Tax equity financing leverages tax benefits by partnering with investors who receive tax credits and deductions, primarily used in renewable energy projects to offset federal tax liabilities. Lease financing involves a lessee renting an asset from a lessor, offering operational flexibility without upfront capital investment, often applied in equipment and real estate transactions. Explore detailed comparisons to determine which financing option aligns with your business goals and tax strategy.

Why it is important

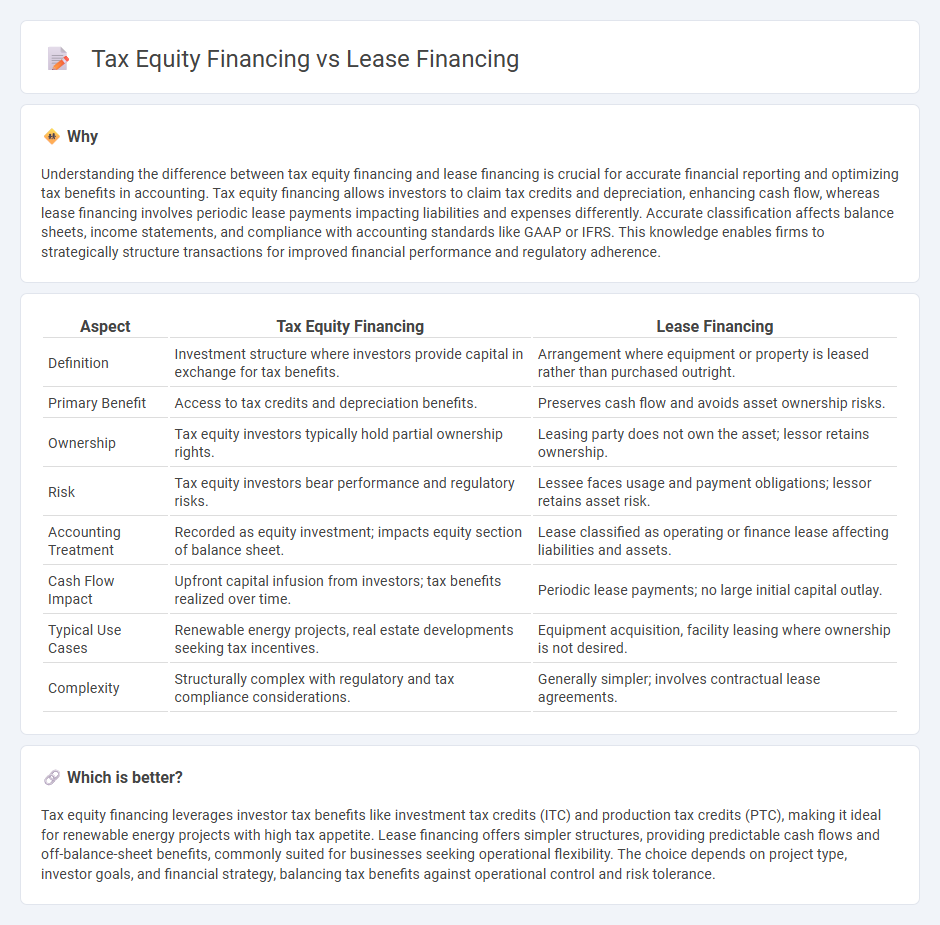

Understanding the difference between tax equity financing and lease financing is crucial for accurate financial reporting and optimizing tax benefits in accounting. Tax equity financing allows investors to claim tax credits and depreciation, enhancing cash flow, whereas lease financing involves periodic lease payments impacting liabilities and expenses differently. Accurate classification affects balance sheets, income statements, and compliance with accounting standards like GAAP or IFRS. This knowledge enables firms to strategically structure transactions for improved financial performance and regulatory adherence.

Comparison Table

| Aspect | Tax Equity Financing | Lease Financing |

|---|---|---|

| Definition | Investment structure where investors provide capital in exchange for tax benefits. | Arrangement where equipment or property is leased rather than purchased outright. |

| Primary Benefit | Access to tax credits and depreciation benefits. | Preserves cash flow and avoids asset ownership risks. |

| Ownership | Tax equity investors typically hold partial ownership rights. | Leasing party does not own the asset; lessor retains ownership. |

| Risk | Tax equity investors bear performance and regulatory risks. | Lessee faces usage and payment obligations; lessor retains asset risk. |

| Accounting Treatment | Recorded as equity investment; impacts equity section of balance sheet. | Lease classified as operating or finance lease affecting liabilities and assets. |

| Cash Flow Impact | Upfront capital infusion from investors; tax benefits realized over time. | Periodic lease payments; no large initial capital outlay. |

| Typical Use Cases | Renewable energy projects, real estate developments seeking tax incentives. | Equipment acquisition, facility leasing where ownership is not desired. |

| Complexity | Structurally complex with regulatory and tax compliance considerations. | Generally simpler; involves contractual lease agreements. |

Which is better?

Tax equity financing leverages investor tax benefits like investment tax credits (ITC) and production tax credits (PTC), making it ideal for renewable energy projects with high tax appetite. Lease financing offers simpler structures, providing predictable cash flows and off-balance-sheet benefits, commonly suited for businesses seeking operational flexibility. The choice depends on project type, investor goals, and financial strategy, balancing tax benefits against operational control and risk tolerance.

Connection

Tax equity financing and lease financing intersect through their shared goal of optimizing tax benefits for renewable energy projects. Tax equity financing provides investors with tax incentives like Investment Tax Credits (ITC) and Production Tax Credits (PTC), which are often passed through via lease agreements. Lease financing structures enable the allocation of these tax benefits to investors, facilitating capital investment while maximizing tax efficiencies in accounting for renewable asset depreciation and credits.

Key Terms

Ownership

Lease financing allows businesses to use assets without ownership, providing operational flexibility and off-balance-sheet advantages. Tax equity financing, primarily used in renewable energy projects, involves investors acquiring partial ownership to benefit from tax credits and incentives. Explore the distinctions further to understand which financing method aligns best with your ownership and tax strategy goals.

Depreciation Benefits

Lease financing allows companies to avoid owning assets directly, thus forgoing depreciation benefits but gaining off-balance-sheet treatment, while tax equity financing enables investors to receive significant tax credits and depreciation deductions like bonus depreciation and Modified Accelerated Cost Recovery System (MACRS). Depreciation benefits in tax equity structures reduce taxable income, enhancing project economics in renewable energy investments and other capital-intensive sectors. Explore further to understand the nuanced impact of depreciation on your financing strategy.

Tax Credits

Lease financing allows businesses to use assets without ownership, preserving capital and leveraging tax benefits indirectly, while tax equity financing directly involves investors providing capital in exchange for ownership interests to access federal tax credits such as the Investment Tax Credit (ITC) or Production Tax Credit (PTC). Tax equity structures are critical in renewable energy projects, enabling developers to monetize tax credits and accelerate project financing, whereas lease financing typically offers less immediate tax credit monetization. Explore the nuances of these financing options to optimize tax credit utilization and project capital structure.

Source and External Links

Finance lease - Wikipedia - A finance lease is a type of lease where the finance company owns the asset while the lessee uses it and pays installments with an option to own at the end, combining operational control with economic risks and benefits.

Lease financing: What is it? | Credibly - Lease financing allows businesses to use assets without owning them upfront by paying lease payments, offering cost-effectiveness, lower upfront costs, flexibility, and no dilution of ownership.

Lease Financing, Comptroller's Handbook - Lease financing involves the lessor as creditor recovering costs through lease payments and tax benefits, with accounting reflecting net investment in the lease based on receivables and residual values.

dowidth.com

dowidth.com