Real-time expense management leverages digital tools to instantly capture, categorize, and track expenditures, enhancing accuracy and reducing manual errors common with paper-based receipts. Paper-based methods rely heavily on physical documents, leading to delayed processing, increased risk of lost receipts, and inefficient reconciliation. Explore how transitioning to digital expense solutions transforms financial workflows and improves organizational transparency.

Why it is important

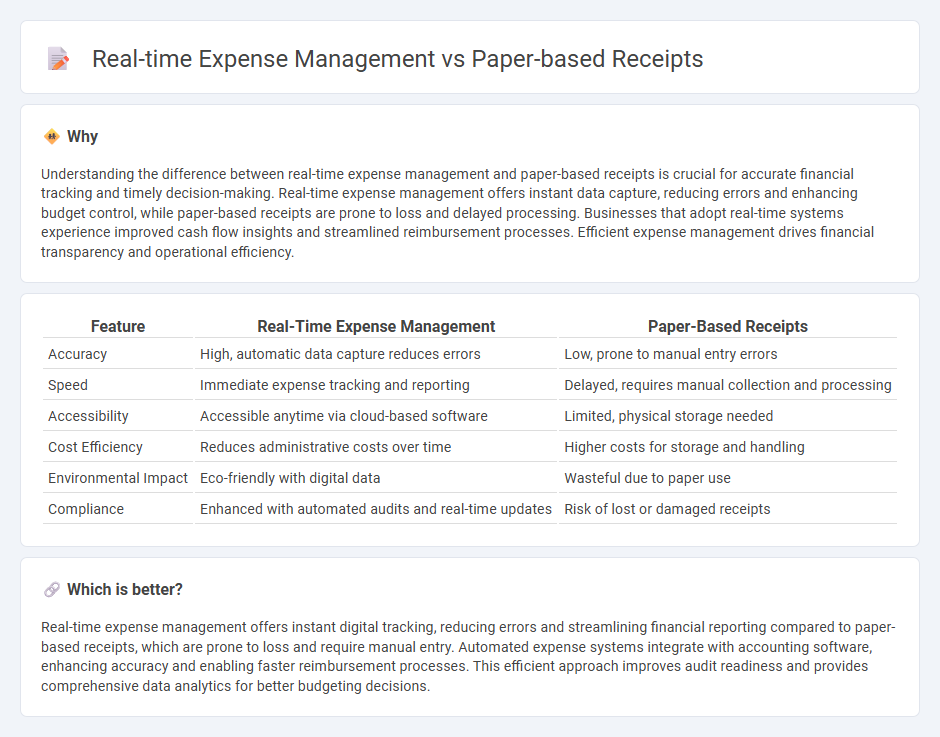

Understanding the difference between real-time expense management and paper-based receipts is crucial for accurate financial tracking and timely decision-making. Real-time expense management offers instant data capture, reducing errors and enhancing budget control, while paper-based receipts are prone to loss and delayed processing. Businesses that adopt real-time systems experience improved cash flow insights and streamlined reimbursement processes. Efficient expense management drives financial transparency and operational efficiency.

Comparison Table

| Feature | Real-Time Expense Management | Paper-Based Receipts |

|---|---|---|

| Accuracy | High, automatic data capture reduces errors | Low, prone to manual entry errors |

| Speed | Immediate expense tracking and reporting | Delayed, requires manual collection and processing |

| Accessibility | Accessible anytime via cloud-based software | Limited, physical storage needed |

| Cost Efficiency | Reduces administrative costs over time | Higher costs for storage and handling |

| Environmental Impact | Eco-friendly with digital data | Wasteful due to paper use |

| Compliance | Enhanced with automated audits and real-time updates | Risk of lost or damaged receipts |

Which is better?

Real-time expense management offers instant digital tracking, reducing errors and streamlining financial reporting compared to paper-based receipts, which are prone to loss and require manual entry. Automated expense systems integrate with accounting software, enhancing accuracy and enabling faster reimbursement processes. This efficient approach improves audit readiness and provides comprehensive data analytics for better budgeting decisions.

Connection

Real-time expense management streamlines financial tracking by instantly capturing and categorizing expenditures, reducing reliance on traditional paper-based receipts that often lead to delays and errors in reimbursement processes. Digital receipt capture technologies convert physical receipts into electronic records, enabling seamless integration with expense management software and improving accuracy. This connection enhances financial transparency, speeds up audit trails, and supports automated reporting within accounting systems.

Key Terms

Documentation

Paper-based receipts often lead to disorganized expense documentation, increasing the risk of lost or damaged records crucial for audits and tax purposes. Real-time expense management systems digitize and categorize receipts instantly, enhancing accuracy and accessibility while streamlining the documentation process. Discover how adopting digital solutions can transform your expense documentation efficiency.

Reconciliation

Paper-based receipts often lead to delayed and error-prone expense reconciliation due to manual data entry and physical document handling. Real-time expense management systems automate data capture, categorization, and syncing with accounting software, significantly reducing reconciliation time and improving accuracy. Explore how transitioning to digital expense management can streamline your financial workflows and enhance reconciliation efficiency.

Automation

Paper-based receipts present challenges such as manual data entry errors and delays in expense tracking, hindering timely financial decision-making. Real-time expense management leverages automation technologies like OCR (Optical Character Recognition) and AI-powered expense categorization to streamline processes and improve accuracy. Explore how automation transforms expense management efficiency and accuracy in modern financial workflows.

Source and External Links

What Are Paper Receipts? 7 Reasons They Are Losing ... - Paper receipts are physical proof of transactions still prevalent due to their tangibility, customer familiarity, accessibility without technology, and some businesses' technological limits, though digital alternatives are increasingly preferred for sustainability and convenience.

How Relevant Is a Paper Receipt Today? - Paper receipts remain popular because they do not require personal information to issue, avoid digital security concerns, and people often feel safer with a physical receipt than an electronic one.

What Is Receipt Paper Made Of? Top 3 Paper Types - Most receipt papers are thermal paper, wood-free paper, or carbonless paper, each serving different printing needs; thermal paper is most common but has raised health and environmental concerns.

dowidth.com

dowidth.com