Cryptocurrency taxation involves reporting and paying taxes on crypto transactions based on their nature, such as income or capital gains, requiring adherence to specific IRS guidelines. Capital gains taxation applies when cryptocurrencies are sold, exchanged, or converted, with gains or losses calculated from the asset's cost basis and holding period. Discover more about how cryptocurrency taxation impacts your financial strategy and compliance requirements.

Why it is important

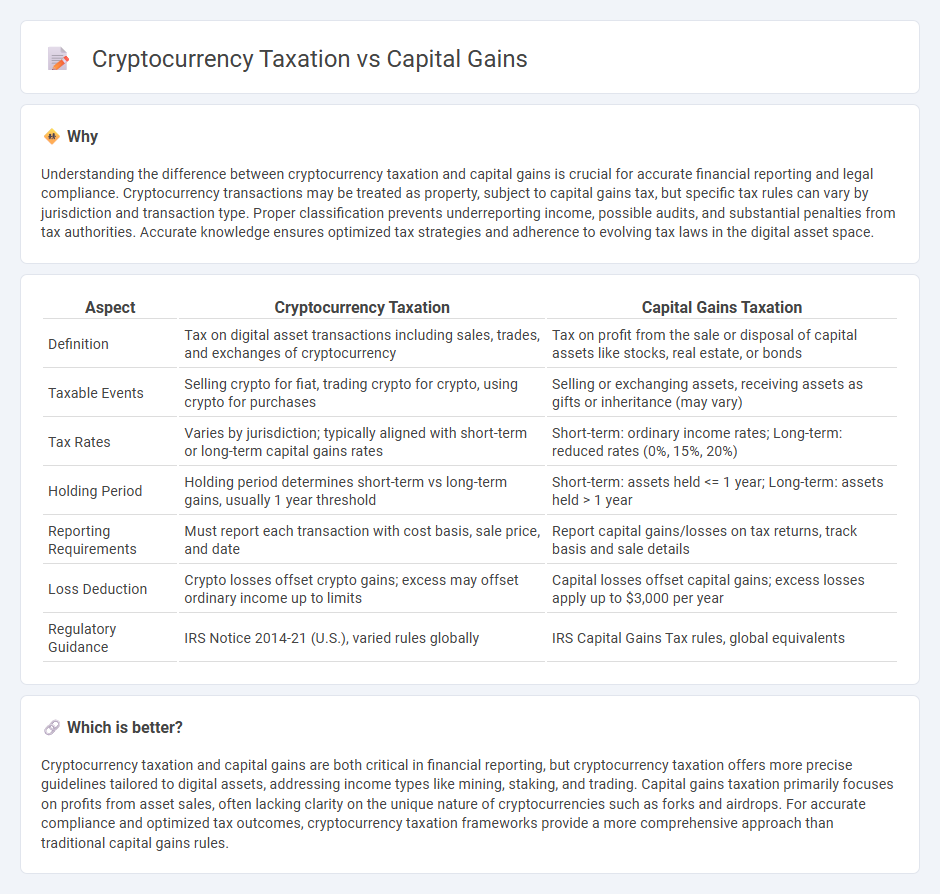

Understanding the difference between cryptocurrency taxation and capital gains is crucial for accurate financial reporting and legal compliance. Cryptocurrency transactions may be treated as property, subject to capital gains tax, but specific tax rules can vary by jurisdiction and transaction type. Proper classification prevents underreporting income, possible audits, and substantial penalties from tax authorities. Accurate knowledge ensures optimized tax strategies and adherence to evolving tax laws in the digital asset space.

Comparison Table

| Aspect | Cryptocurrency Taxation | Capital Gains Taxation |

|---|---|---|

| Definition | Tax on digital asset transactions including sales, trades, and exchanges of cryptocurrency | Tax on profit from the sale or disposal of capital assets like stocks, real estate, or bonds |

| Taxable Events | Selling crypto for fiat, trading crypto for crypto, using crypto for purchases | Selling or exchanging assets, receiving assets as gifts or inheritance (may vary) |

| Tax Rates | Varies by jurisdiction; typically aligned with short-term or long-term capital gains rates | Short-term: ordinary income rates; Long-term: reduced rates (0%, 15%, 20%) |

| Holding Period | Holding period determines short-term vs long-term gains, usually 1 year threshold | Short-term: assets held <= 1 year; Long-term: assets held > 1 year |

| Reporting Requirements | Must report each transaction with cost basis, sale price, and date | Report capital gains/losses on tax returns, track basis and sale details |

| Loss Deduction | Crypto losses offset crypto gains; excess may offset ordinary income up to limits | Capital losses offset capital gains; excess losses apply up to $3,000 per year |

| Regulatory Guidance | IRS Notice 2014-21 (U.S.), varied rules globally | IRS Capital Gains Tax rules, global equivalents |

Which is better?

Cryptocurrency taxation and capital gains are both critical in financial reporting, but cryptocurrency taxation offers more precise guidelines tailored to digital assets, addressing income types like mining, staking, and trading. Capital gains taxation primarily focuses on profits from asset sales, often lacking clarity on the unique nature of cryptocurrencies such as forks and airdrops. For accurate compliance and optimized tax outcomes, cryptocurrency taxation frameworks provide a more comprehensive approach than traditional capital gains rules.

Connection

Cryptocurrency taxation directly impacts capital gains reporting as digital asset transactions are treated as taxable events under IRS guidelines. When cryptocurrency is sold, exchanged, or used to purchase goods, the difference between the acquisition cost and the sale price constitutes a capital gain or loss. Accurate tracking of these transactions is essential for calculating taxable income and complying with tax regulations.

Key Terms

Realized Gains

Realized gains from cryptocurrency transactions are subject to capital gains tax, similar to stocks and other investments, where the taxable amount is the difference between the sale price and the acquisition cost. Tax rates on these gains vary depending on whether they are short-term (held less than a year) or long-term (held more than a year), with long-term gains often benefiting from lower tax rates. Explore detailed guidelines on calculating and reporting cryptocurrency realized gains to ensure compliance and optimize your tax strategy.

Cost Basis

Understanding the cost basis is crucial for accurately calculating capital gains tax on cryptocurrency transactions, as it represents the original value of the asset when acquired. The IRS treats cryptocurrency as property, so the cost basis includes the purchase price plus any fees or commissions, directly impacting taxable gains or losses upon sale or exchange. Explore detailed strategies to optimize cost basis reporting and minimize tax liabilities on your crypto investments.

Taxable Events

Taxable events for capital gains include the sale or exchange of assets, triggering a tax obligation on the profit made. In cryptocurrency taxation, taxable events occur not only during sales but also when trading coins, converting to fiat currency, or using crypto for purchases, each generating potential capital gains tax liabilities. Explore detailed guidelines to understand how these taxable events specifically impact your financial reporting and tax payments.

Source and External Links

Capital Gains Tax: What you need to know - This webpage provides an overview of capital gains tax, including how it is realized and taxed, and strategies to minimize taxes.

2024 and 2025 Capital Gains Tax Rates and Rules - This article discusses capital gains tax rates for 2024 and 2025, including the different tax brackets and how income affects these rates.

2024-2025 Long-Term Capital Gains Tax Rates - This article explains how long-term capital gains tax rates work, including examples of how holding period affects tax rates and net gains.

dowidth.com

dowidth.com