Environmental Social Governance (ESG) accounting integrates sustainability metrics, ethical practices, and social responsibility into financial reporting to provide a comprehensive view of a company's broader impact. Green accounting focuses specifically on quantifying and accounting for environmental costs and benefits related to natural resource use and pollution control. Explore further to understand how these accounting approaches influence corporate strategy and investor decisions.

Why it is important

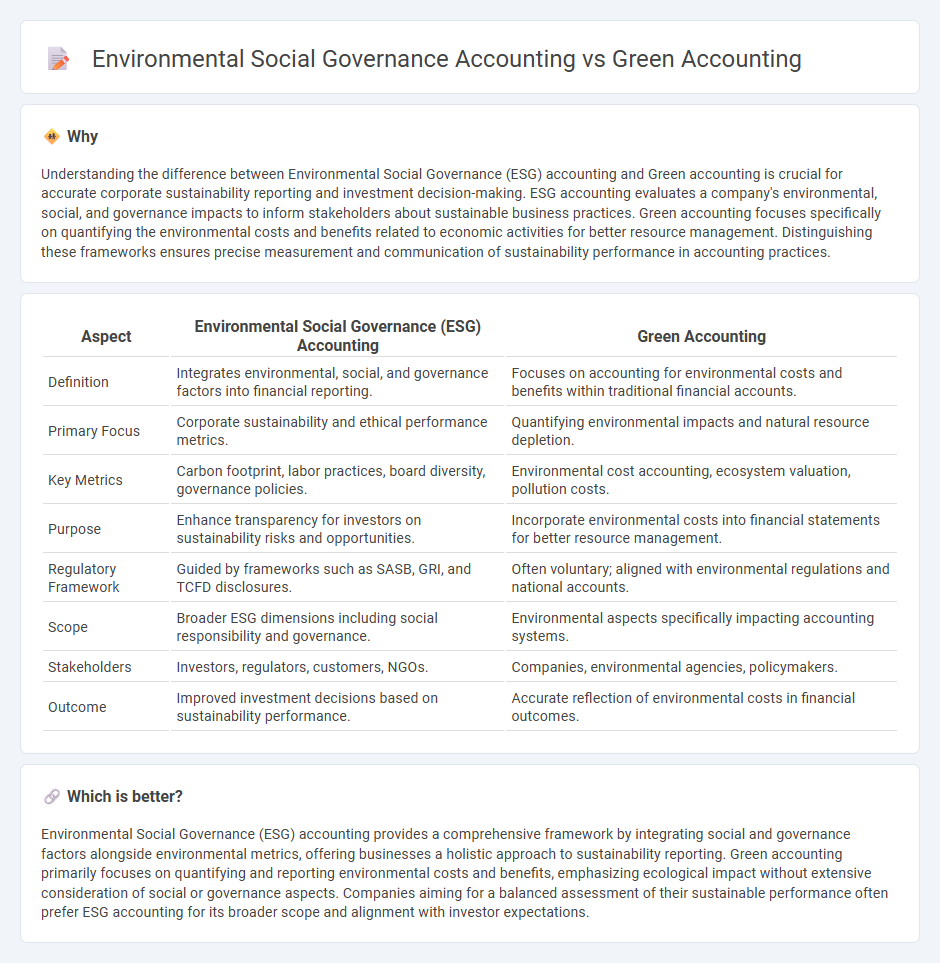

Understanding the difference between Environmental Social Governance (ESG) accounting and Green accounting is crucial for accurate corporate sustainability reporting and investment decision-making. ESG accounting evaluates a company's environmental, social, and governance impacts to inform stakeholders about sustainable business practices. Green accounting focuses specifically on quantifying the environmental costs and benefits related to economic activities for better resource management. Distinguishing these frameworks ensures precise measurement and communication of sustainability performance in accounting practices.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Green Accounting |

|---|---|---|

| Definition | Integrates environmental, social, and governance factors into financial reporting. | Focuses on accounting for environmental costs and benefits within traditional financial accounts. |

| Primary Focus | Corporate sustainability and ethical performance metrics. | Quantifying environmental impacts and natural resource depletion. |

| Key Metrics | Carbon footprint, labor practices, board diversity, governance policies. | Environmental cost accounting, ecosystem valuation, pollution costs. |

| Purpose | Enhance transparency for investors on sustainability risks and opportunities. | Incorporate environmental costs into financial statements for better resource management. |

| Regulatory Framework | Guided by frameworks such as SASB, GRI, and TCFD disclosures. | Often voluntary; aligned with environmental regulations and national accounts. |

| Scope | Broader ESG dimensions including social responsibility and governance. | Environmental aspects specifically impacting accounting systems. |

| Stakeholders | Investors, regulators, customers, NGOs. | Companies, environmental agencies, policymakers. |

| Outcome | Improved investment decisions based on sustainability performance. | Accurate reflection of environmental costs in financial outcomes. |

Which is better?

Environmental Social Governance (ESG) accounting provides a comprehensive framework by integrating social and governance factors alongside environmental metrics, offering businesses a holistic approach to sustainability reporting. Green accounting primarily focuses on quantifying and reporting environmental costs and benefits, emphasizing ecological impact without extensive consideration of social or governance aspects. Companies aiming for a balanced assessment of their sustainable performance often prefer ESG accounting for its broader scope and alignment with investor expectations.

Connection

Environmental social governance (ESG) accounting and green accounting both integrate sustainability metrics into financial reporting to enhance corporate transparency and accountability. ESG accounting focuses on environmental impact, social responsibility, and governance practices, while green accounting quantifies the economic effects of environmental conservation and resource usage. Together, they enable businesses to align financial performance with ecological stewardship and ethical standards.

Key Terms

Sustainability Reporting

Green accounting quantifies environmental costs and benefits within traditional financial frameworks, emphasizing the inclusion of natural resource depletion and pollution impacts in economic analysis. Environmental Social Governance (ESG) accounting expands beyond environmental metrics to integrate social responsibility and corporate governance factors, guiding sustainability reporting with a holistic, stakeholder-driven approach. Explore further to understand how these methodologies shape transparent and impactful sustainability disclosures.

Carbon Footprint

Green accounting emphasizes quantifying environmental costs and benefits within financial statements, focusing on metrics like carbon footprint to assess the impact of corporate activities on natural resources. Environmental Social Governance (ESG) accounting incorporates carbon footprint analysis as part of a broader framework evaluating environmental responsibility, social impact, and governance practices to guide sustainable investments and corporate transparency. Explore how integrating carbon footprint metrics into these accounting approaches drives sustainable decision-making and corporate accountability.

Triple Bottom Line

Green accounting integrates environmental costs into traditional financial analysis, emphasizing resource depletion and pollution impacts to enhance sustainability reporting. Environmental Social Governance (ESG) accounting assesses corporate performance through environmental responsibility, social equity, and governance practices, aligning with the Triple Bottom Line framework of people, planet, and profit. Explore detailed differences to understand how each approach drives sustainable business strategies.

Source and External Links

Green Accounting: Integrating Sustainability into Financial Reporting - Green accounting is an expanded concept that integrates environmental, social, and sustainable development factors into financial reporting, going beyond traditional financial metrics to include non-financial indicators for better stakeholder value.

Green accounting - Wikipedia - Green accounting attempts to factor environmental costs into financial results, aiming to reconcile economic goals with environmental sustainability, although it currently lacks standardized accounting practices and is often debated.

Green Accounting and Sustainability Reporting - Green accounting tracks organizational efforts and investments to protect the environment, considering risks and benefits to limit negative environmental impact and often forming part of broader sustainability reporting.

dowidth.com

dowidth.com