Lease accounting software specializes in managing lease contracts, ensuring compliance with accounting standards like ASC 842 and IFRS 16, while also automating lease liability calculations and amortization schedules. Billing and invoicing software focuses on generating invoices, tracking payments, and managing customer billing cycles to optimize cash flow and reduce revenue leakage. Explore how these distinct financial tools can improve your organization's accounting efficiency and accuracy.

Why it is important

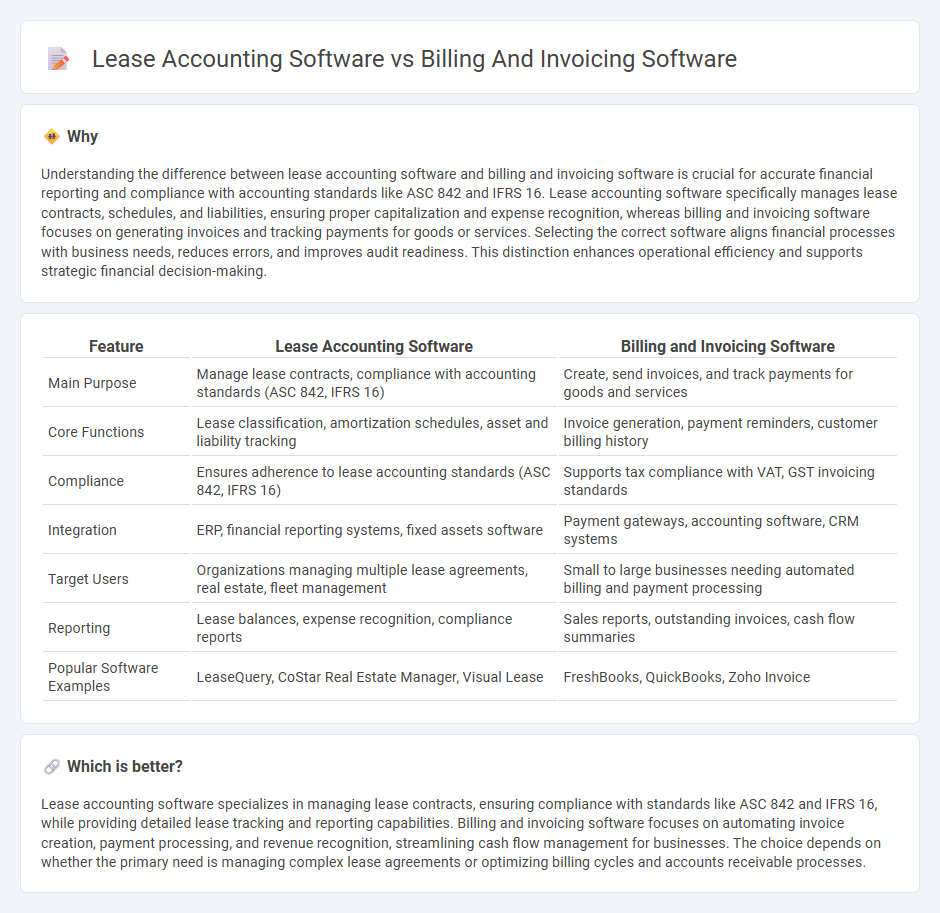

Understanding the difference between lease accounting software and billing and invoicing software is crucial for accurate financial reporting and compliance with accounting standards like ASC 842 and IFRS 16. Lease accounting software specifically manages lease contracts, schedules, and liabilities, ensuring proper capitalization and expense recognition, whereas billing and invoicing software focuses on generating invoices and tracking payments for goods or services. Selecting the correct software aligns financial processes with business needs, reduces errors, and improves audit readiness. This distinction enhances operational efficiency and supports strategic financial decision-making.

Comparison Table

| Feature | Lease Accounting Software | Billing and Invoicing Software |

|---|---|---|

| Main Purpose | Manage lease contracts, compliance with accounting standards (ASC 842, IFRS 16) | Create, send invoices, and track payments for goods and services |

| Core Functions | Lease classification, amortization schedules, asset and liability tracking | Invoice generation, payment reminders, customer billing history |

| Compliance | Ensures adherence to lease accounting standards (ASC 842, IFRS 16) | Supports tax compliance with VAT, GST invoicing standards |

| Integration | ERP, financial reporting systems, fixed assets software | Payment gateways, accounting software, CRM systems |

| Target Users | Organizations managing multiple lease agreements, real estate, fleet management | Small to large businesses needing automated billing and payment processing |

| Reporting | Lease balances, expense recognition, compliance reports | Sales reports, outstanding invoices, cash flow summaries |

| Popular Software Examples | LeaseQuery, CoStar Real Estate Manager, Visual Lease | FreshBooks, QuickBooks, Zoho Invoice |

Which is better?

Lease accounting software specializes in managing lease contracts, ensuring compliance with standards like ASC 842 and IFRS 16, while providing detailed lease tracking and reporting capabilities. Billing and invoicing software focuses on automating invoice creation, payment processing, and revenue recognition, streamlining cash flow management for businesses. The choice depends on whether the primary need is managing complex lease agreements or optimizing billing cycles and accounts receivable processes.

Connection

Lease accounting software and billing and invoicing software are connected through their shared focus on managing financial transactions and compliance for businesses. Lease accounting software automates lease classification, payment schedules, and lease liabilities, while billing and invoicing software streamlines the generation of customer invoices and revenue recognition. Integration between the two ensures accurate tracking of lease payments and rental income, enhancing financial reporting and cash flow management.

Key Terms

Revenue Recognition

Billing and invoicing software streamlines the generation of customer bills and manages payment tracking, focusing primarily on transactional accuracy and cash flow management. Lease accounting software specializes in compliance with accounting standards such as ASC 842 and IFRS 16, ensuring precise revenue recognition by automating lease classification, amortization, and reporting. Explore detailed comparisons to understand which solution aligns best with your business's revenue recognition needs.

Accounts Receivable

Billing and invoicing software streamlines Accounts Receivable by automating invoice generation, payment tracking, and customer communication, enhancing cash flow and reducing errors. Lease accounting software focuses on managing lease contracts and compliance with accounting standards like ASC 842 and IFRS 16, integrating lease payments with AR processes for accurate financial reporting. Explore the benefits and features of each solution to optimize your company's Accounts Receivable management.

Lease Liability

Billing and invoicing software primarily manages customer payments, invoices, and revenue recognition, while lease accounting software specializes in tracking lease liabilities and complying with lease accounting standards like ASC 842 and IFRS 16. Lease accounting software calculates the present value of lease liabilities, monitors lease terms, and automates journal entries for right-of-use assets and lease liabilities. Explore more to understand how lease accounting software ensures accurate lease liability management and financial reporting compliance.

Source and External Links

Salesforce Revenue Cloud - Comprehensive, enterprise-grade cloud billing and invoicing platform designed for automating complex billing processes, managing subscriptions, and integrating with sales and CRM systems for end-to-end revenue lifecycle management.

Wave Financial Invoicing - Free, user-friendly invoicing software targeted at small businesses, featuring customizable templates, automated reminders, recurring billing, and seamless integration with accounting tools.

Zoho Invoice - No-cost, online invoicing app that allows small businesses to create, send, and track invoices, manage time and project billing, record expenses, and automate payment reminders.

dowidth.com

dowidth.com