Digital asset taxation involves unique regulatory frameworks and valuation challenges due to the decentralized nature and volatility of cryptocurrencies. Forex asset taxation typically follows established rules focusing on gains and losses from currency exchange rates between traditional fiat currencies. Explore our detailed guide to understand the key differences and compliance requirements for both digital and forex asset taxation.

Why it is important

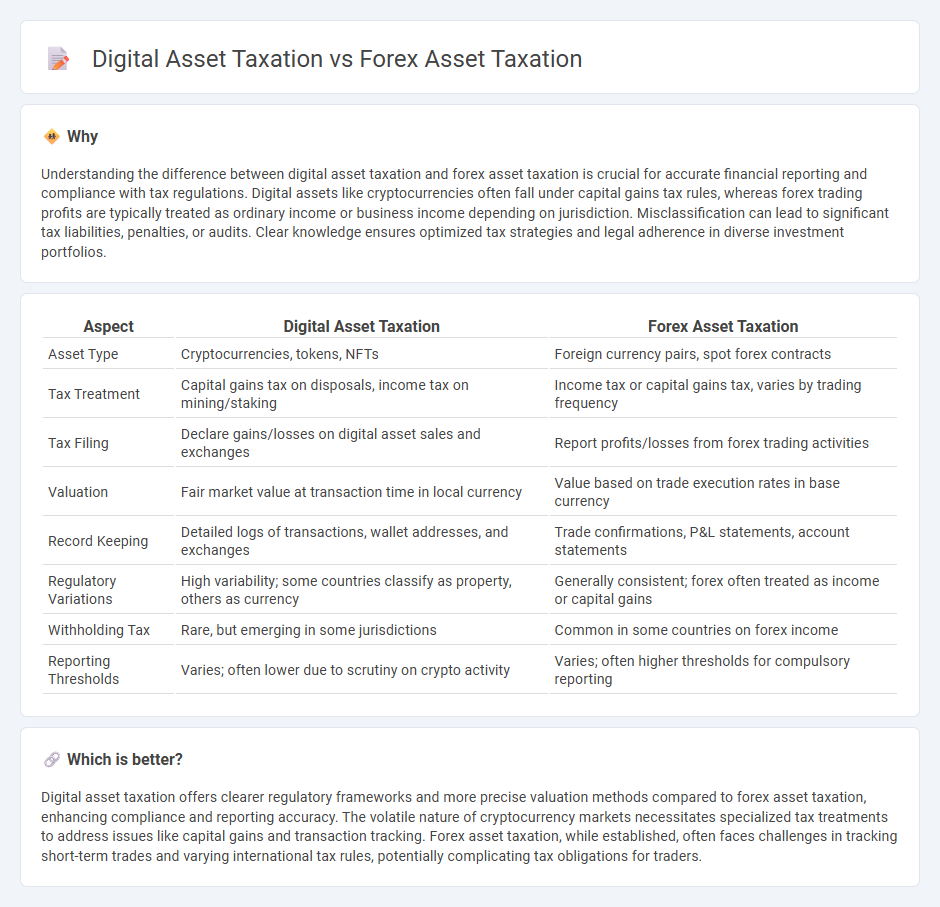

Understanding the difference between digital asset taxation and forex asset taxation is crucial for accurate financial reporting and compliance with tax regulations. Digital assets like cryptocurrencies often fall under capital gains tax rules, whereas forex trading profits are typically treated as ordinary income or business income depending on jurisdiction. Misclassification can lead to significant tax liabilities, penalties, or audits. Clear knowledge ensures optimized tax strategies and legal adherence in diverse investment portfolios.

Comparison Table

| Aspect | Digital Asset Taxation | Forex Asset Taxation |

|---|---|---|

| Asset Type | Cryptocurrencies, tokens, NFTs | Foreign currency pairs, spot forex contracts |

| Tax Treatment | Capital gains tax on disposals, income tax on mining/staking | Income tax or capital gains tax, varies by trading frequency |

| Tax Filing | Declare gains/losses on digital asset sales and exchanges | Report profits/losses from forex trading activities |

| Valuation | Fair market value at transaction time in local currency | Value based on trade execution rates in base currency |

| Record Keeping | Detailed logs of transactions, wallet addresses, and exchanges | Trade confirmations, P&L statements, account statements |

| Regulatory Variations | High variability; some countries classify as property, others as currency | Generally consistent; forex often treated as income or capital gains |

| Withholding Tax | Rare, but emerging in some jurisdictions | Common in some countries on forex income |

| Reporting Thresholds | Varies; often lower due to scrutiny on crypto activity | Varies; often higher thresholds for compulsory reporting |

Which is better?

Digital asset taxation offers clearer regulatory frameworks and more precise valuation methods compared to forex asset taxation, enhancing compliance and reporting accuracy. The volatile nature of cryptocurrency markets necessitates specialized tax treatments to address issues like capital gains and transaction tracking. Forex asset taxation, while established, often faces challenges in tracking short-term trades and varying international tax rules, potentially complicating tax obligations for traders.

Connection

Digital asset taxation and forex asset taxation are interconnected through their treatment as taxable financial instruments subject to capital gains and income tax regulations. Both asset types require accurate tracking of transactions, valuation at the point of exchange, and reporting to tax authorities to ensure compliance with local tax laws. Integration of blockchain technology in digital assets parallels forex transaction systems, enhancing transparency and auditability in tax reporting processes.

Key Terms

Capital Gains

Capital Gains taxation on forex assets is typically treated as ordinary income in many jurisdictions, with rates depending on the holding period and local tax laws. Digital asset capital gains, such as those from cryptocurrency trading, are often categorized separately with specific reporting requirements and may be subject to varying tax rates or exemptions depending on the asset classification. Explore detailed guidelines to optimize your tax strategy and ensure full compliance with evolving regulations.

Fair Market Value

Forex asset taxation hinges on the accurate determination of Fair Market Value (FMV) at the time of each trade, as gains and losses are calculated based on the currency exchange rates prevailing during transactions. Digital asset taxation also relies on FMV, typically assessed at the moment of acquiring, selling, or converting cryptocurrencies, reflecting their volatile market prices. Explore the nuances of FMV application in both asset categories to optimize tax compliance and reporting strategies.

Reporting Requirements

Forex asset taxation requires detailed reporting of gains and losses on currency trades, including transaction dates, amounts, and exchange rates. Digital asset taxation mandates disclosure of cryptocurrency transactions, token exchanges, and staking rewards with strict documentation of wallet addresses and transaction IDs to ensure compliance. Explore our comprehensive guide to understand the specific reporting requirements for each asset class.

Source and External Links

Taxation in the Forex market: what traders need to know - Forex earnings are taxed based on the trader's residency, with taxable income calculated as trading profits minus expenses, and in the US, gains can be subject to short-term capital gains rates (up to 37%) or split 60/40 between long-term and short-term capital gains depending on the instrument.

Forex Trading Taxes in the US - Updated 2025 - DailyForex - Spot Forex gains are taxed as ordinary income in the US, while regulated futures and options are taxed with 60% as long-term and 40% as short-term capital gains, and traders may qualify for additional tax benefits under "Trader Tax Status".

How to Pay Taxes on Gains Made from Forex Trading? - Axiory - In the US, 60% of gains from certain Forex instruments (under Section 1256) are taxed at 15%, while the remaining 40% is taxed at the trader's ordinary income tax rate, and losses can reduce taxable income if filed correctly.

dowidth.com

dowidth.com