Embedded finance reconciliation involves integrating financial transactions directly within non-financial platforms, ensuring seamless tracking of payments and settlements across multiple services. E-wallet reconciliation focuses on verifying and matching digital wallet transactions against recorded balances to prevent discrepancies and fraud. Explore deeper insights into the distinctions and processes of these two critical reconciliation methods.

Why it is important

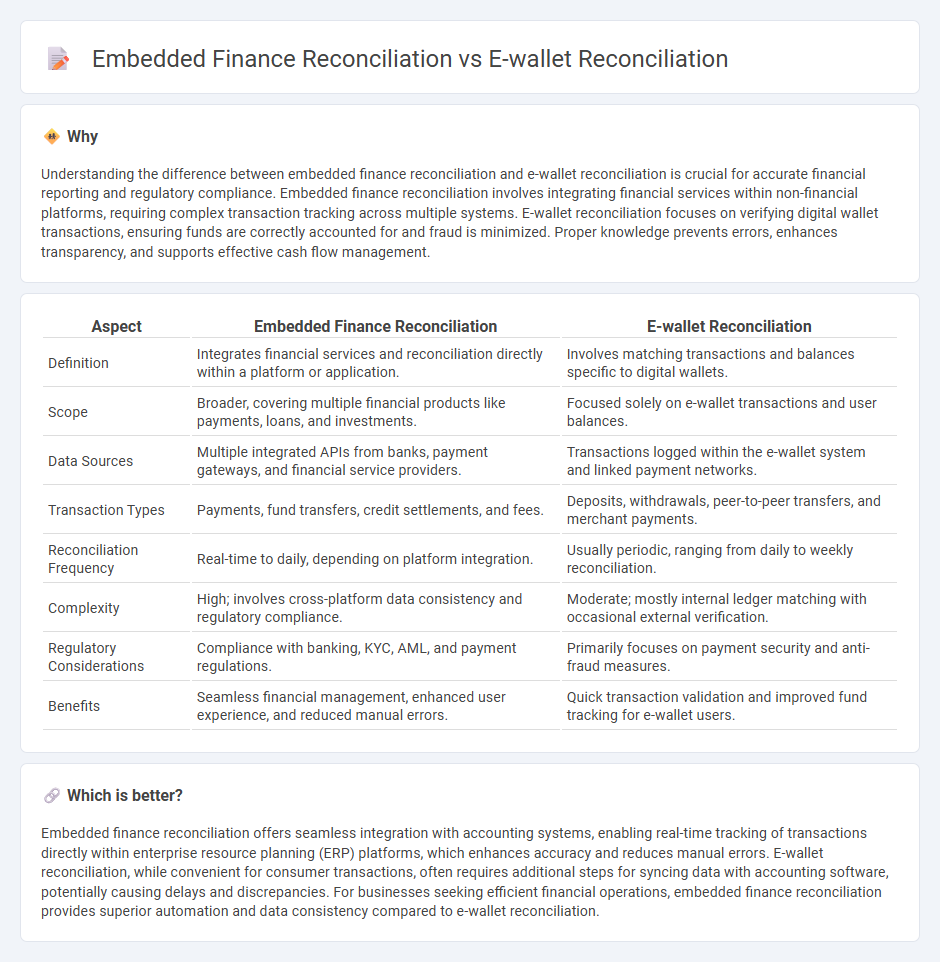

Understanding the difference between embedded finance reconciliation and e-wallet reconciliation is crucial for accurate financial reporting and regulatory compliance. Embedded finance reconciliation involves integrating financial services within non-financial platforms, requiring complex transaction tracking across multiple systems. E-wallet reconciliation focuses on verifying digital wallet transactions, ensuring funds are correctly accounted for and fraud is minimized. Proper knowledge prevents errors, enhances transparency, and supports effective cash flow management.

Comparison Table

| Aspect | Embedded Finance Reconciliation | E-wallet Reconciliation |

|---|---|---|

| Definition | Integrates financial services and reconciliation directly within a platform or application. | Involves matching transactions and balances specific to digital wallets. |

| Scope | Broader, covering multiple financial products like payments, loans, and investments. | Focused solely on e-wallet transactions and user balances. |

| Data Sources | Multiple integrated APIs from banks, payment gateways, and financial service providers. | Transactions logged within the e-wallet system and linked payment networks. |

| Transaction Types | Payments, fund transfers, credit settlements, and fees. | Deposits, withdrawals, peer-to-peer transfers, and merchant payments. |

| Reconciliation Frequency | Real-time to daily, depending on platform integration. | Usually periodic, ranging from daily to weekly reconciliation. |

| Complexity | High; involves cross-platform data consistency and regulatory compliance. | Moderate; mostly internal ledger matching with occasional external verification. |

| Regulatory Considerations | Compliance with banking, KYC, AML, and payment regulations. | Primarily focuses on payment security and anti-fraud measures. |

| Benefits | Seamless financial management, enhanced user experience, and reduced manual errors. | Quick transaction validation and improved fund tracking for e-wallet users. |

Which is better?

Embedded finance reconciliation offers seamless integration with accounting systems, enabling real-time tracking of transactions directly within enterprise resource planning (ERP) platforms, which enhances accuracy and reduces manual errors. E-wallet reconciliation, while convenient for consumer transactions, often requires additional steps for syncing data with accounting software, potentially causing delays and discrepancies. For businesses seeking efficient financial operations, embedded finance reconciliation provides superior automation and data consistency compared to e-wallet reconciliation.

Connection

Embedded finance reconciliation streamlines transaction verification by integrating payment processes directly within platforms, enhancing accuracy and efficiency. E-wallet reconciliation complements this by matching digital wallet transactions with accounting records, ensuring financial data consistency. Together, they create a seamless financial ecosystem that reduces errors and accelerates financial reporting.

Key Terms

**E-wallet reconciliation:**

E-wallet reconciliation involves systematically matching transaction records between the e-wallet platform and bank statements to ensure accuracy and identify discrepancies such as failed or duplicate payments. This process is crucial for detecting fraudulent activities, managing chargebacks, and maintaining regulatory compliance in digital wallet operations. Explore detailed strategies and tools for effective e-wallet reconciliation to enhance financial transparency and operational efficiency.

Transaction matching

E-wallet reconciliation involves matching individual transactions between digital wallets and corresponding financial records, ensuring accuracy in user balances and payment flows. Embedded finance reconciliation integrates transaction matching within third-party platforms, aligning payments and settlements seamlessly across diverse financial services. Explore the nuances of transaction matching to enhance your reconciliation processes effectively.

Float balance

E-wallet reconciliation centers on accurately tracking and managing the float balance, which represents the preloaded funds available for user transactions within the wallet system. Embedded finance reconciliation integrates float balance management with broader financial services, ensuring seamless synchronization between third-party platforms and banking infrastructures, enhancing real-time liquidity visibility. Discover the key differences and best practices for optimizing float balance reconciliation in both e-wallet and embedded finance systems.

Source and External Links

Payout Reconciliation: Process, Types, and Importance - E-wallet reconciliation involves comparing digital wallet transactions with company records, but lack of detailed statements from providers can make monitoring and ensuring accuracy more challenging.

Everything You Need to Know About Payments Reconciliation - Digital wallet reconciliation specifically validates transactions made through apps like PayPal or Venmo to confirm that internal records match the actual payments processed by the platform.

Ecommerce payment reconciliation explained - For e-wallets, gather transaction data from your platform and payment processor, then systematically match and verify each entry to catch discrepancies, fees, or timing delays that might affect reconciliation.

dowidth.com

dowidth.com