Cryptotax focuses on the specialized accounting and tax issues related to cryptocurrency transactions, ensuring compliance with tax regulations for digital assets. Forensic accounting involves investigating financial records and transactions to detect fraud, embezzlement, or other financial crimes. Explore further to understand how these distinct accounting disciplines address unique regulatory challenges.

Why it is important

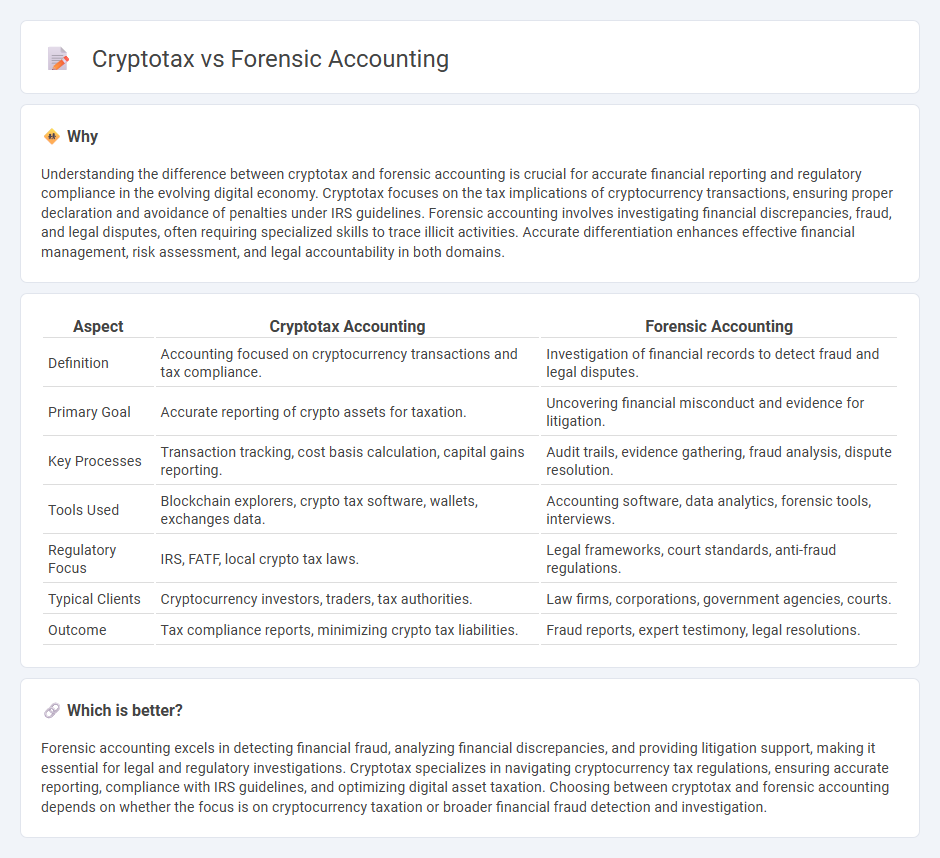

Understanding the difference between cryptotax and forensic accounting is crucial for accurate financial reporting and regulatory compliance in the evolving digital economy. Cryptotax focuses on the tax implications of cryptocurrency transactions, ensuring proper declaration and avoidance of penalties under IRS guidelines. Forensic accounting involves investigating financial discrepancies, fraud, and legal disputes, often requiring specialized skills to trace illicit activities. Accurate differentiation enhances effective financial management, risk assessment, and legal accountability in both domains.

Comparison Table

| Aspect | Cryptotax Accounting | Forensic Accounting |

|---|---|---|

| Definition | Accounting focused on cryptocurrency transactions and tax compliance. | Investigation of financial records to detect fraud and legal disputes. |

| Primary Goal | Accurate reporting of crypto assets for taxation. | Uncovering financial misconduct and evidence for litigation. |

| Key Processes | Transaction tracking, cost basis calculation, capital gains reporting. | Audit trails, evidence gathering, fraud analysis, dispute resolution. |

| Tools Used | Blockchain explorers, crypto tax software, wallets, exchanges data. | Accounting software, data analytics, forensic tools, interviews. |

| Regulatory Focus | IRS, FATF, local crypto tax laws. | Legal frameworks, court standards, anti-fraud regulations. |

| Typical Clients | Cryptocurrency investors, traders, tax authorities. | Law firms, corporations, government agencies, courts. |

| Outcome | Tax compliance reports, minimizing crypto tax liabilities. | Fraud reports, expert testimony, legal resolutions. |

Which is better?

Forensic accounting excels in detecting financial fraud, analyzing financial discrepancies, and providing litigation support, making it essential for legal and regulatory investigations. Cryptotax specializes in navigating cryptocurrency tax regulations, ensuring accurate reporting, compliance with IRS guidelines, and optimizing digital asset taxation. Choosing between cryptotax and forensic accounting depends on whether the focus is on cryptocurrency taxation or broader financial fraud detection and investigation.

Connection

Cryptotax and forensic accounting intersect through the detailed analysis of blockchain transactions to ensure tax compliance and uncover fraudulent activities. Forensic accountants leverage cryptotax data to trace illicit funds, identify tax evasion, and support legal investigations. This synergy enhances financial transparency and enforces regulatory adherence in the digital asset domain.

Key Terms

**Forensic Accounting:**

Forensic accounting involves the application of accounting principles to investigate financial discrepancies, fraud, and legal disputes, often requiring expertise in auditing, financial analysis, and legal frameworks. It plays a critical role in uncovering financial crimes by meticulously examining transactions, identifying anomalies, and providing evidence for litigation or regulatory actions. Discover how forensic accounting techniques can safeguard financial integrity and support legal proceedings.

Fraud Detection

Forensic accounting utilizes investigative accounting techniques and financial analysis to detect and prevent fraud by tracing asset misappropriation and financial statement manipulation. Cryptotax focuses on compliance and fraud detection within cryptocurrency transactions by analyzing blockchain data and ensuring accurate reporting of digital asset activities. Explore more to understand how both disciplines protect financial integrity through specialized fraud detection methods.

Litigation Support

Forensic accounting in litigation support involves analyzing financial records to uncover fraud, embezzlement, or financial discrepancies, providing expert testimony in court cases. Cryptotax litigation support requires specialized knowledge of blockchain transactions, digital wallets, and tax regulations to address disputes related to cryptocurrency reporting and compliance. Explore how these fields intersect and differ to enhance your understanding of financial dispute resolution.

Source and External Links

Forensic Accounting Career Overview - Forensic accountants use accounting and auditing skills to investigate financial crimes like fraud and embezzlement, support legal proceedings, audit finances, and assess financial risk, requiring expertise in accounting principles, financial laws, and data analysis.

What Is Forensic Accounting? - Forensic accounting combines accounting and investigative techniques to detect financial crimes by analyzing business and personal records, gathering evidence, and preparing reports to assist legal cases and fraud investigations.

What Is Forensic Accounting? - Forensic accountants investigate financial crimes by tracing funds, preparing expert witness reports, conducting criminal investigations, and assisting in mediation and arbitration of fraud claims, requiring an understanding of financial reporting in legal and investigative contexts.

dowidth.com

dowidth.com