Supply chain finance improves cash flow by allowing suppliers to receive early payments on approved invoices through third-party financing, while dynamic discounting offers buyers the option to pay suppliers early in exchange for discounts based on payment timing. Both strategies optimize working capital and enhance supplier relationships by addressing payment terms and liquidity. Explore how these financial tools can transform your supply chain efficiency and cost savings.

Why it is important

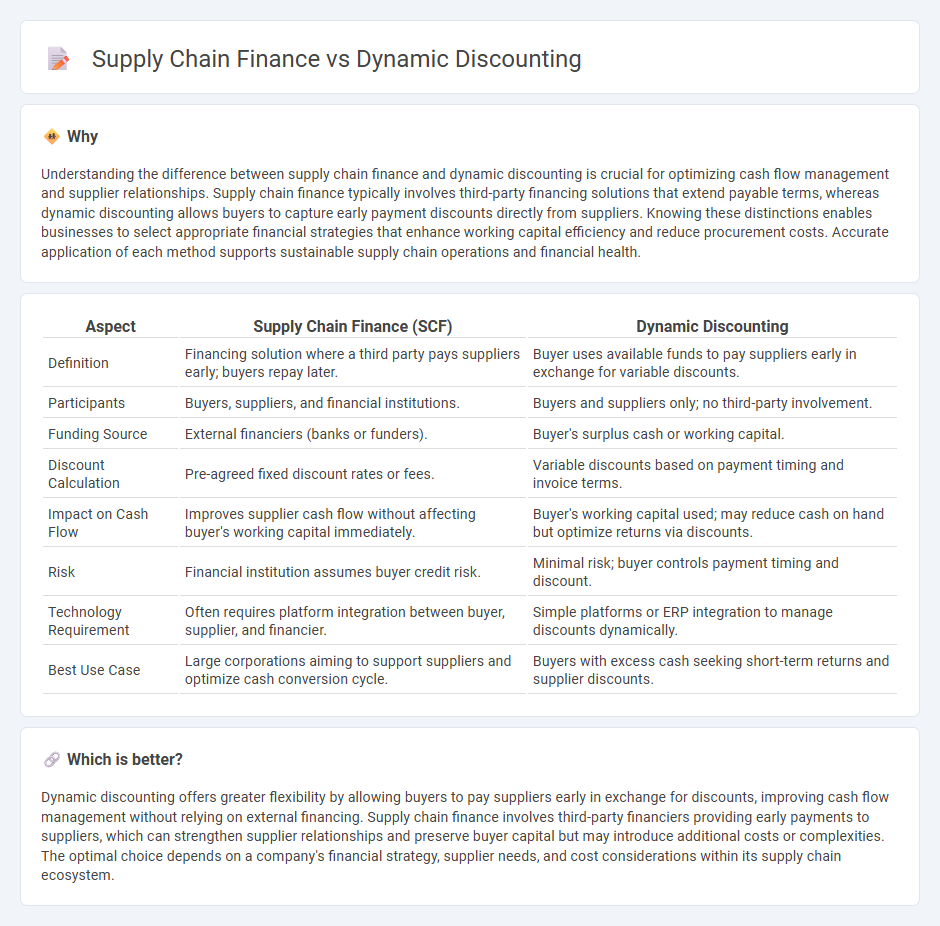

Understanding the difference between supply chain finance and dynamic discounting is crucial for optimizing cash flow management and supplier relationships. Supply chain finance typically involves third-party financing solutions that extend payable terms, whereas dynamic discounting allows buyers to capture early payment discounts directly from suppliers. Knowing these distinctions enables businesses to select appropriate financial strategies that enhance working capital efficiency and reduce procurement costs. Accurate application of each method supports sustainable supply chain operations and financial health.

Comparison Table

| Aspect | Supply Chain Finance (SCF) | Dynamic Discounting |

|---|---|---|

| Definition | Financing solution where a third party pays suppliers early; buyers repay later. | Buyer uses available funds to pay suppliers early in exchange for variable discounts. |

| Participants | Buyers, suppliers, and financial institutions. | Buyers and suppliers only; no third-party involvement. |

| Funding Source | External financiers (banks or funders). | Buyer's surplus cash or working capital. |

| Discount Calculation | Pre-agreed fixed discount rates or fees. | Variable discounts based on payment timing and invoice terms. |

| Impact on Cash Flow | Improves supplier cash flow without affecting buyer's working capital immediately. | Buyer's working capital used; may reduce cash on hand but optimize returns via discounts. |

| Risk | Financial institution assumes buyer credit risk. | Minimal risk; buyer controls payment timing and discount. |

| Technology Requirement | Often requires platform integration between buyer, supplier, and financier. | Simple platforms or ERP integration to manage discounts dynamically. |

| Best Use Case | Large corporations aiming to support suppliers and optimize cash conversion cycle. | Buyers with excess cash seeking short-term returns and supplier discounts. |

Which is better?

Dynamic discounting offers greater flexibility by allowing buyers to pay suppliers early in exchange for discounts, improving cash flow management without relying on external financing. Supply chain finance involves third-party financiers providing early payments to suppliers, which can strengthen supplier relationships and preserve buyer capital but may introduce additional costs or complexities. The optimal choice depends on a company's financial strategy, supplier needs, and cost considerations within its supply chain ecosystem.

Connection

Supply chain finance enhances liquidity by allowing buyers to optimize payment terms while suppliers access early payment options through financial institutions. Dynamic discounting leverages real-time payment analytics to offer early payment discounts based on the buyer's available cash flow, improving working capital for both parties. Integrating dynamic discounting within supply chain finance frameworks creates a seamless solution that reduces costs and strengthens supplier relationships through efficient cash flow management.

Key Terms

Early Payment

Dynamic discounting enables buyers to pay suppliers earlier than agreed terms in exchange for a discount, improving cash flow for suppliers while reducing procurement costs for buyers. Supply chain finance (SCF) offers third-party financing solutions that allow suppliers to receive early payments at competitive rates without impacting the buyer's working capital. Explore the differences and benefits of early payment solutions to optimize your supply chain financial strategy.

Working Capital

Dynamic discounting accelerates payments by leveraging early payment discounts, enhancing supplier cash flow and improving buyer working capital efficiency. Supply chain finance involves third-party financing to optimize payment terms and liquidity for both buyers and suppliers, reducing days payable outstanding (DPO) without straining supplier relationships. Explore how integrating these strategies can maximize working capital benefits and streamline financial operations.

Invoice Financing

Dynamic discounting offers suppliers early payment discounts directly from buyers by accelerating invoice settlement, improving cash flow without third-party involvement. Supply chain finance involves financiers funding supplier invoices at favorable rates based on buyer creditworthiness, enhancing liquidity across the supply chain. Explore the differences in invoice financing benefits and solutions for optimizing working capital.

Source and External Links

What Is Dynamic Discounting? | Definition & Meaning - Taulia - Dynamic discounting is a solution where suppliers receive early payment in exchange for a discount, providing flexible funding and improving cash flow.

Dynamic Discounting: A Key Enabler for Supply Chain Finance - Dynamic discounting allows suppliers to offer discounts on invoices for early payment, enhancing supply chain finance with flexible terms.

Dynamic discounting - Wikipedia - Dynamic discounting involves dynamically calculated discounts for early payments, offering suppliers quicker access to cash and buyers risk-free returns.

dowidth.com

dowidth.com