Embedded finance reconciliation involves aligning transactional data from integrated financial services within platforms, ensuring accuracy between embedded payment activities and core accounting systems. Expense reconciliation focuses on matching employee-submitted expenses against corporate policies and financial records to prevent discrepancies and fraud. Explore further to understand the distinct processes and benefits of each reconciliation method in modern accounting.

Why it is important

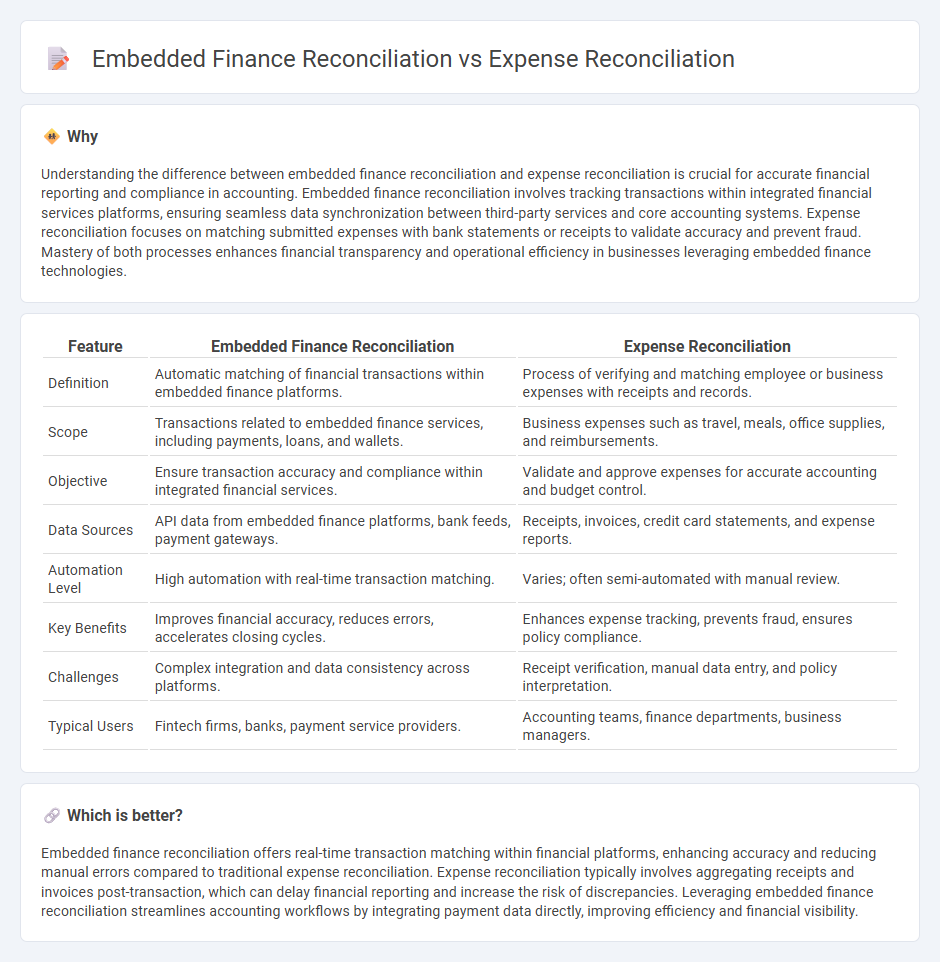

Understanding the difference between embedded finance reconciliation and expense reconciliation is crucial for accurate financial reporting and compliance in accounting. Embedded finance reconciliation involves tracking transactions within integrated financial services platforms, ensuring seamless data synchronization between third-party services and core accounting systems. Expense reconciliation focuses on matching submitted expenses with bank statements or receipts to validate accuracy and prevent fraud. Mastery of both processes enhances financial transparency and operational efficiency in businesses leveraging embedded finance technologies.

Comparison Table

| Feature | Embedded Finance Reconciliation | Expense Reconciliation |

|---|---|---|

| Definition | Automatic matching of financial transactions within embedded finance platforms. | Process of verifying and matching employee or business expenses with receipts and records. |

| Scope | Transactions related to embedded finance services, including payments, loans, and wallets. | Business expenses such as travel, meals, office supplies, and reimbursements. |

| Objective | Ensure transaction accuracy and compliance within integrated financial services. | Validate and approve expenses for accurate accounting and budget control. |

| Data Sources | API data from embedded finance platforms, bank feeds, payment gateways. | Receipts, invoices, credit card statements, and expense reports. |

| Automation Level | High automation with real-time transaction matching. | Varies; often semi-automated with manual review. |

| Key Benefits | Improves financial accuracy, reduces errors, accelerates closing cycles. | Enhances expense tracking, prevents fraud, ensures policy compliance. |

| Challenges | Complex integration and data consistency across platforms. | Receipt verification, manual data entry, and policy interpretation. |

| Typical Users | Fintech firms, banks, payment service providers. | Accounting teams, finance departments, business managers. |

Which is better?

Embedded finance reconciliation offers real-time transaction matching within financial platforms, enhancing accuracy and reducing manual errors compared to traditional expense reconciliation. Expense reconciliation typically involves aggregating receipts and invoices post-transaction, which can delay financial reporting and increase the risk of discrepancies. Leveraging embedded finance reconciliation streamlines accounting workflows by integrating payment data directly, improving efficiency and financial visibility.

Connection

Embedded finance reconciliation streamlines the integration of financial services within business platforms, enabling seamless tracking of transactions and real-time data synchronization. Expense reconciliation relies on this integrated financial data to accurately match and verify business expenditures against embedded payments and records. This connection enhances accuracy, reduces manual errors, and accelerates the overall accounting process.

Key Terms

**Expense Reconciliation:**

Expense reconciliation involves matching and verifying company expenditures against financial records to ensure accuracy and prevent discrepancies, often using automated tools for efficiency. This process is crucial for maintaining transparent financial reporting and compliance with accounting standards. Explore more about optimizing expense reconciliation to enhance corporate financial control.

Receipts Matching

Expense reconciliation involves verifying and matching receipts against recorded expenses to ensure accuracy and prevent fraud, typically within corporate accounting systems. Embedded finance reconciliation integrates financial services directly into business platforms, streamlining receipts matching through automated processes and real-time transaction validation. Discover how leveraging advanced receipt matching in embedded finance can enhance financial accuracy and operational efficiency.

General Ledger

Expense reconciliation involves matching transaction records to ensure all expenditures are accurately recorded in the General Ledger, highlighting discrepancies between invoices, payments, and ledger entries. Embedded finance reconciliation integrates financial services directly within business platforms, streamlining the reconciliation process by automating updates to the General Ledger in real-time. Discover how advanced reconciliation techniques can enhance accuracy and efficiency in your General Ledger management.

Source and External Links

What is Expense Reconciliation? - Navan - Expense reconciliation is the process of verifying and matching business expenses with records for accuracy and compliance, crucial for preventing errors, fraud, and ensuring proper financial reporting.

Expense Reconciliation: How to Reconcile Expenses Faster - Ramp - Expense reconciliation can be done manually or automated, involving collecting, verifying, and matching receipts and financial records to identify discrepancies and ensure accuracy.

Expense Reconciliation Guide: Implement a Winning Strategy - Tipalti - Expense reconciliation compares and matches financial records related to expenses to verify alignment with budgets and detect unauthorized or incorrect charges, typically as the final stage of the expense management cycle.

dowidth.com

dowidth.com