Decentralized ledger accounting distributes transaction records across multiple nodes, enhancing transparency and reducing the risk of fraud compared to traditional centralized systems. Digital ledger technology (DLT) underpins this approach by securely recording and verifying transactions using cryptographic methods, ensuring data integrity and real-time updates. Explore how these technologies revolutionize financial record-keeping and business operations.

Why it is important

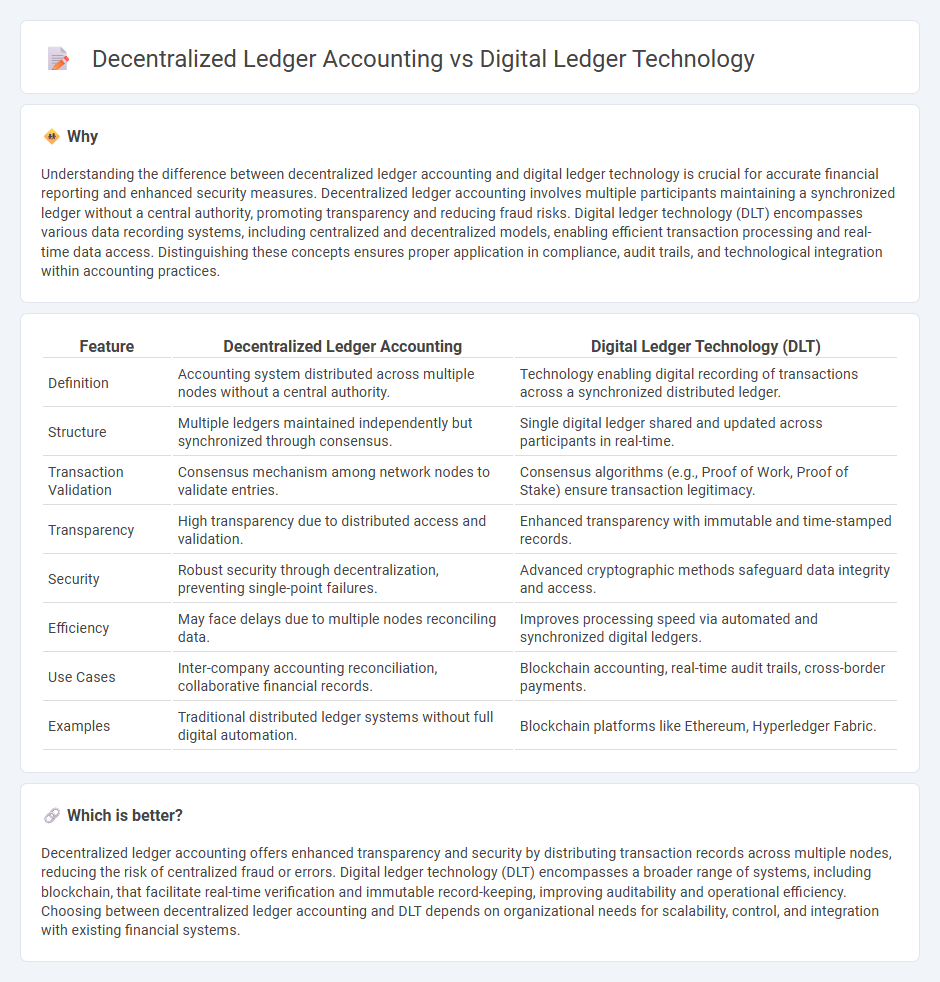

Understanding the difference between decentralized ledger accounting and digital ledger technology is crucial for accurate financial reporting and enhanced security measures. Decentralized ledger accounting involves multiple participants maintaining a synchronized ledger without a central authority, promoting transparency and reducing fraud risks. Digital ledger technology (DLT) encompasses various data recording systems, including centralized and decentralized models, enabling efficient transaction processing and real-time data access. Distinguishing these concepts ensures proper application in compliance, audit trails, and technological integration within accounting practices.

Comparison Table

| Feature | Decentralized Ledger Accounting | Digital Ledger Technology (DLT) |

|---|---|---|

| Definition | Accounting system distributed across multiple nodes without a central authority. | Technology enabling digital recording of transactions across a synchronized distributed ledger. |

| Structure | Multiple ledgers maintained independently but synchronized through consensus. | Single digital ledger shared and updated across participants in real-time. |

| Transaction Validation | Consensus mechanism among network nodes to validate entries. | Consensus algorithms (e.g., Proof of Work, Proof of Stake) ensure transaction legitimacy. |

| Transparency | High transparency due to distributed access and validation. | Enhanced transparency with immutable and time-stamped records. |

| Security | Robust security through decentralization, preventing single-point failures. | Advanced cryptographic methods safeguard data integrity and access. |

| Efficiency | May face delays due to multiple nodes reconciling data. | Improves processing speed via automated and synchronized digital ledgers. |

| Use Cases | Inter-company accounting reconciliation, collaborative financial records. | Blockchain accounting, real-time audit trails, cross-border payments. |

| Examples | Traditional distributed ledger systems without full digital automation. | Blockchain platforms like Ethereum, Hyperledger Fabric. |

Which is better?

Decentralized ledger accounting offers enhanced transparency and security by distributing transaction records across multiple nodes, reducing the risk of centralized fraud or errors. Digital ledger technology (DLT) encompasses a broader range of systems, including blockchain, that facilitate real-time verification and immutable record-keeping, improving auditability and operational efficiency. Choosing between decentralized ledger accounting and DLT depends on organizational needs for scalability, control, and integration with existing financial systems.

Connection

Decentralized ledger accounting relies on digital ledger technology (DLT) to record transactions across a distributed network, ensuring transparency and immutability. This connection enhances security by eliminating a central authority and reduces errors through consensus mechanisms inherent in blockchain systems. By integrating DLT, decentralized ledger accounting facilitates real-time auditing and efficient financial data management.

Key Terms

Blockchain

Digital ledger technology (DLT) encompasses various systems that record transactions across multiple locations, with blockchain being the most prominent type featuring a chain of cryptographically linked blocks. Decentralized ledger accounting specifically refers to the distributed management of accounting records without a central authority, ensuring enhanced transparency, immutability, and security through consensus mechanisms inherent in blockchain networks. Explore the transformative impact of blockchain-based decentralized ledger accounting on modern financial systems for deeper insights.

Smart Contracts

Digital ledger technology (DLT) encompasses a broad range of databases that are distributed across multiple locations, while decentralized ledger accounting specifically applies DLT in financial record-keeping without central authority. Smart contracts automate transaction processes within these ledgers by executing predefined rules, enhancing transparency and reducing settlement times. Explore the key differences and applications of smart contracts in DLT and decentralized ledger accounting to unlock their transformative potential.

Consensus Mechanism

Digital Ledger Technology (DLT) employs various consensus mechanisms such as Proof of Work (PoW) and Proof of Stake (PoS) to validate transactions and maintain data integrity across distributed networks. Decentralized Ledger Accounting (DLA) emphasizes consensus protocols tailored for financial transparency and auditability, often integrating Byzantine Fault Tolerance (BFT) variants to ensure accuracy and fault resistance. Explore more to understand how consensus mechanisms shape security and efficiency in these evolving ledger systems.

Source and External Links

What is distributed ledger technology (DLT)? - Distributed ledger technology is a digital system that records asset transactions simultaneously in multiple places using a decentralized peer-to-peer network, ensuring transparency, immutability, and no reliance on a central authority for validation.

Distributed ledger - Distributed ledger technology (DLT) is a synchronized digital database spread across multiple geographical locations or institutions, relying on consensus algorithms and cryptography to maintain data integrity without a central administrator.

What are distributed ledger technologies? - DLTs enable secure, cost-efficient transactions without intermediaries by distributing control of a shared ledger among participants, offering a tamper-evident and trustless network that supports unrestricted access and transaction speed.

dowidth.com

dowidth.com