On-demand accruals enable businesses to record expenses as they incur, aligning costs with revenues for accurate financial reporting. Expense recognition principles ensure expenses are matched to the period in which related revenues are earned, adhering to GAAP standards. Explore how these accounting methods improve financial accuracy and compliance.

Why it is important

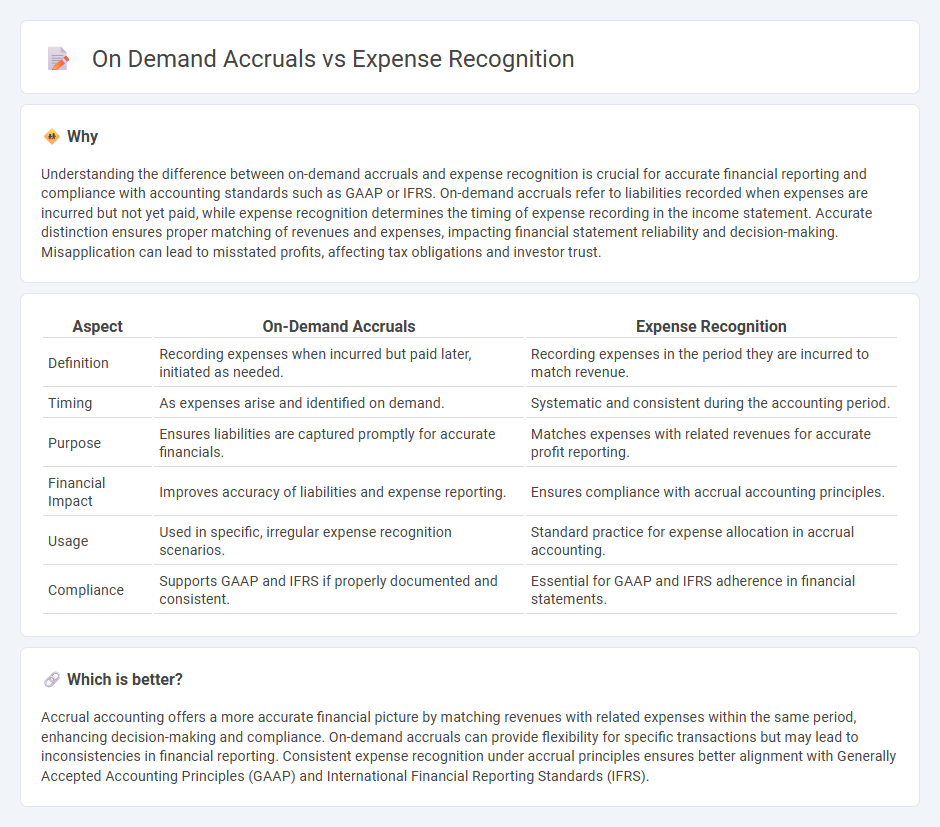

Understanding the difference between on-demand accruals and expense recognition is crucial for accurate financial reporting and compliance with accounting standards such as GAAP or IFRS. On-demand accruals refer to liabilities recorded when expenses are incurred but not yet paid, while expense recognition determines the timing of expense recording in the income statement. Accurate distinction ensures proper matching of revenues and expenses, impacting financial statement reliability and decision-making. Misapplication can lead to misstated profits, affecting tax obligations and investor trust.

Comparison Table

| Aspect | On-Demand Accruals | Expense Recognition |

|---|---|---|

| Definition | Recording expenses when incurred but paid later, initiated as needed. | Recording expenses in the period they are incurred to match revenue. |

| Timing | As expenses arise and identified on demand. | Systematic and consistent during the accounting period. |

| Purpose | Ensures liabilities are captured promptly for accurate financials. | Matches expenses with related revenues for accurate profit reporting. |

| Financial Impact | Improves accuracy of liabilities and expense reporting. | Ensures compliance with accrual accounting principles. |

| Usage | Used in specific, irregular expense recognition scenarios. | Standard practice for expense allocation in accrual accounting. |

| Compliance | Supports GAAP and IFRS if properly documented and consistent. | Essential for GAAP and IFRS adherence in financial statements. |

Which is better?

Accrual accounting offers a more accurate financial picture by matching revenues with related expenses within the same period, enhancing decision-making and compliance. On-demand accruals can provide flexibility for specific transactions but may lead to inconsistencies in financial reporting. Consistent expense recognition under accrual principles ensures better alignment with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Connection

On demand accruals align expense recognition with the period in which liabilities are incurred, ensuring accurate financial reporting and compliance with GAAP. This method matches expenses to the corresponding revenue period regardless of cash flow timing, enhancing the precision of financial statements. Properly implemented accruals improve budget forecasting and provide stakeholders with a clear view of an entity's financial position.

Key Terms

Matching Principle

Expense recognition requires matching expenses to the revenues they help generate within the same accounting period, adhering strictly to the Matching Principle. On-demand accruals allow businesses to record expenses and liabilities when they are incurred, not necessarily when cash is paid, supporting accurate financial reporting. Explore more to understand how these methods impact financial statements and compliance with accounting standards.

Accrual Basis

Expense recognition under the accrual basis of accounting requires recording expenses when they are incurred, regardless of when cash payments occur, ensuring financial statements reflect true financial performance. On-demand accruals involve adjusting entries made periodically to recognize expenses that have been incurred but not yet recorded, enhancing accuracy in expense matching and period reporting. Explore more about how these principles impact financial transparency and compliance.

Revenue Recognition

Expense recognition allocates costs to the same period as the related revenues, adhering to the matching principle in revenue recognition standards like ASC 606 and IFRS 15. On-demand accruals adjust expenses in real-time to match revenue spikes, enhancing accuracy in financial reporting and compliance. Explore how aligning expense recognition with on-demand accruals improves revenue recognition precision and financial performance analysis.

Source and External Links

Expense Recognition Principle - The expense recognition principle requires businesses to record expenses in the same period as the related revenue they help generate, aligning with accrual accounting for accurate financial reporting.

Expense Recognition Principle - This principle ensures that expenses are recognized during the same period as the revenues they relate to, crucial for maintaining accurate financial statements under accrual accounting.

Expense Recognition Principle - It involves matching expenses with the revenues they generate and recording both in the same accounting period, a core aspect of accrual accounting that enhances financial reporting clarity.

dowidth.com

dowidth.com