Digital twin accounting creates a virtual replica of financial processes, enabling real-time data analysis and predictive insights for enhanced decision-making. Automated accounting relies on software to perform repetitive tasks such as transaction recording, invoicing, and reconciliation, increasing efficiency and accuracy. Explore how integrating both can revolutionize your financial management strategies.

Why it is important

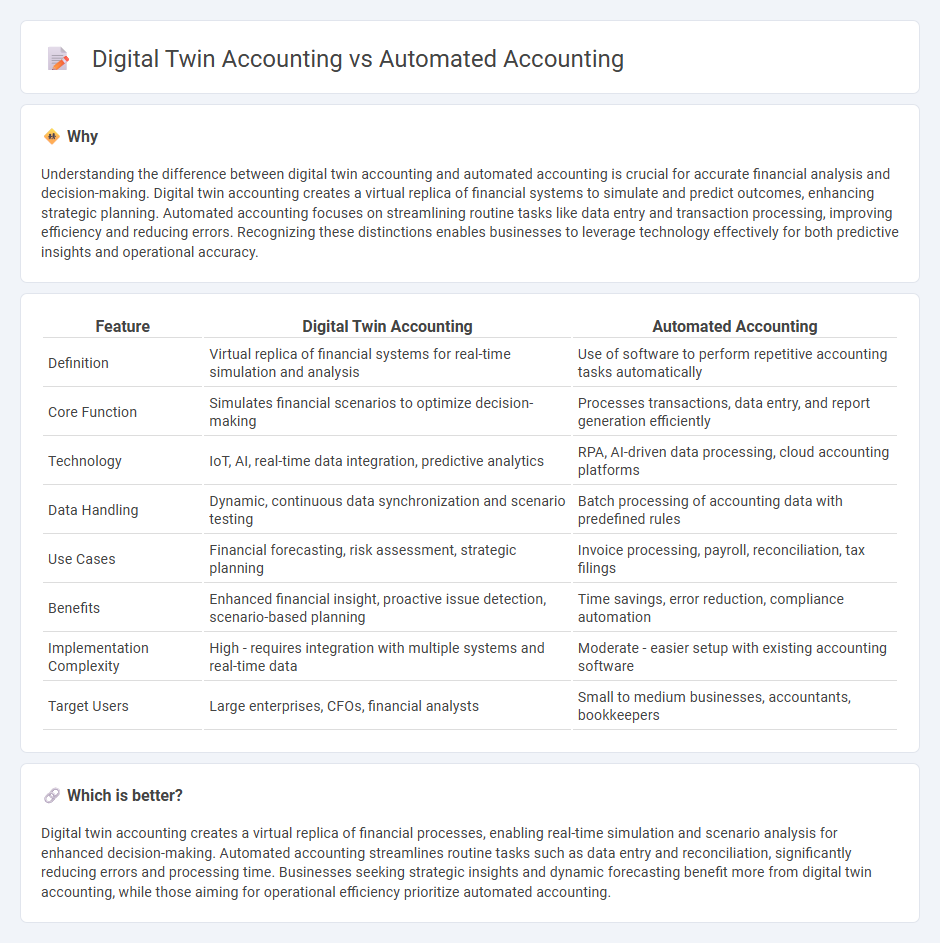

Understanding the difference between digital twin accounting and automated accounting is crucial for accurate financial analysis and decision-making. Digital twin accounting creates a virtual replica of financial systems to simulate and predict outcomes, enhancing strategic planning. Automated accounting focuses on streamlining routine tasks like data entry and transaction processing, improving efficiency and reducing errors. Recognizing these distinctions enables businesses to leverage technology effectively for both predictive insights and operational accuracy.

Comparison Table

| Feature | Digital Twin Accounting | Automated Accounting |

|---|---|---|

| Definition | Virtual replica of financial systems for real-time simulation and analysis | Use of software to perform repetitive accounting tasks automatically |

| Core Function | Simulates financial scenarios to optimize decision-making | Processes transactions, data entry, and report generation efficiently |

| Technology | IoT, AI, real-time data integration, predictive analytics | RPA, AI-driven data processing, cloud accounting platforms |

| Data Handling | Dynamic, continuous data synchronization and scenario testing | Batch processing of accounting data with predefined rules |

| Use Cases | Financial forecasting, risk assessment, strategic planning | Invoice processing, payroll, reconciliation, tax filings |

| Benefits | Enhanced financial insight, proactive issue detection, scenario-based planning | Time savings, error reduction, compliance automation |

| Implementation Complexity | High - requires integration with multiple systems and real-time data | Moderate - easier setup with existing accounting software |

| Target Users | Large enterprises, CFOs, financial analysts | Small to medium businesses, accountants, bookkeepers |

Which is better?

Digital twin accounting creates a virtual replica of financial processes, enabling real-time simulation and scenario analysis for enhanced decision-making. Automated accounting streamlines routine tasks such as data entry and reconciliation, significantly reducing errors and processing time. Businesses seeking strategic insights and dynamic forecasting benefit more from digital twin accounting, while those aiming for operational efficiency prioritize automated accounting.

Connection

Digital twin accounting leverages real-time digital replicas of financial processes, enabling enhanced data accuracy and predictive analysis that automated accounting systems utilize to streamline transaction recording and reporting. Automated accounting employs algorithms and robotic process automation to handle repetitive tasks, which complements digital twin models by providing continuous, accurate financial data for simulation and optimization. Integrating these technologies improves decision-making, reduces errors, and boosts overall efficiency in financial management.

Key Terms

Transaction Processing

Automated accounting streamlines transaction processing by using software to record, categorize, and reconcile financial data with minimal human intervention. Digital twin accounting enhances this process by creating a real-time virtual replica of financial systems, enabling dynamic simulation and analysis of transactions for more accurate forecasting and risk management. Explore how digital twin accounting transforms traditional transaction processing for deeper financial insights.

Real-time Data Synchronization

Automated accounting systems streamline financial processes by reducing manual input, yet often lack seamless integration with real-time data updates. Digital twin accounting leverages real-time data synchronization, creating a dynamic virtual replica of financial operations that ensures accuracy and instant reflection of business changes. Explore how digital twin accounting transforms financial management with immediate data synchronization capabilities.

Predictive Analytics

Predictive analytics in automated accounting leverages algorithms to process historical financial data for real-time forecasting and anomaly detection, enhancing decision-making accuracy. Digital twin accounting integrates predictive models with dynamic virtual replicas of financial processes, enabling scenario simulations and stress testing for proactive financial management. Explore how these cutting-edge technologies transform accounting practices with predictive insights.

Source and External Links

Understanding Accounting Automation and its Benefits | Workiva - Automated accounting uses AI, machine learning, and robotic process automation to make finance processes like procure-to-pay and record-to-report more efficient, accurate, and cost-effective, reducing human error and improving data visibility and compliance.

12 Time-Saving Benefits of Automated Accounting - NetSuite - Automation in accounting digitizes repetitive tasks such as invoice processing, enabling real-time transaction handling, better integration with ERP software, faster decision-making, improved compliance, and scalable financial operations.

A Guide to Automated Accounting: Benefits and Tips - HighRadius - Automated accounting software leverages AI to automate bookkeeping, data extraction, and financial reporting, improving efficiency by up to 40%, allowing accountants to focus on strategic tasks rather than routine data entry.

dowidth.com

dowidth.com