Crypto asset valuation requires recognizing the fluctuating market prices impacting fair value measurements, contrasting with amortized cost that records assets based on initial cost minus principal repayments and amortization. Fair value measurement reflects real-time market conditions, offering transparency and responsiveness, while amortized cost emphasizes stability and predictability in financial reporting. Explore detailed insights on how these valuation methods influence accounting practices for digital assets.

Why it is important

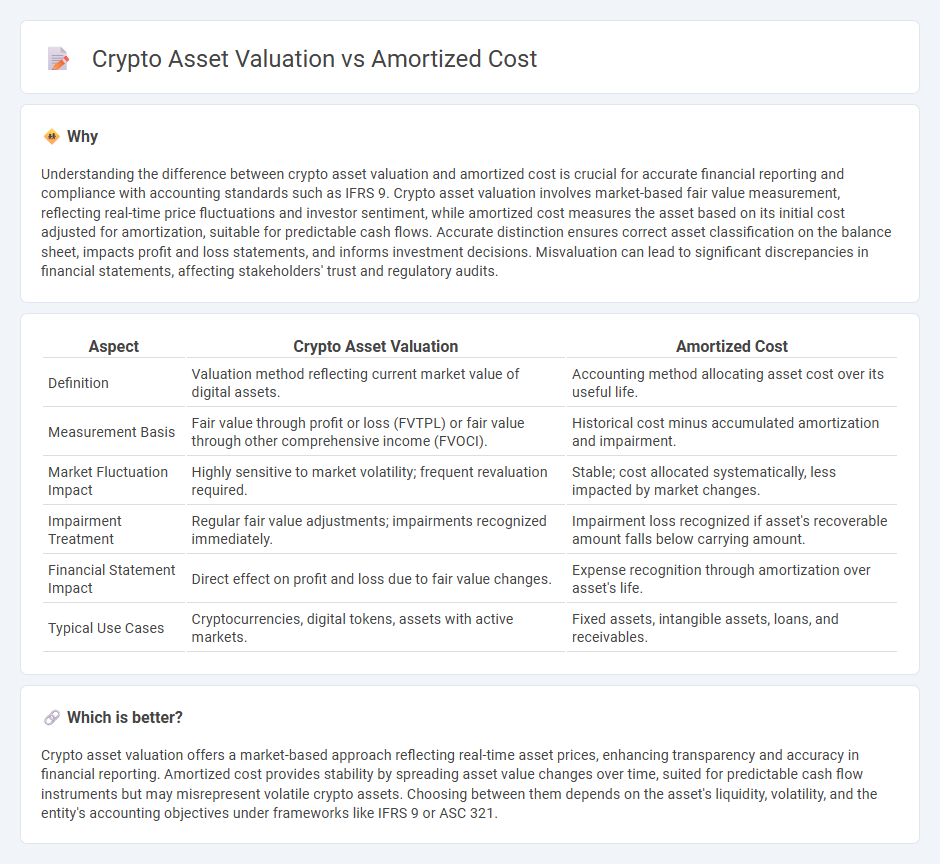

Understanding the difference between crypto asset valuation and amortized cost is crucial for accurate financial reporting and compliance with accounting standards such as IFRS 9. Crypto asset valuation involves market-based fair value measurement, reflecting real-time price fluctuations and investor sentiment, while amortized cost measures the asset based on its initial cost adjusted for amortization, suitable for predictable cash flows. Accurate distinction ensures correct asset classification on the balance sheet, impacts profit and loss statements, and informs investment decisions. Misvaluation can lead to significant discrepancies in financial statements, affecting stakeholders' trust and regulatory audits.

Comparison Table

| Aspect | Crypto Asset Valuation | Amortized Cost |

|---|---|---|

| Definition | Valuation method reflecting current market value of digital assets. | Accounting method allocating asset cost over its useful life. |

| Measurement Basis | Fair value through profit or loss (FVTPL) or fair value through other comprehensive income (FVOCI). | Historical cost minus accumulated amortization and impairment. |

| Market Fluctuation Impact | Highly sensitive to market volatility; frequent revaluation required. | Stable; cost allocated systematically, less impacted by market changes. |

| Impairment Treatment | Regular fair value adjustments; impairments recognized immediately. | Impairment loss recognized if asset's recoverable amount falls below carrying amount. |

| Financial Statement Impact | Direct effect on profit and loss due to fair value changes. | Expense recognition through amortization over asset's life. |

| Typical Use Cases | Cryptocurrencies, digital tokens, assets with active markets. | Fixed assets, intangible assets, loans, and receivables. |

Which is better?

Crypto asset valuation offers a market-based approach reflecting real-time asset prices, enhancing transparency and accuracy in financial reporting. Amortized cost provides stability by spreading asset value changes over time, suited for predictable cash flow instruments but may misrepresent volatile crypto assets. Choosing between them depends on the asset's liquidity, volatility, and the entity's accounting objectives under frameworks like IFRS 9 or ASC 321.

Connection

Crypto asset valuation relies on accurate amortized cost methods to measure the asset's carrying amount over time, reflecting purchase price adjusted for depreciation or impairment. Amortized cost provides a systematic approach to expense recognition, ensuring financial statements represent the crypto asset's net value realistically. This connection enhances transparency and compliance with accounting standards such as IFRS 9 and ASC 326 in crypto asset reporting.

Key Terms

Historical Cost

Historical Cost accounting records crypto assets at their original purchase price, providing a consistent and objective measure for amortized cost valuation. This method minimizes volatility by avoiding market fluctuations, offering stability in financial reporting for assets like Bitcoin or Ethereum. Explore how historical cost impacts long-term investment strategies and balance sheet transparency in crypto asset valuation.

Fair Value

Amortized cost accounting measures a crypto asset's value based on its initial investment adjusted for payments, often reflecting a more stable valuation during holding periods. Fair Value accounting captures the current market price, providing real-time insights into a crypto asset's worth but can introduce volatility. Explore how these valuation methods impact financial reporting and investment decisions in the crypto space.

Impairment

Amortized cost valuation of crypto assets measures the asset's initial cost adjusted for principal repayments and amortization, providing a stable value unless impairment occurs. Impairment testing is critical in this context, as it requires recognizing a loss when the asset's fair value falls below its amortized cost, reflecting a decline in recoverable value. Explore deeper insights into impairment processes and their impact on crypto asset accounting frameworks.

Source and External Links

Amortised Cost and Effective Interest Rate (IFRS 9) - Amortised cost is a measurement method for certain financial assets and liabilities which uses the effective interest rate to discount projected future cash flows to their present value, incorporating initial amounts, interest income/expense, repayments, and credit losses.

What is Amortized Cost? - Vintti - Amortized cost reflects the purchase price of a financial asset or liability adjusted over its lifetime for discounts, premiums, and payments, calculated using the effective interest rate method to spread these amounts and show a realistic investment value.

Amortized Costs - Infracost - Amortized cost in accounting spreads the expense of an asset over its expected useful life, taking into account factors like interest rates and residual value, which is essential for accurate cost allocation and financial understanding over time.

dowidth.com

dowidth.com