Embedded finance compliance demands rigorous adherence to regulatory standards that ensure secure and transparent financial integration within digital platforms. IFRS adoption standardizes financial reporting, enabling consistent interpretation and comparability of accounting statements across international boundaries. Explore how aligning embedded finance compliance with IFRS adoption can optimize financial governance and reporting accuracy.

Why it is important

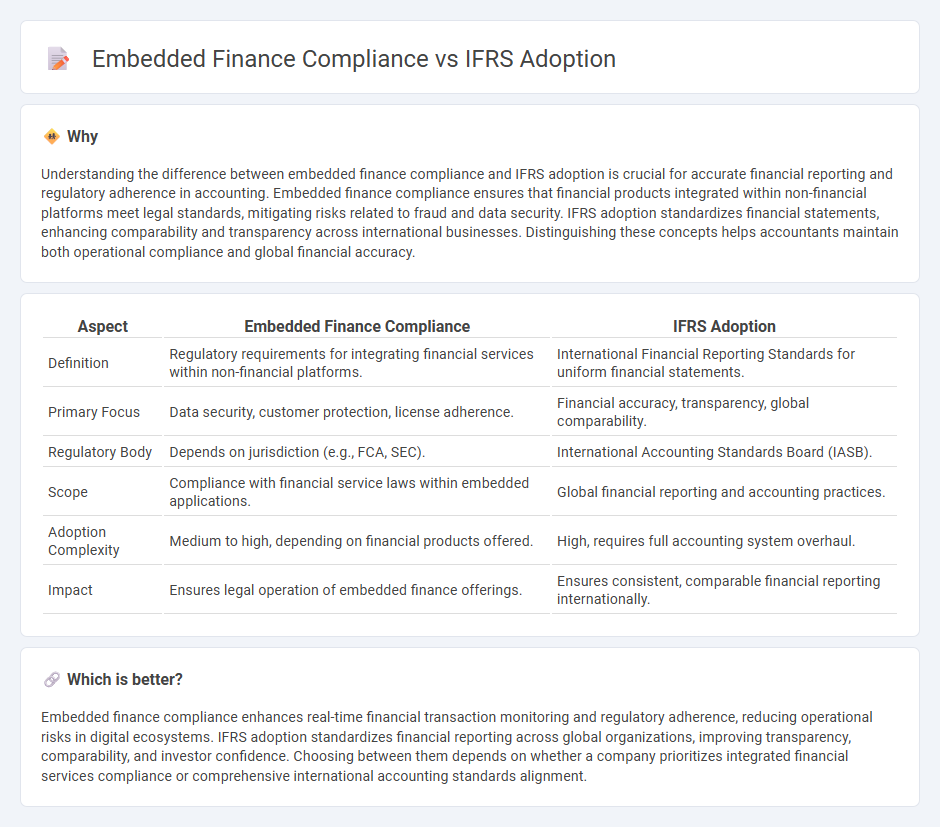

Understanding the difference between embedded finance compliance and IFRS adoption is crucial for accurate financial reporting and regulatory adherence in accounting. Embedded finance compliance ensures that financial products integrated within non-financial platforms meet legal standards, mitigating risks related to fraud and data security. IFRS adoption standardizes financial statements, enhancing comparability and transparency across international businesses. Distinguishing these concepts helps accountants maintain both operational compliance and global financial accuracy.

Comparison Table

| Aspect | Embedded Finance Compliance | IFRS Adoption |

|---|---|---|

| Definition | Regulatory requirements for integrating financial services within non-financial platforms. | International Financial Reporting Standards for uniform financial statements. |

| Primary Focus | Data security, customer protection, license adherence. | Financial accuracy, transparency, global comparability. |

| Regulatory Body | Depends on jurisdiction (e.g., FCA, SEC). | International Accounting Standards Board (IASB). |

| Scope | Compliance with financial service laws within embedded applications. | Global financial reporting and accounting practices. |

| Adoption Complexity | Medium to high, depending on financial products offered. | High, requires full accounting system overhaul. |

| Impact | Ensures legal operation of embedded finance offerings. | Ensures consistent, comparable financial reporting internationally. |

Which is better?

Embedded finance compliance enhances real-time financial transaction monitoring and regulatory adherence, reducing operational risks in digital ecosystems. IFRS adoption standardizes financial reporting across global organizations, improving transparency, comparability, and investor confidence. Choosing between them depends on whether a company prioritizes integrated financial services compliance or comprehensive international accounting standards alignment.

Connection

Embedded finance compliance ensures accurate financial data integration critical for adhering to IFRS standards during reporting processes. Adopting IFRS frameworks streamlines the recognition and measurement of embedded financial services within accounting systems. This connection enhances transparency and consistency in financial disclosures across global markets.

Key Terms

Financial Reporting Standards

IFRS adoption requires comprehensive alignment of financial reporting practices to ensure transparency, comparability, and accuracy in financial statements across global markets. Embedded finance compliance demands adherence to specific regulatory frameworks that govern integration of financial services within non-financial platforms, impacting disclosures and risk management under IFRS. Explore in-depth insights to understand their synergistic effects on corporate reporting and regulatory adherence.

Regulatory Framework

IFRS adoption involves aligning financial reporting with international accounting standards to ensure transparency and comparability across global markets, while embedded finance compliance centers on adhering to specific financial regulations integrated within non-financial platforms, such as data privacy, anti-money laundering (AML), and payment services directives. Regulatory frameworks for IFRS are established by the International Accounting Standards Board (IASB), whereas embedded finance compliance is governed by regional financial authorities like the Financial Conduct Authority (FCA) in the UK or the Consumer Financial Protection Bureau (CFPB) in the US. Discover comprehensive insights into navigating these regulatory landscapes effectively.

Risk Management

IFRS adoption enhances risk management by improving financial transparency and consistency in reporting, which aids in identifying potential risks early. Embedded finance compliance requires robust risk controls to safeguard sensitive financial data and ensure regulatory adherence across integrated financial services. Discover how aligning IFRS standards with embedded finance compliance can optimize your risk management strategies.

Source and External Links

The Inevitable United States Adoption of IFRS - Discusses IFRS as a global set of financial reporting standards adopted by 143 countries and argues the U.S. adoption of IFRS is inevitable and beneficial for international uniformity in financial reporting.

International Financial Reporting Standards - Wikipedia - Explains that IFRS standards are required or permitted in 132 jurisdictions worldwide including major economies, facilitating comparability and investment analysis across borders.

Use of IFRS standards by jurisdiction: United States - IFRS Foundation - Details that in the U.S., IFRS is permitted for foreign private issuers but not required for domestic public companies, which must use US GAAP; IFRS for SMEs is optionally recognized for private companies.

dowidth.com

dowidth.com