Collaborative audit trails enhance transparency by allowing multiple stakeholders to contribute and verify financial records, improving accuracy and trust. Continuous auditing leverages automated tools to provide real-time monitoring of transactions and controls, enabling timely detection of anomalies and compliance issues. Explore how these innovative approaches transform traditional accounting practices for greater efficiency and assurance.

Why it is important

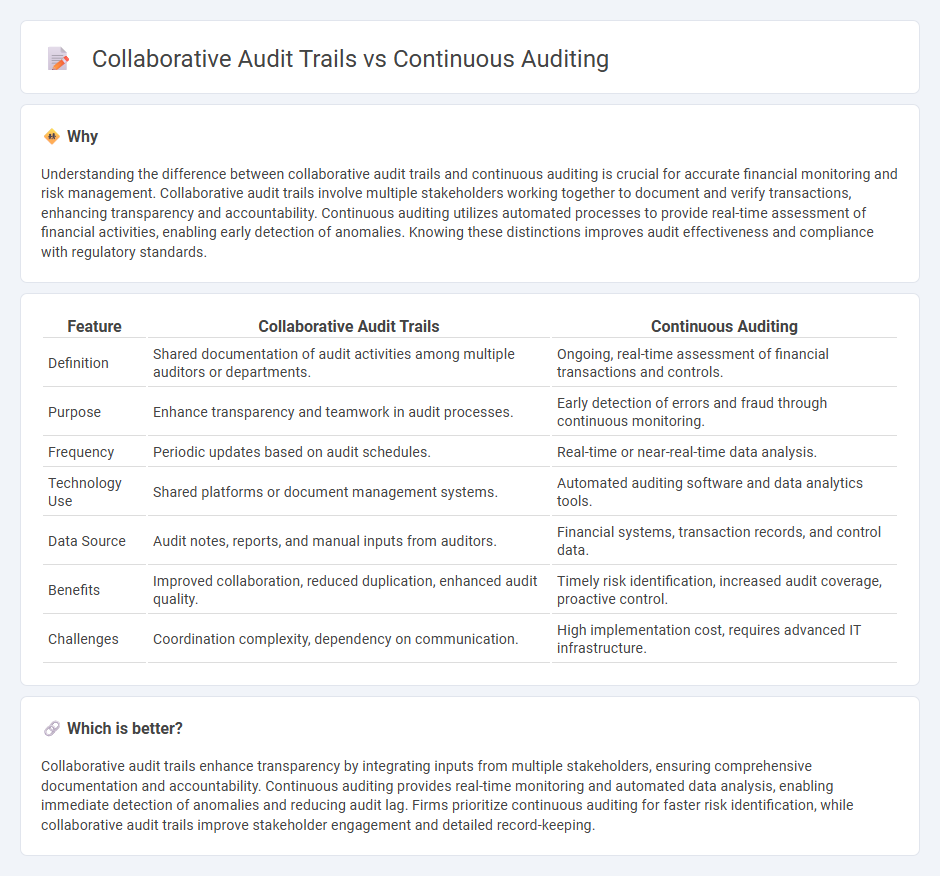

Understanding the difference between collaborative audit trails and continuous auditing is crucial for accurate financial monitoring and risk management. Collaborative audit trails involve multiple stakeholders working together to document and verify transactions, enhancing transparency and accountability. Continuous auditing utilizes automated processes to provide real-time assessment of financial activities, enabling early detection of anomalies. Knowing these distinctions improves audit effectiveness and compliance with regulatory standards.

Comparison Table

| Feature | Collaborative Audit Trails | Continuous Auditing |

|---|---|---|

| Definition | Shared documentation of audit activities among multiple auditors or departments. | Ongoing, real-time assessment of financial transactions and controls. |

| Purpose | Enhance transparency and teamwork in audit processes. | Early detection of errors and fraud through continuous monitoring. |

| Frequency | Periodic updates based on audit schedules. | Real-time or near-real-time data analysis. |

| Technology Use | Shared platforms or document management systems. | Automated auditing software and data analytics tools. |

| Data Source | Audit notes, reports, and manual inputs from auditors. | Financial systems, transaction records, and control data. |

| Benefits | Improved collaboration, reduced duplication, enhanced audit quality. | Timely risk identification, increased audit coverage, proactive control. |

| Challenges | Coordination complexity, dependency on communication. | High implementation cost, requires advanced IT infrastructure. |

Which is better?

Collaborative audit trails enhance transparency by integrating inputs from multiple stakeholders, ensuring comprehensive documentation and accountability. Continuous auditing provides real-time monitoring and automated data analysis, enabling immediate detection of anomalies and reducing audit lag. Firms prioritize continuous auditing for faster risk identification, while collaborative audit trails improve stakeholder engagement and detailed record-keeping.

Connection

Collaborative audit trails enhance continuous auditing by providing real-time, transparent records of financial transactions accessible to multiple stakeholders. Continuous auditing leverages these dynamic audit trails to detect anomalies and ensure compliance promptly, increasing overall financial accuracy. Integration of both fosters proactive risk management and strengthens internal controls within accounting systems.

Key Terms

Real-time data monitoring

Continuous auditing enables real-time data monitoring by automatically analyzing financial transactions as they occur, ensuring immediate detection of anomalies and compliance issues. Collaborative audit trails enhance transparency and accountability by allowing multiple stakeholders to access and verify the audit logs simultaneously, improving data integrity in dynamic environments. Explore how combining these approaches can revolutionize your audit processes with real-time accuracy and collaboration.

Distributed ledger

Continuous auditing leverages real-time data analysis to provide ongoing assurance and immediate detection of discrepancies within distributed ledger systems, enhancing transparency and reliability. Collaborative audit trails enable multiple stakeholders to verify and record transactions collectively on a distributed ledger, ensuring trust and immutability across decentralized networks. Explore in-depth how these technologies transform audit processes in blockchain environments.

Audit transparency

Continuous auditing enhances audit transparency by providing real-time, automated monitoring of financial transactions, ensuring discrepancies are identified promptly. Collaborative audit trails increase transparency through shared, decentralized records, allowing multiple stakeholders to verify and validate audit data collectively. Explore more to understand how these methods transform audit transparency.

Source and External Links

Continuous audit and monitoring - PwC - Continuous auditing is a method where auditors perform audit-related activities on a continuous basis by using analytical rules to detect anomalies in transactional data, enabling timely investigation and remediation of risks.

Continuous Auditing: Advantages & Challenges - DataSnipper - Continuous auditing uses automated processes to provide auditors with frequent and detailed financial reviews, offering real-time data insights and comprehensive transaction coverage beyond traditional sampling methods.

A framework for continuous auditing: Why companies don't need to ... - Continuous auditing automates control and risk assessments to enhance traditional audit methods by providing ongoing testing and faster risk detection without replacing standard audits.

dowidth.com

dowidth.com