Cryptocurrency auditing focuses on verifying digital asset transactions, ensuring blockchain integrity, and compliance with regulatory standards specific to decentralized currencies. Performance auditing evaluates an organization's financial operations, assessing efficiency, effectiveness, and adherence to accounting policies. Explore the key differences and critical insights in auditing methodologies for modern accounting practices.

Why it is important

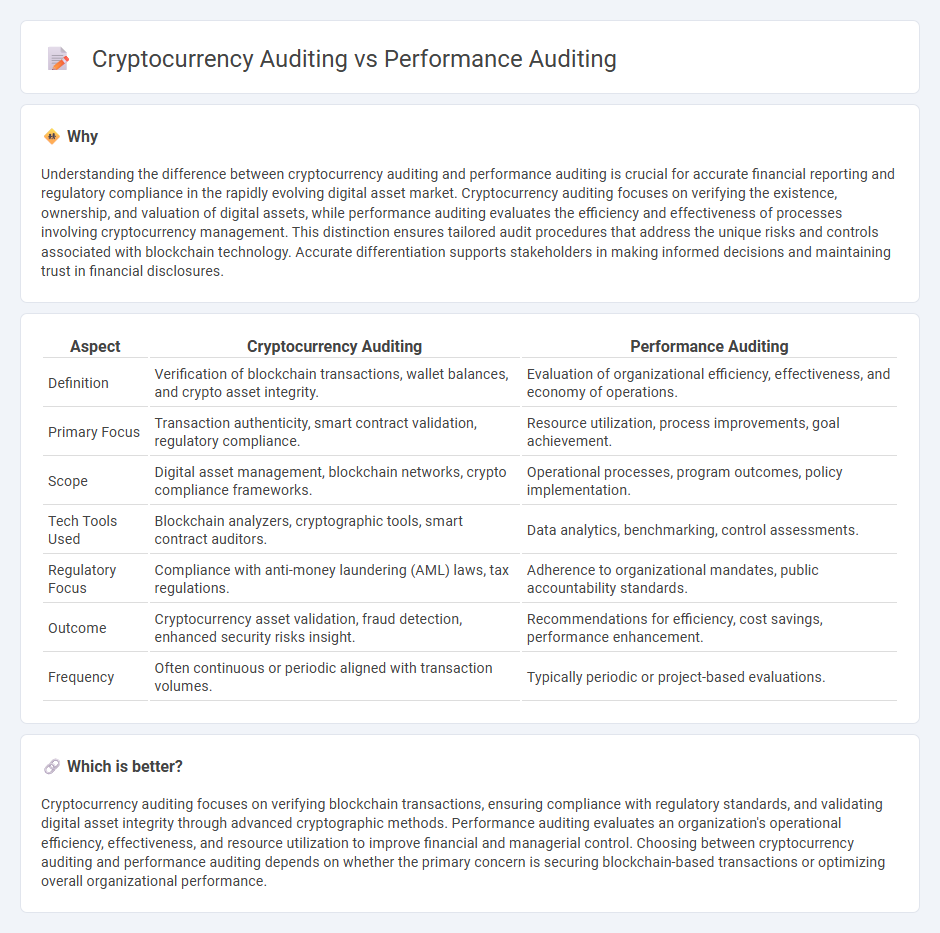

Understanding the difference between cryptocurrency auditing and performance auditing is crucial for accurate financial reporting and regulatory compliance in the rapidly evolving digital asset market. Cryptocurrency auditing focuses on verifying the existence, ownership, and valuation of digital assets, while performance auditing evaluates the efficiency and effectiveness of processes involving cryptocurrency management. This distinction ensures tailored audit procedures that address the unique risks and controls associated with blockchain technology. Accurate differentiation supports stakeholders in making informed decisions and maintaining trust in financial disclosures.

Comparison Table

| Aspect | Cryptocurrency Auditing | Performance Auditing |

|---|---|---|

| Definition | Verification of blockchain transactions, wallet balances, and crypto asset integrity. | Evaluation of organizational efficiency, effectiveness, and economy of operations. |

| Primary Focus | Transaction authenticity, smart contract validation, regulatory compliance. | Resource utilization, process improvements, goal achievement. |

| Scope | Digital asset management, blockchain networks, crypto compliance frameworks. | Operational processes, program outcomes, policy implementation. |

| Tech Tools Used | Blockchain analyzers, cryptographic tools, smart contract auditors. | Data analytics, benchmarking, control assessments. |

| Regulatory Focus | Compliance with anti-money laundering (AML) laws, tax regulations. | Adherence to organizational mandates, public accountability standards. |

| Outcome | Cryptocurrency asset validation, fraud detection, enhanced security risks insight. | Recommendations for efficiency, cost savings, performance enhancement. |

| Frequency | Often continuous or periodic aligned with transaction volumes. | Typically periodic or project-based evaluations. |

Which is better?

Cryptocurrency auditing focuses on verifying blockchain transactions, ensuring compliance with regulatory standards, and validating digital asset integrity through advanced cryptographic methods. Performance auditing evaluates an organization's operational efficiency, effectiveness, and resource utilization to improve financial and managerial control. Choosing between cryptocurrency auditing and performance auditing depends on whether the primary concern is securing blockchain-based transactions or optimizing overall organizational performance.

Connection

Cryptocurrency auditing intersects with performance auditing by evaluating the efficiency and effectiveness of blockchain operations within financial systems. Performance auditing assesses the accuracy of crypto asset management, internal controls, and compliance with regulatory standards, ensuring transparency and risk mitigation. Integrating these audits helps organizations optimize cryptocurrency transactions and safeguard digital asset integrity.

Key Terms

**Performance Auditing:**

Performance auditing assesses the efficiency, effectiveness, and economy of government programs or organizational operations, using systematic evaluation methods and compliance benchmarks. It focuses on optimizing resource use, improving operational procedures, and achieving strategic objectives aligned with public or corporate accountability standards. Discover more about how performance auditing drives informed decision-making and enhances organizational impact.

Efficiency

Performance auditing assesses organizational efficiency by evaluating resource utilization, process effectiveness, and goal achievement, ensuring optimal operations. Cryptocurrency auditing focuses on verifying blockchain transactions, smart contract integrity, and asset security to enhance the efficiency and transparency of digital asset management. Explore detailed methodologies and tools used in both audits to maximize operational efficiency.

Effectiveness

Performance auditing evaluates an organization's processes and resource utilization to determine how effectively objectives are met, emphasizing value for money and operational efficiency. Cryptocurrency auditing focuses on verifying the accuracy and security of blockchain transactions and digital asset management to ensure compliance and safeguard against fraud. Explore more to understand how these auditing types enhance transparency and accountability in different sectors.

Source and External Links

How to Conduct a Performance Audit | TN.gov - Performance audits provide objective analysis to assist management in improving operational performance, reducing costs, and facilitating informed decision-making by assessing program effectiveness, economy, efficiency, internal controls, and compliance with laws and regulations.

Chapter 1 - What is performance auditing? - Performance auditing evaluates the economy, efficiency, and effectiveness of government activities, aiming to promote accountability, transparency, and better governance by providing independent analysis and recommendations for improvement.

Performance Auditing - KPMG - Performance auditing assesses whether an organization's operations are economical, efficient, and effective in achieving strategic objectives, going beyond financial controls to examine management practices and suggest innovative solutions for improvement.

dowidth.com

dowidth.com