Transfer pricing analytics evaluates intercompany transaction prices to ensure compliance with tax regulations and optimize profit allocation across jurisdictions. Budget variance analysis examines the differences between planned financial outcomes and actual performance to identify discrepancies and improve future budgeting accuracy. Discover how mastering both techniques can enhance your company's financial strategy and regulatory compliance.

Why it is important

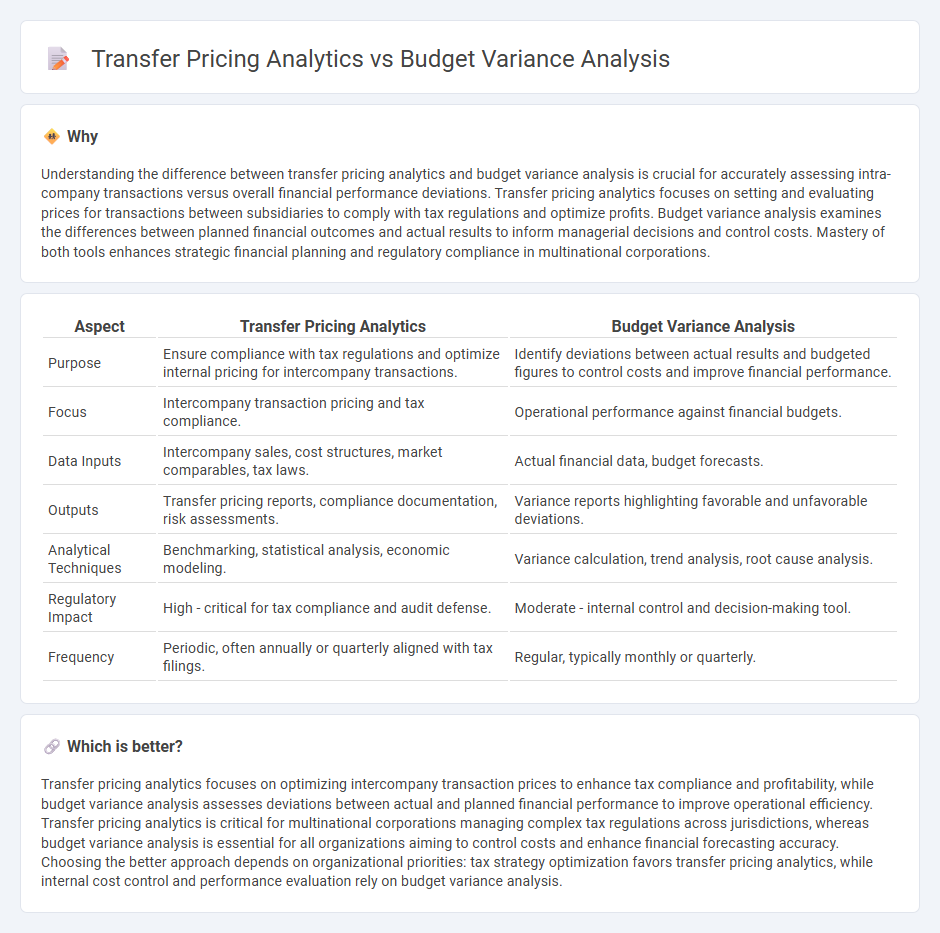

Understanding the difference between transfer pricing analytics and budget variance analysis is crucial for accurately assessing intra-company transactions versus overall financial performance deviations. Transfer pricing analytics focuses on setting and evaluating prices for transactions between subsidiaries to comply with tax regulations and optimize profits. Budget variance analysis examines the differences between planned financial outcomes and actual results to inform managerial decisions and control costs. Mastery of both tools enhances strategic financial planning and regulatory compliance in multinational corporations.

Comparison Table

| Aspect | Transfer Pricing Analytics | Budget Variance Analysis |

|---|---|---|

| Purpose | Ensure compliance with tax regulations and optimize internal pricing for intercompany transactions. | Identify deviations between actual results and budgeted figures to control costs and improve financial performance. |

| Focus | Intercompany transaction pricing and tax compliance. | Operational performance against financial budgets. |

| Data Inputs | Intercompany sales, cost structures, market comparables, tax laws. | Actual financial data, budget forecasts. |

| Outputs | Transfer pricing reports, compliance documentation, risk assessments. | Variance reports highlighting favorable and unfavorable deviations. |

| Analytical Techniques | Benchmarking, statistical analysis, economic modeling. | Variance calculation, trend analysis, root cause analysis. |

| Regulatory Impact | High - critical for tax compliance and audit defense. | Moderate - internal control and decision-making tool. |

| Frequency | Periodic, often annually or quarterly aligned with tax filings. | Regular, typically monthly or quarterly. |

Which is better?

Transfer pricing analytics focuses on optimizing intercompany transaction prices to enhance tax compliance and profitability, while budget variance analysis assesses deviations between actual and planned financial performance to improve operational efficiency. Transfer pricing analytics is critical for multinational corporations managing complex tax regulations across jurisdictions, whereas budget variance analysis is essential for all organizations aiming to control costs and enhance financial forecasting accuracy. Choosing the better approach depends on organizational priorities: tax strategy optimization favors transfer pricing analytics, while internal cost control and performance evaluation rely on budget variance analysis.

Connection

Transfer pricing analytics and budget variance analysis are interconnected through their roles in financial performance evaluation and compliance management. Transfer pricing analytics ensures intercompany transactions reflect market conditions, affecting cost allocations and profit margins that contribute to budget variances. Budget variance analysis identifies discrepancies between planned and actual financial outcomes, highlighting areas where transfer pricing adjustments can optimize tax efficiency and resource allocation.

Key Terms

**Budget Variance Analysis:**

Budget variance analysis examines the differences between budgeted and actual financial performance to identify cost overruns and inefficiencies. It provides insights into spending patterns and helps managers adjust future budgets and operational strategies for improved financial control. Discover more about how precise budget variance analysis can enhance organizational financial health.

Actual vs. Budget

Budget variance analysis compares actual financial performance against budgeted projections to identify discrepancies and control costs effectively. Transfer pricing analytics evaluates pricing strategies for internal transactions between subsidiaries, focusing on adherence to regulatory frameworks rather than direct budget comparisons. Explore detailed methodologies to enhance accuracy in Actual vs. Budget financial assessments.

Favorable/Unfavorable Variance

Budget variance analysis identifies favorable or unfavorable variances by comparing actual costs to budgeted costs, highlighting areas of financial performance that deviate from expectations. Transfer pricing analytics assesses the impact of intercompany pricing strategies on profitability, considering market conditions and regulatory compliance, which can influence variance outcomes. Explore the nuances of these methods to enhance financial management and strategic decision-making.

Source and External Links

What Is Budget Variance? Definition, Causes, How To ... - This resource provides a detailed explanation of budget variance, including how to calculate it and examples of its application.

Budget Variance Analysis (Step-by-Step Guide) - Offers a step-by-step guide on performing a thorough budget variance analysis to ensure a company's financial performance aligns with its goals.

Guide to Budget Variance Analysis - Provides a comprehensive guide on calculating and analyzing budget variance, focusing on comparing actual results with budgeted values.

dowidth.com

dowidth.com