Neobank reconciliation involves matching digital-only bank transaction records with internal financial data to ensure accuracy and detect discrepancies. Bank statement reconciliation compares traditional bank-issued paper or electronic statements with a company's ledger to verify transactions and balances. Discover more about the differences and best practices in reconciliation.

Why it is important

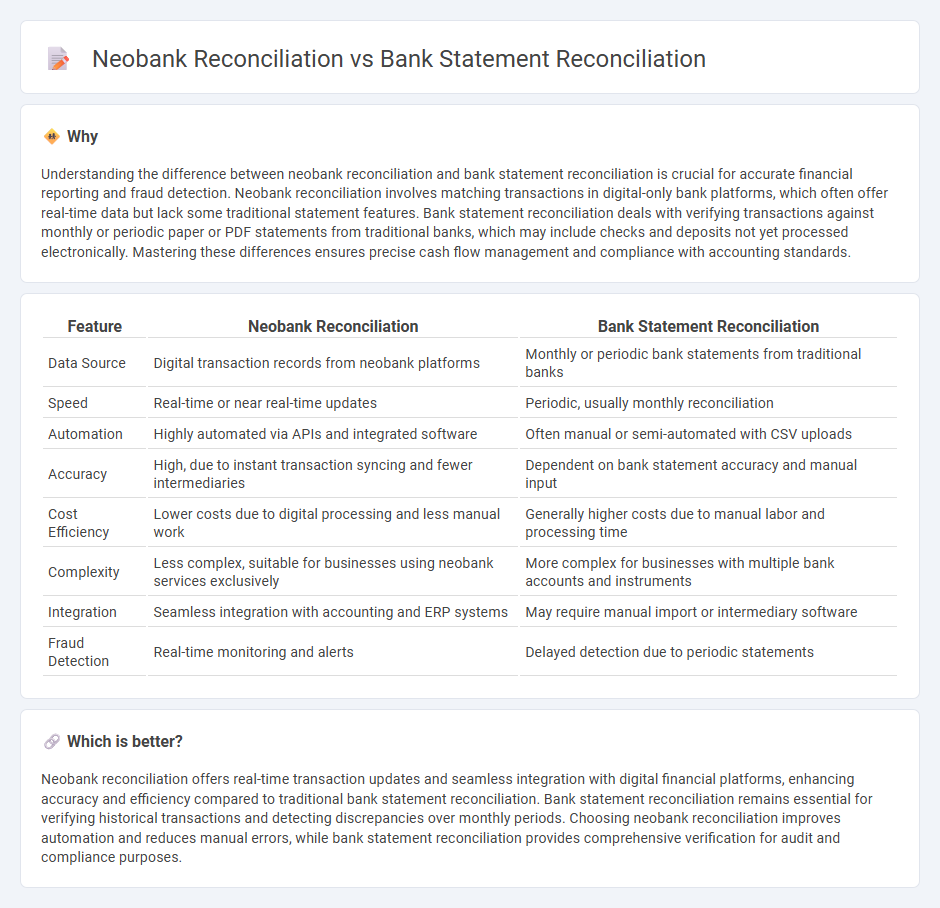

Understanding the difference between neobank reconciliation and bank statement reconciliation is crucial for accurate financial reporting and fraud detection. Neobank reconciliation involves matching transactions in digital-only bank platforms, which often offer real-time data but lack some traditional statement features. Bank statement reconciliation deals with verifying transactions against monthly or periodic paper or PDF statements from traditional banks, which may include checks and deposits not yet processed electronically. Mastering these differences ensures precise cash flow management and compliance with accounting standards.

Comparison Table

| Feature | Neobank Reconciliation | Bank Statement Reconciliation |

|---|---|---|

| Data Source | Digital transaction records from neobank platforms | Monthly or periodic bank statements from traditional banks |

| Speed | Real-time or near real-time updates | Periodic, usually monthly reconciliation |

| Automation | Highly automated via APIs and integrated software | Often manual or semi-automated with CSV uploads |

| Accuracy | High, due to instant transaction syncing and fewer intermediaries | Dependent on bank statement accuracy and manual input |

| Cost Efficiency | Lower costs due to digital processing and less manual work | Generally higher costs due to manual labor and processing time |

| Complexity | Less complex, suitable for businesses using neobank services exclusively | More complex for businesses with multiple bank accounts and instruments |

| Integration | Seamless integration with accounting and ERP systems | May require manual import or intermediary software |

| Fraud Detection | Real-time monitoring and alerts | Delayed detection due to periodic statements |

Which is better?

Neobank reconciliation offers real-time transaction updates and seamless integration with digital financial platforms, enhancing accuracy and efficiency compared to traditional bank statement reconciliation. Bank statement reconciliation remains essential for verifying historical transactions and detecting discrepancies over monthly periods. Choosing neobank reconciliation improves automation and reduces manual errors, while bank statement reconciliation provides comprehensive verification for audit and compliance purposes.

Connection

Neobank reconciliation leverages real-time transaction data from digital-only banks to streamline bank statement reconciliation processes, enhancing accuracy and efficiency. Both reconciliations involve verifying account balances by matching internal records with bank statements to identify discrepancies, errors, or unauthorized transactions. Integrating neobank reconciliation tools automates data syncing, reduces manual input errors, and accelerates financial reporting in accounting workflows.

Key Terms

**Bank Statement Reconciliation:**

Bank statement reconciliation involves verifying and matching the transactions listed in a bank statement with an organization's accounting records to identify discrepancies, errors, or fraudulent activity. This process ensures accuracy in financial records, helps manage cash flow effectively, and supports compliance with regulatory standards. Explore detailed steps and best practices to streamline your bank statement reconciliation process.

Bank Statement

Bank statement reconciliation involves verifying transactions listed in a traditional bank statement against internal records to identify discrepancies and ensure accuracy. Neobank reconciliation, while similar, typically incorporates digital-only transaction data and real-time updates provided by the neobank's online platform. Explore how these reconciliation processes enhance financial accuracy in modern banking environments.

Outstanding Checks

Outstanding checks significantly impact bank statement reconciliation by representing issued payments not yet cleared, causing discrepancies between the bank's records and the company's ledger. Neobank reconciliation often offers real-time updates and digital tools to track these outstanding checks more efficiently, reducing manual errors and improving cash flow accuracy. Explore the unique features of neobank reconciliation to optimize your financial management process.

Source and External Links

Bank Reconciliation: What It Is and How to Do It - This article provides a comprehensive overview of bank reconciliation, including a step-by-step guide on how to reconcile a bank statement with a company's financial records.

Definition & Example of Bank Reconciliation - This resource defines bank reconciliation and offers examples, highlighting its importance in financial accuracy and fraud detection.

How To Do a Bank Reconciliation? (8 Steps With Best Practices) - This blog post outlines an eight-step process for performing a bank reconciliation, emphasizing best practices for accuracy and control.

dowidth.com

dowidth.com