Deferred revenue recognition records income received before goods or services are delivered, reflecting a liability on the balance sheet until earned. Prepaid expenses represent payments made in advance for future benefits, recorded as assets and gradually expensed over time. Explore the key differences to improve financial reporting accuracy and compliance.

Why it is important

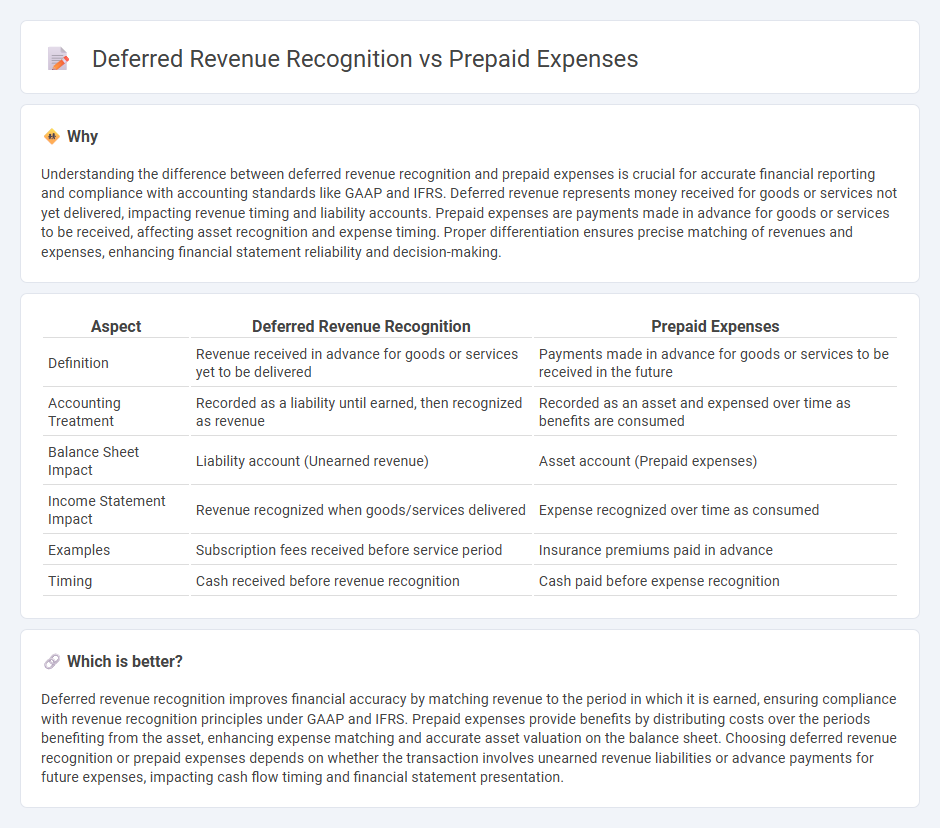

Understanding the difference between deferred revenue recognition and prepaid expenses is crucial for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Deferred revenue represents money received for goods or services not yet delivered, impacting revenue timing and liability accounts. Prepaid expenses are payments made in advance for goods or services to be received, affecting asset recognition and expense timing. Proper differentiation ensures precise matching of revenues and expenses, enhancing financial statement reliability and decision-making.

Comparison Table

| Aspect | Deferred Revenue Recognition | Prepaid Expenses |

|---|---|---|

| Definition | Revenue received in advance for goods or services yet to be delivered | Payments made in advance for goods or services to be received in the future |

| Accounting Treatment | Recorded as a liability until earned, then recognized as revenue | Recorded as an asset and expensed over time as benefits are consumed |

| Balance Sheet Impact | Liability account (Unearned revenue) | Asset account (Prepaid expenses) |

| Income Statement Impact | Revenue recognized when goods/services delivered | Expense recognized over time as consumed |

| Examples | Subscription fees received before service period | Insurance premiums paid in advance |

| Timing | Cash received before revenue recognition | Cash paid before expense recognition |

Which is better?

Deferred revenue recognition improves financial accuracy by matching revenue to the period in which it is earned, ensuring compliance with revenue recognition principles under GAAP and IFRS. Prepaid expenses provide benefits by distributing costs over the periods benefiting from the asset, enhancing expense matching and accurate asset valuation on the balance sheet. Choosing deferred revenue recognition or prepaid expenses depends on whether the transaction involves unearned revenue liabilities or advance payments for future expenses, impacting cash flow timing and financial statement presentation.

Connection

Deferred revenue recognition and prepaid expenses both involve timing adjustments in accounting to match revenues and expenses with the appropriate accounting periods. Deferred revenue represents cash received before services are performed or goods delivered, requiring recognition as revenue over time, while prepaid expenses reflect payments made in advance for future benefits, expensed progressively. Both accounts ensure accurate financial reporting by aligning cash flows with earned revenues and incurred expenses, enhancing the matching principle.

Key Terms

Asset

Prepaid expenses represent payments made for goods or services to be received in the future, classified as current assets on the balance sheet until they are recognized as expenses. Deferred revenue, on the other hand, is money received before earning it, recorded as a liability until the related revenue is recognized. Explore deeper insights on how these asset and liability treatments impact financial reporting and cash flow management.

Liability

Prepaid expenses are recorded as assets initially and expensed over time, reflecting the consumption of benefits previously paid for, whereas deferred revenue represents cash received before delivering goods or services, recorded as a liability until earned. Deferred revenue recognition directly impacts liabilities by increasing unearned revenue, which is reduced as revenue is recognized upon fulfillment of contractual obligations. Explore detailed accounting treatments and implications for accurate financial reporting of liabilities.

Unearned Revenue

Unearned revenue, a key component of deferred revenue, represents payments received before goods or services are delivered, requiring careful revenue recognition to match earning with delivery. Unlike prepaid expenses, which are advance payments made for future benefits, unearned revenue creates a liability until obligations are fulfilled. Explore advanced strategies and accounting standards for precise unearned revenue recognition to ensure compliance and accurate financial reporting.

Source and External Links

Prepaid Expenses: Definition, Examples & Journal Entries - SolveXia - Prepaid expenses are future costs paid in advance, recorded initially as assets (e.g., prepaid rent or insurance), and then expensed over time as the benefit is realized.

What are Prepaid Expenses? | F&A Glossary - BlackLine - Prepaid expenses are prepayments for recurring costs such as rent or insurance, treated as current assets because they represent future economic benefits that convert into expenses over time.

Prepaid Expenses: Definition, Examples & How to Record - Rippling - Prepaid expenses are advanced payments for goods or services recorded initially as assets and gradually expensed monthly or annually through adjusting journal entries.

dowidth.com

dowidth.com