Cryptofinance reconciliation involves verifying transactions and balances within digital asset accounts, ensuring accuracy amid cryptocurrency volatility and blockchain complexities. Investment account reconciliation focuses on matching investment records, such as stocks, bonds, and mutual funds, with bank statements to confirm transactional accuracy and compliance. Discover deeper insights into how these reconciliation processes enhance financial transparency and control.

Why it is important

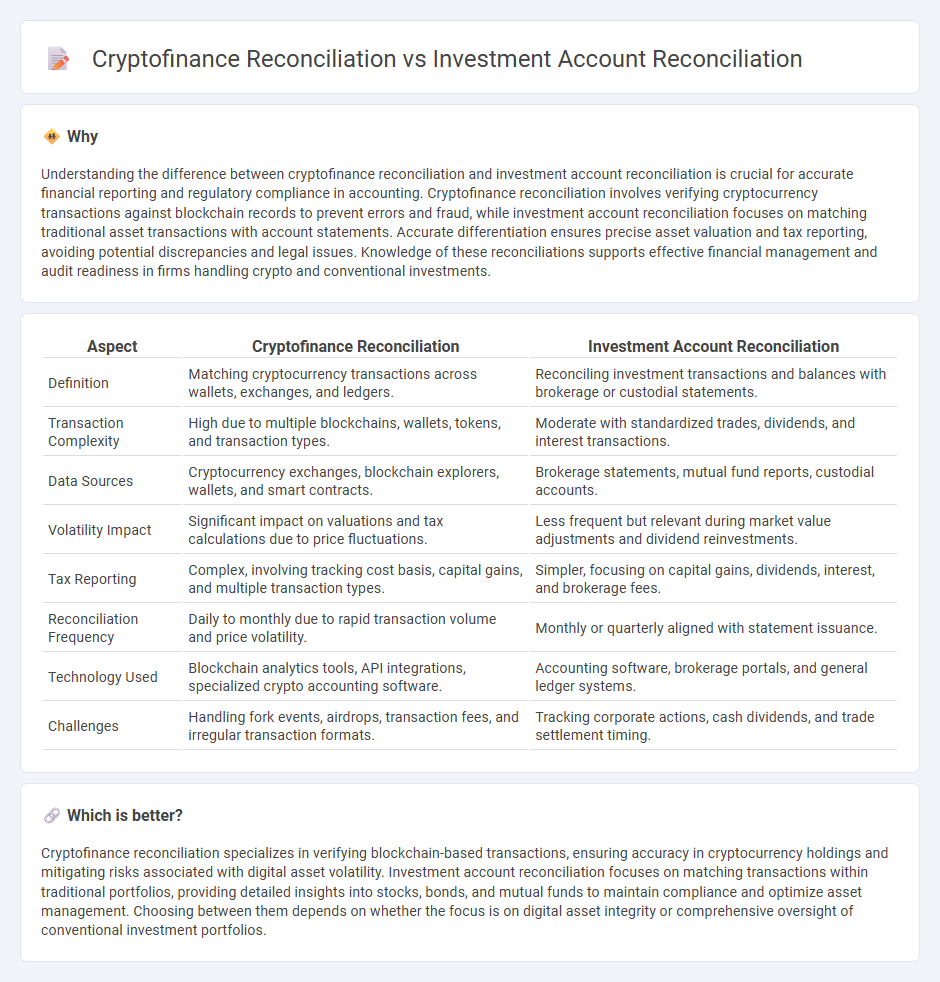

Understanding the difference between cryptofinance reconciliation and investment account reconciliation is crucial for accurate financial reporting and regulatory compliance in accounting. Cryptofinance reconciliation involves verifying cryptocurrency transactions against blockchain records to prevent errors and fraud, while investment account reconciliation focuses on matching traditional asset transactions with account statements. Accurate differentiation ensures precise asset valuation and tax reporting, avoiding potential discrepancies and legal issues. Knowledge of these reconciliations supports effective financial management and audit readiness in firms handling crypto and conventional investments.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Investment Account Reconciliation |

|---|---|---|

| Definition | Matching cryptocurrency transactions across wallets, exchanges, and ledgers. | Reconciling investment transactions and balances with brokerage or custodial statements. |

| Transaction Complexity | High due to multiple blockchains, wallets, tokens, and transaction types. | Moderate with standardized trades, dividends, and interest transactions. |

| Data Sources | Cryptocurrency exchanges, blockchain explorers, wallets, and smart contracts. | Brokerage statements, mutual fund reports, custodial accounts. |

| Volatility Impact | Significant impact on valuations and tax calculations due to price fluctuations. | Less frequent but relevant during market value adjustments and dividend reinvestments. |

| Tax Reporting | Complex, involving tracking cost basis, capital gains, and multiple transaction types. | Simpler, focusing on capital gains, dividends, interest, and brokerage fees. |

| Reconciliation Frequency | Daily to monthly due to rapid transaction volume and price volatility. | Monthly or quarterly aligned with statement issuance. |

| Technology Used | Blockchain analytics tools, API integrations, specialized crypto accounting software. | Accounting software, brokerage portals, and general ledger systems. |

| Challenges | Handling fork events, airdrops, transaction fees, and irregular transaction formats. | Tracking corporate actions, cash dividends, and trade settlement timing. |

Which is better?

Cryptofinance reconciliation specializes in verifying blockchain-based transactions, ensuring accuracy in cryptocurrency holdings and mitigating risks associated with digital asset volatility. Investment account reconciliation focuses on matching transactions within traditional portfolios, providing detailed insights into stocks, bonds, and mutual funds to maintain compliance and optimize asset management. Choosing between them depends on whether the focus is on digital asset integrity or comprehensive oversight of conventional investment portfolios.

Connection

Cryptofinance reconciliation and investment account reconciliation both involve verifying and matching transaction records to ensure accuracy and consistency in financial reporting. In cryptofinance reconciliation, blockchain-based transactions and digital asset holdings are cross-checked with exchange records and wallets, while investment account reconciliation reconciles portfolio transactions, dividends, and fees against custodial statements. Integrating these processes enhances transparency in managing diverse asset classes and streamlines financial audits across traditional and digital investment portfolios.

Key Terms

Cost Basis

Investment account reconciliation centers on verifying transaction accuracy and portfolio holdings, with cost basis calculations crucial for tax reporting and capital gains determination. Cryptofinance reconciliation involves tracking blockchain asset transfers and wallet balances, where cost basis computation faces challenges due to multiple wallets, tokens, and varying transaction fees. Explore comprehensive strategies to optimize cost basis tracking and compliance in both traditional and crypto investment reconciliations.

Digital Asset Valuation

Investment account reconciliation involves matching transactions and balances to ensure accuracy in traditional financial instruments like stocks and bonds, while Cryptofinance reconciliation focuses on digital assets such as cryptocurrencies and tokens, addressing the unique challenges of blockchain-based transactions. Digital asset valuation requires real-time market data integration, handling price volatility, and addressing discrepancies in decentralized ledger entries to maintain accurate financial reporting. Explore more to understand how advanced technologies streamline digital asset valuation in cryptofinance reconciliation.

Blockchain Transaction Ledger

Investment account reconciliation involves matching transaction records with bank statements to ensure accuracy and consistency, while Cryptofinance reconciliation focuses on validating blockchain transaction ledgers for decentralized asset verification and fraud prevention. Blockchain transaction ledgers provide immutable, time-stamped records that enhance transparency and traceability in cryptofinance, unlike traditional ledgers that rely on centralized verification processes. Explore the unique mechanisms and benefits of blockchain reconciliation to deepen your understanding of advanced financial record-keeping.

Source and External Links

Investment Reconciliation [examples, processes & best practices] - Investment reconciliation is the process of ensuring internal portfolio data matches custodians, brokers, and fund administrators, by comparing trades, positions, cash flows, corporate actions, P&L, and NAV to detect and resolve discrepancies for accurate investment management.

Reconcile Investments - IBM - Investment account reconciliation involves running reports that compare opening balances and transactions across group companies or owning companies, categorizing investments by consolidation methods to ensure accurate reporting and balance alignment.

Investment Reconciliation checklist | Manifestly Checklists - Investment reconciliation is a critical accounting process that compares internal investment records against external financial statements to verify accuracy, ensure correct income recognition, maintain regulatory compliance, and support reliable financial reporting.

dowidth.com

dowidth.com