Cryptocurrency valuation involves assigning a monetary value to digital assets, reflecting their market price, utility, and scarcity, whereas the revaluation model adjusts asset values periodically to mirror current market conditions on financial statements. Unlike traditional assets, cryptocurrencies present unique challenges in valuation due to high volatility and lack of standardized appraisal methods. Discover more about how these valuation approaches impact financial reporting and investment decisions.

Why it is important

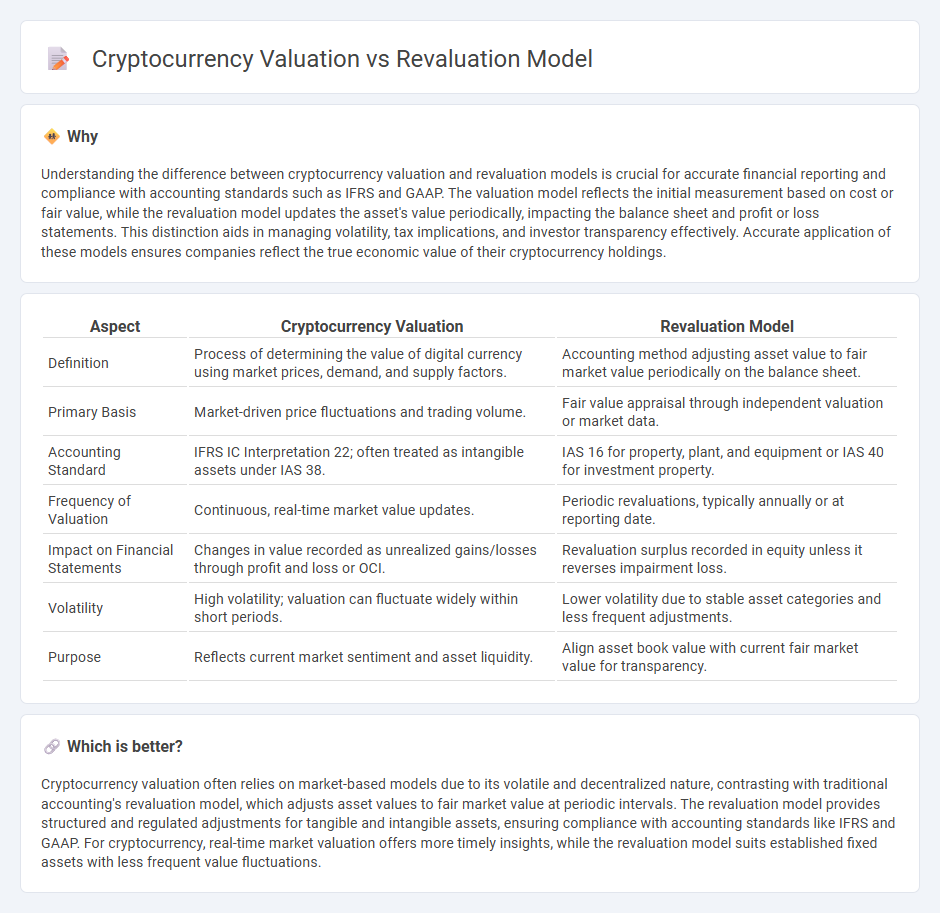

Understanding the difference between cryptocurrency valuation and revaluation models is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP. The valuation model reflects the initial measurement based on cost or fair value, while the revaluation model updates the asset's value periodically, impacting the balance sheet and profit or loss statements. This distinction aids in managing volatility, tax implications, and investor transparency effectively. Accurate application of these models ensures companies reflect the true economic value of their cryptocurrency holdings.

Comparison Table

| Aspect | Cryptocurrency Valuation | Revaluation Model |

|---|---|---|

| Definition | Process of determining the value of digital currency using market prices, demand, and supply factors. | Accounting method adjusting asset value to fair market value periodically on the balance sheet. |

| Primary Basis | Market-driven price fluctuations and trading volume. | Fair value appraisal through independent valuation or market data. |

| Accounting Standard | IFRS IC Interpretation 22; often treated as intangible assets under IAS 38. | IAS 16 for property, plant, and equipment or IAS 40 for investment property. |

| Frequency of Valuation | Continuous, real-time market value updates. | Periodic revaluations, typically annually or at reporting date. |

| Impact on Financial Statements | Changes in value recorded as unrealized gains/losses through profit and loss or OCI. | Revaluation surplus recorded in equity unless it reverses impairment loss. |

| Volatility | High volatility; valuation can fluctuate widely within short periods. | Lower volatility due to stable asset categories and less frequent adjustments. |

| Purpose | Reflects current market sentiment and asset liquidity. | Align asset book value with current fair market value for transparency. |

Which is better?

Cryptocurrency valuation often relies on market-based models due to its volatile and decentralized nature, contrasting with traditional accounting's revaluation model, which adjusts asset values to fair market value at periodic intervals. The revaluation model provides structured and regulated adjustments for tangible and intangible assets, ensuring compliance with accounting standards like IFRS and GAAP. For cryptocurrency, real-time market valuation offers more timely insights, while the revaluation model suits established fixed assets with less frequent value fluctuations.

Connection

Cryptocurrency valuation relies heavily on market-driven data to determine current fair value, aligning with the principles of the revaluation model used in accounting to update asset values on financial statements. The revaluation model allows companies to adjust the carrying amount of cryptocurrency holdings based on periodic fair value assessments, reflecting real-time market conditions. This connection ensures transparent and accurate reporting of digital assets in financial records, enhancing investor confidence and regulatory compliance.

Key Terms

Fair Value

The revaluation model in accounting adjusts asset values based on fair value measurements, providing updated estimates that reflect current market conditions and enhance financial statement accuracy. Cryptocurrency valuation relies heavily on fair value due to the volatile and intangible nature of digital assets, often using market prices from exchanges or models like discounted cash flows and network value-to-transactions ratio. Discover more insights into how fair value principles impact traditional and digital asset valuation techniques.

Volatility

The revaluation model assesses asset values based on periodic updates reflecting market conditions, providing a stable framework for traditional investments. Cryptocurrency valuation, however, is heavily influenced by extreme volatility, with price fluctuations driven by market sentiment, regulatory news, and technological developments. Explore more to understand how volatility impacts valuation strategies in emerging digital assets.

Impairment

The revaluation model measures assets based on fair value adjustments, requiring periodic reviews for impairment that reflect recoverable amounts and potential losses. Cryptocurrency valuation faces unique impairment challenges due to high volatility, lack of intrinsic cash flows, and evolving accounting standards. Explore in-depth insights on how impairment impacts these differing valuation approaches and their implications for financial reporting.

Source and External Links

What is the Revaluation Model? - The Revaluation Model is an accounting method used to measure and report long-lived assets at their fair value minus accumulated depreciation and impairment losses.

Revaluation Model Definition - The revaluation model allows businesses to carry fixed assets at their revalued amount, which is the fair value less accumulated depreciation and impairment losses, and requires frequent revaluations.

Revaluation Model - This model attempts to reflect changes in an asset's value over time by adjusting its carrying amount to fair value, with increases recorded as revaluation surpluses and decreases as expenses if prior surpluses are depleted.

dowidth.com

dowidth.com