Dynamic discounting improves cash flow by allowing buyers to pay suppliers early in exchange for discounted invoices, enhancing supplier relationships and reducing procurement costs. Invoice financing provides businesses with immediate working capital by selling outstanding invoices to a third party, accelerating access to funds without waiting for payment terms. Explore how these financial strategies can optimize your company's liquidity and operational efficiency.

Why it is important

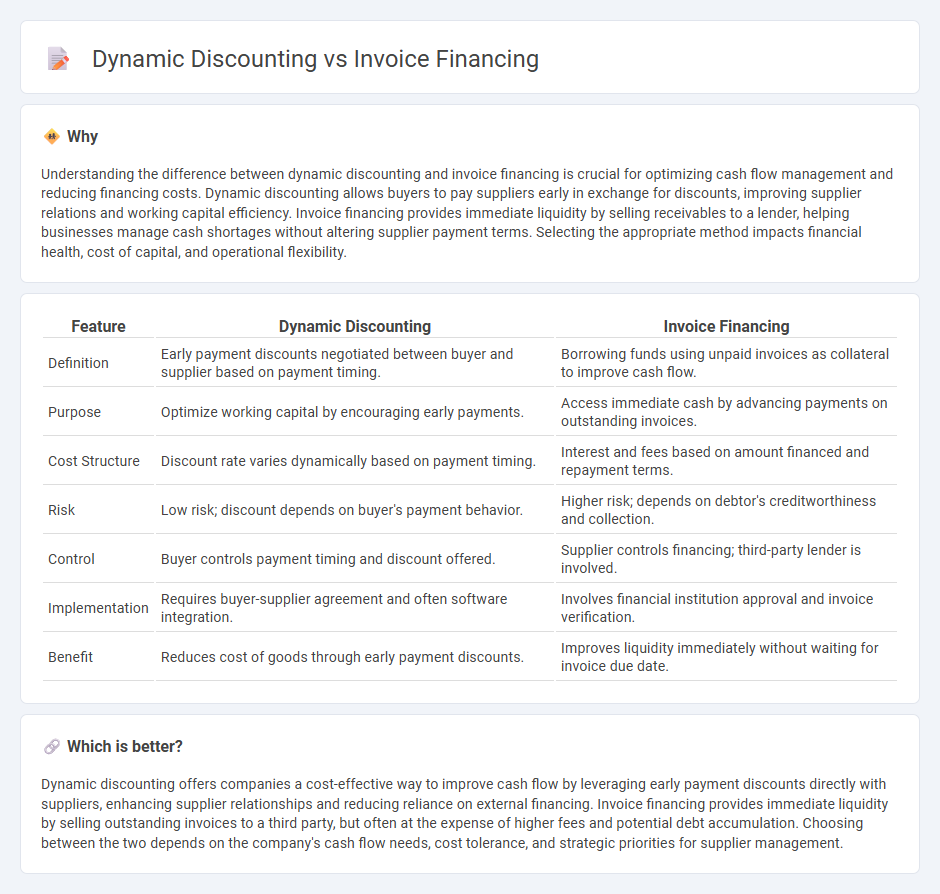

Understanding the difference between dynamic discounting and invoice financing is crucial for optimizing cash flow management and reducing financing costs. Dynamic discounting allows buyers to pay suppliers early in exchange for discounts, improving supplier relations and working capital efficiency. Invoice financing provides immediate liquidity by selling receivables to a lender, helping businesses manage cash shortages without altering supplier payment terms. Selecting the appropriate method impacts financial health, cost of capital, and operational flexibility.

Comparison Table

| Feature | Dynamic Discounting | Invoice Financing |

|---|---|---|

| Definition | Early payment discounts negotiated between buyer and supplier based on payment timing. | Borrowing funds using unpaid invoices as collateral to improve cash flow. |

| Purpose | Optimize working capital by encouraging early payments. | Access immediate cash by advancing payments on outstanding invoices. |

| Cost Structure | Discount rate varies dynamically based on payment timing. | Interest and fees based on amount financed and repayment terms. |

| Risk | Low risk; discount depends on buyer's payment behavior. | Higher risk; depends on debtor's creditworthiness and collection. |

| Control | Buyer controls payment timing and discount offered. | Supplier controls financing; third-party lender is involved. |

| Implementation | Requires buyer-supplier agreement and often software integration. | Involves financial institution approval and invoice verification. |

| Benefit | Reduces cost of goods through early payment discounts. | Improves liquidity immediately without waiting for invoice due date. |

Which is better?

Dynamic discounting offers companies a cost-effective way to improve cash flow by leveraging early payment discounts directly with suppliers, enhancing supplier relationships and reducing reliance on external financing. Invoice financing provides immediate liquidity by selling outstanding invoices to a third party, but often at the expense of higher fees and potential debt accumulation. Choosing between the two depends on the company's cash flow needs, cost tolerance, and strategic priorities for supplier management.

Connection

Dynamic discounting and invoice financing are interconnected financial strategies that improve cash flow management for businesses. Dynamic discounting allows buyers to pay invoices early in exchange for discounts, effectively reducing costs, while invoice financing provides suppliers with immediate access to funds by selling outstanding invoices. Both methods leverage accounts receivable to enhance working capital and optimize payment cycles, strengthening supply chain relationships.

Key Terms

Receivables

Invoice financing leverages accounts receivable by allowing businesses to access immediate cash flow through collateralizing outstanding invoices, while dynamic discounting optimizes early payment discounts directly with suppliers to enhance liquidity. Both strategies improve receivables management but dynamic discounting offers more cost-effective working capital solutions without the need for external financing. Explore detailed comparisons to understand which approach maximizes your receivables efficiency and financial health.

Early Payment

Invoice financing provides businesses with immediate cash flow by selling their outstanding invoices to a third party at a discount, speeding up access to working capital without waiting for customer payment terms. Dynamic discounting leverages early payment to suppliers by offering variable discounts in exchange for accelerated invoice settlement directly between buyer and supplier, improving supplier cash flow while optimizing buyer savings. Explore how early payment strategies through invoice financing and dynamic discounting can transform your cash flow management and supplier relationships.

Cash Flow

Invoice financing accelerates cash flow by allowing businesses to sell outstanding invoices to a lender at a discount, providing immediate liquidity without waiting for customer payments. Dynamic discounting improves cash flow by enabling buyers to pay suppliers earlier in exchange for a discount, reducing costs and optimizing working capital. Explore how each method impacts your cash flow strategy to determine the best fit for your financial needs.

Source and External Links

How to Use Invoice Financing (And When You Shouldn't) - This article explains how invoice financing works, its benefits, and when it might not be the best option for businesses.

What is Invoice Financing? - This guide provides a detailed overview of invoice financing, including how it works and its costs, making it a good fit for businesses with cash flow issues.

Invoice Financing: Definition and How It Works - This article defines invoice financing as a type of business loan that uses outstanding invoices as collateral, helping small businesses manage cash flow gaps.

dowidth.com

dowidth.com