Cryptocurrency taxation requires precise reporting of digital asset transactions, with the IRS mandating Form 8949 for detailed capital gains and losses documentation. Form 8949 captures essential transaction data such as acquisition dates, sale dates, cost basis, and proceeds to ensure compliance with IRS regulations. Explore the complexities of cryptocurrency taxation and Form 8949 reporting to stay informed and compliant.

Why it is important

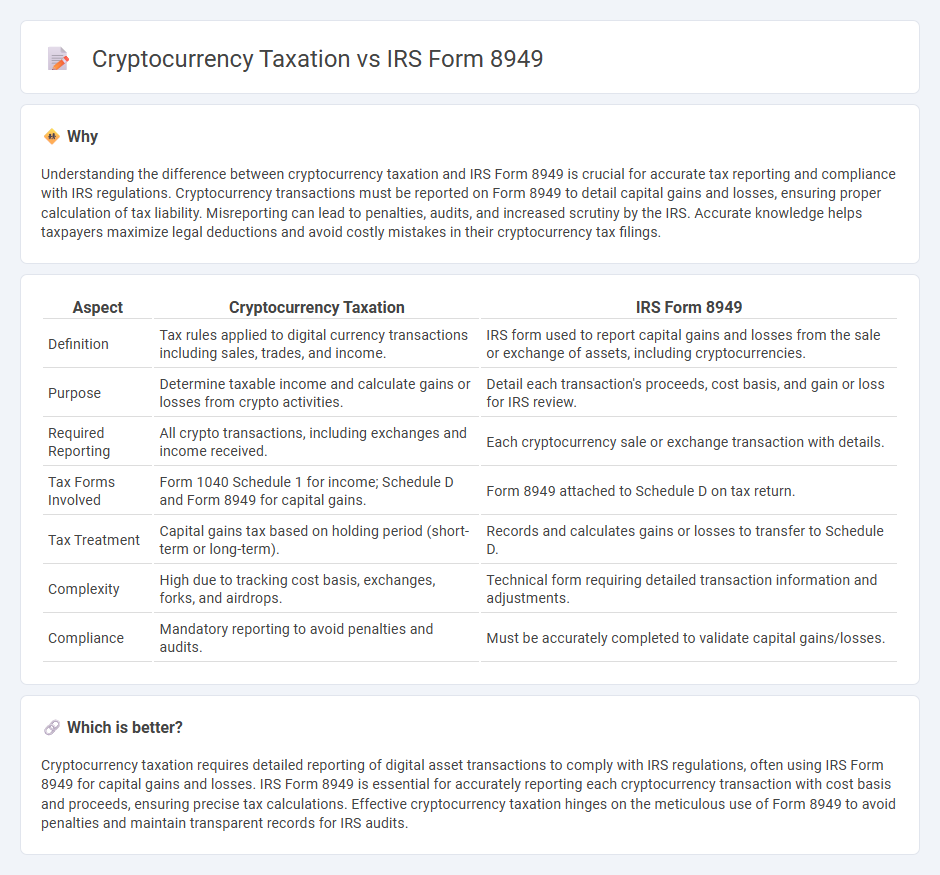

Understanding the difference between cryptocurrency taxation and IRS Form 8949 is crucial for accurate tax reporting and compliance with IRS regulations. Cryptocurrency transactions must be reported on Form 8949 to detail capital gains and losses, ensuring proper calculation of tax liability. Misreporting can lead to penalties, audits, and increased scrutiny by the IRS. Accurate knowledge helps taxpayers maximize legal deductions and avoid costly mistakes in their cryptocurrency tax filings.

Comparison Table

| Aspect | Cryptocurrency Taxation | IRS Form 8949 |

|---|---|---|

| Definition | Tax rules applied to digital currency transactions including sales, trades, and income. | IRS form used to report capital gains and losses from the sale or exchange of assets, including cryptocurrencies. |

| Purpose | Determine taxable income and calculate gains or losses from crypto activities. | Detail each transaction's proceeds, cost basis, and gain or loss for IRS review. |

| Required Reporting | All crypto transactions, including exchanges and income received. | Each cryptocurrency sale or exchange transaction with details. |

| Tax Forms Involved | Form 1040 Schedule 1 for income; Schedule D and Form 8949 for capital gains. | Form 8949 attached to Schedule D on tax return. |

| Tax Treatment | Capital gains tax based on holding period (short-term or long-term). | Records and calculates gains or losses to transfer to Schedule D. |

| Complexity | High due to tracking cost basis, exchanges, forks, and airdrops. | Technical form requiring detailed transaction information and adjustments. |

| Compliance | Mandatory reporting to avoid penalties and audits. | Must be accurately completed to validate capital gains/losses. |

Which is better?

Cryptocurrency taxation requires detailed reporting of digital asset transactions to comply with IRS regulations, often using IRS Form 8949 for capital gains and losses. IRS Form 8949 is essential for accurately reporting each cryptocurrency transaction with cost basis and proceeds, ensuring precise tax calculations. Effective cryptocurrency taxation hinges on the meticulous use of Form 8949 to avoid penalties and maintain transparent records for IRS audits.

Connection

Cryptocurrency taxation requires accurate reporting of digital asset transactions, which is facilitated through IRS Form 8949. This form specifically tracks gains and losses from the sale or exchange of cryptocurrencies, ensuring compliance with IRS regulations. Proper use of Form 8949 enables taxpayers to calculate taxable income from crypto investments and file accurate returns.

Key Terms

Capital Gains

IRS Form 8949 is essential for reporting capital gains and losses from cryptocurrency transactions, as the IRS classifies virtual currency as property subject to capital gains tax. Each crypto sale, exchange, or disposition must be detailed on Form 8949, including dates, proceeds, cost basis, and gain or loss, ensuring accurate calculation of taxable capital gains. Explore how using Form 8949 impacts your cryptocurrency tax reporting and compliance requirements.

Cost Basis

IRS Form 8949 is essential for reporting capital gains and losses from cryptocurrency transactions, emphasizing accurate cost basis calculations to determine taxable income. The cost basis reflects the original purchase price plus any associated fees, which directly impacts the gain or loss reported on Form 8949 and influences your overall tax liability. Explore more detailed guidelines on calculating cost basis for cryptocurrencies and proper IRS reporting requirements for optimized tax compliance.

Taxable Events

IRS Form 8949 is essential for reporting capital gains and losses from cryptocurrency transactions, specifically capturing taxable events such as sales, exchanges, or disposals of digital assets. Taxable events include converting crypto to fiat currency, trading one cryptocurrency for another, or using crypto to purchase goods or services, all of which must be detailed with date acquired, date sold, proceeds, and cost basis on Form 8949. Discover how to accurately report your cryptocurrency taxable events to comply with IRS requirements and optimize your tax reporting strategy.

Source and External Links

How to Use IRS Form 8949 for Capital Gains and Losses - TaxAct Blog - IRS Form 8949 is used to report sales of capital assets such as stocks, cryptocurrency, and real estate, detailing each transaction's purchase price, sales price, and holding period, with totals carried over to Schedule D for capital gains and losses calculation.

Instructions for Form 8949 - 2024 - IRS - Form 8949 is used to report sales and exchanges of capital assets for individuals, corporations, and partnerships, allowing reconciliation of amounts reported on Form 1099-B and other forms with the taxpayer's return.

Where can I find form 8949? - TaxSlayer Support - Form 8949 reports sales and exchanges of capital assets and reconciles amounts reported on 1099-B or 1099-S with those on your tax return, with subtotals carried to Schedule D for aggregate gain or loss calculation.

dowidth.com

dowidth.com