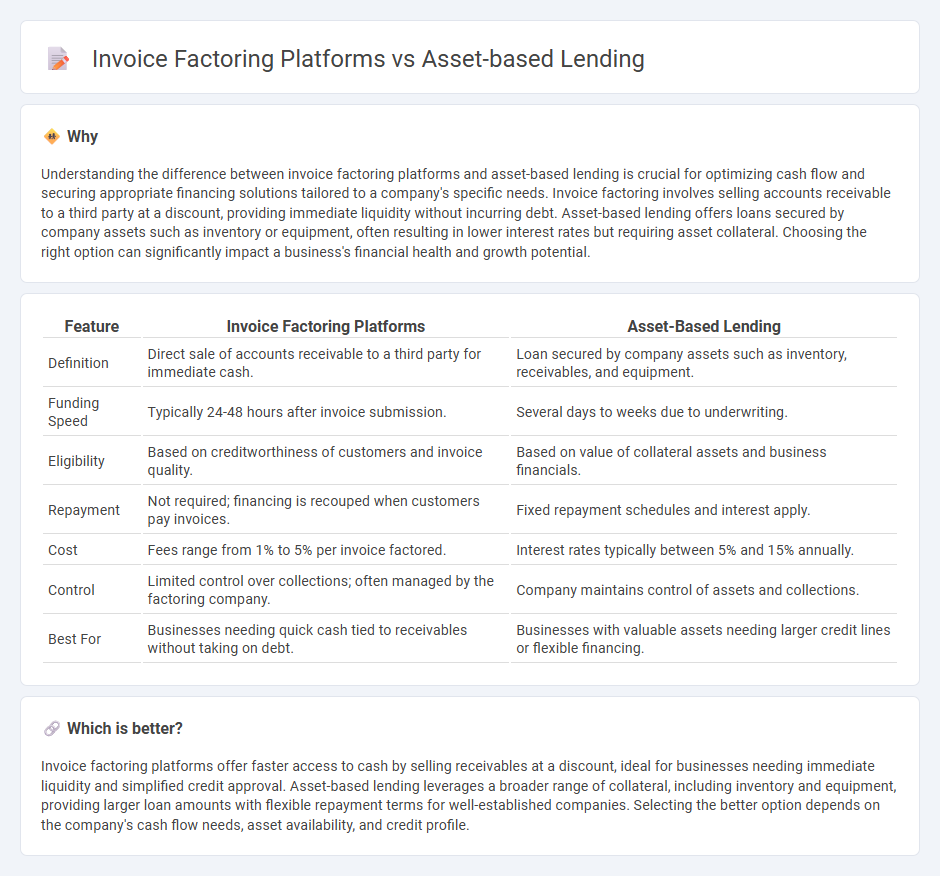

Understanding the difference between invoice factoring platforms and asset-based lending is crucial for optimizing cash flow and securing appropriate financing solutions tailored to a company's specific needs. Invoice factoring involves selling accounts receivable to a third party at a discount, providing immediate liquidity without incurring debt. Asset-based lending offers loans secured by company assets such as inventory or equipment, often resulting in lower interest rates but requiring asset collateral. Choosing the right option can significantly impact a business's financial health and growth potential.

Comparison Table

| Feature | Invoice Factoring Platforms | Asset-Based Lending |

|---|---|---|

| Definition | Direct sale of accounts receivable to a third party for immediate cash. | Loan secured by company assets such as inventory, receivables, and equipment. |

| Funding Speed | Typically 24-48 hours after invoice submission. | Several days to weeks due to underwriting. |

| Eligibility | Based on creditworthiness of customers and invoice quality. | Based on value of collateral assets and business financials. |

| Repayment | Not required; financing is recouped when customers pay invoices. | Fixed repayment schedules and interest apply. |

| Cost | Fees range from 1% to 5% per invoice factored. | Interest rates typically between 5% and 15% annually. |

| Control | Limited control over collections; often managed by the factoring company. | Company maintains control of assets and collections. |

| Best For | Businesses needing quick cash tied to receivables without taking on debt. | Businesses with valuable assets needing larger credit lines or flexible financing. |

Which is better?

Invoice factoring platforms offer faster access to cash by selling receivables at a discount, ideal for businesses needing immediate liquidity and simplified credit approval. Asset-based lending leverages a broader range of collateral, including inventory and equipment, providing larger loan amounts with flexible repayment terms for well-established companies. Selecting the better option depends on the company's cash flow needs, asset availability, and credit profile.

Connection

Invoice factoring platforms and asset-based lending both provide businesses with cash flow solutions by leveraging accounts receivable as collateral. Invoice factoring converts outstanding invoices into immediate working capital, while asset-based lending offers loans secured by various assets, including receivables, inventory, and equipment. These financing methods connect through their reliance on tangible business assets to improve liquidity and support operational expenses.

Key Terms

Collateral

Asset-based lending platforms provide financing secured by a company's tangible assets such as inventory, machinery, and accounts receivable, offering borrowers the ability to leverage multiple types of collateral for larger loan amounts. Invoice factoring platforms focus primarily on accounts receivable as collateral, purchasing outstanding invoices to provide immediate cash flow without incurring debt on the borrower's balance sheet. Explore the distinct collateral strategies of both platforms to determine which aligns best with your business financing needs.

Accounts Receivable

Asset-based lending leverages accounts receivable as collateral, providing borrowers with revolving credit lines tied directly to the value of their outstanding invoices. Invoice factoring platforms convert accounts receivable into immediate cash by selling invoices to a third party at a discount, often streamlining cash flow without increasing debt. Explore the differences and advantages of these financing methods to optimize your business's working capital strategy.

Advance Rate

Asset-based lending typically offers advance rates of 80% to 90% of the collateral value, such as accounts receivable or inventory, while invoice factoring platforms provide advance rates ranging from 70% to 95% of the invoice amount. The advance rate directly impacts liquidity, with higher rates enabling businesses to access more working capital quickly but often at the cost of higher fees or stricter qualification criteria. Explore detailed comparisons to understand which financing option offers the optimal advance rate for your business needs.

Source and External Links

Asset-Based Lending | ABL Finance - First Citizens Bank offers asset-based lending to help businesses leverage assets like accounts receivable, inventory, or fixed assets as collateral for loans or lines of credit.

Asset-Based Loans & Lines of Credit - First National Bank provides asset-based lending solutions using assets such as equipment, real estate, accounts receivable, or inventory to secure loans and lines of credit for business growth.

What Is Asset-Based Lending (ABL)? - American Express explains asset-based lending as a financing method that uses a company's assets, like inventory or real estate, as collateral to secure loans or lines of credit.

dowidth.com

dowidth.com