Cryptocurrency valuation relies on factors such as market demand, blockchain technology, transaction volume, and network security, making it highly volatile and dependent on digital asset liquidity. Investment property valuation focuses on tangible assets, considering location, rental income, market comparables, and capitalization rates to determine fair market value. Explore the distinct methodologies and challenges involved to deepen your understanding of these valuation approaches.

Why it is important

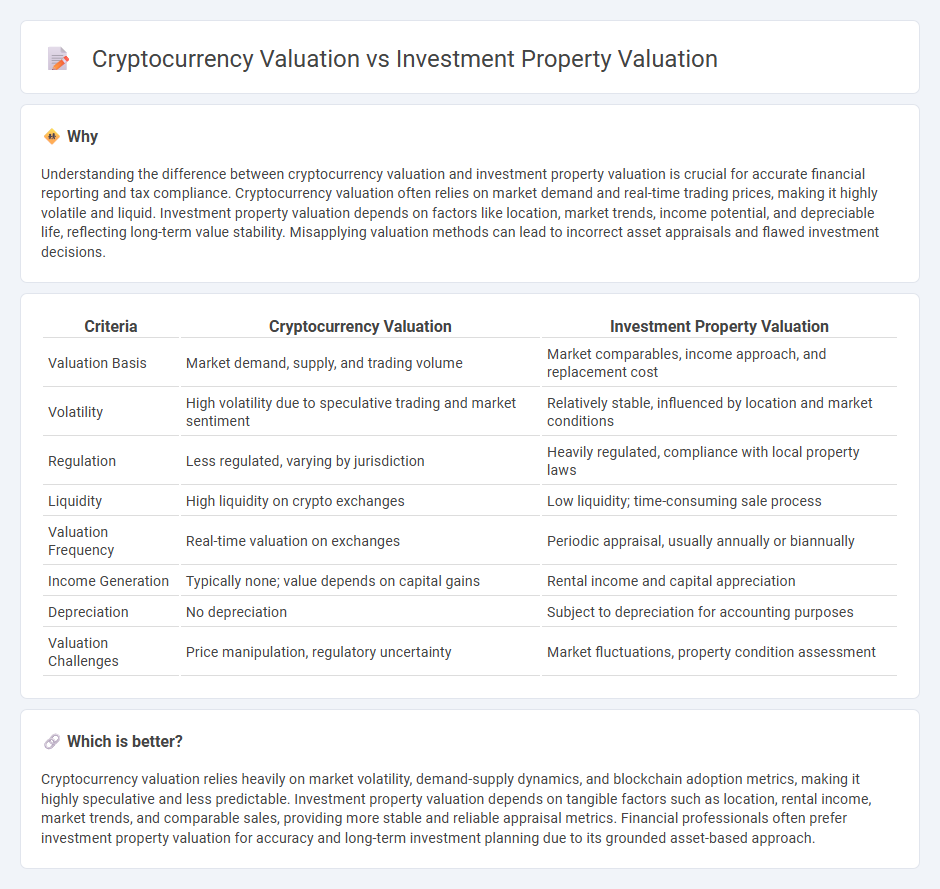

Understanding the difference between cryptocurrency valuation and investment property valuation is crucial for accurate financial reporting and tax compliance. Cryptocurrency valuation often relies on market demand and real-time trading prices, making it highly volatile and liquid. Investment property valuation depends on factors like location, market trends, income potential, and depreciable life, reflecting long-term value stability. Misapplying valuation methods can lead to incorrect asset appraisals and flawed investment decisions.

Comparison Table

| Criteria | Cryptocurrency Valuation | Investment Property Valuation |

|---|---|---|

| Valuation Basis | Market demand, supply, and trading volume | Market comparables, income approach, and replacement cost |

| Volatility | High volatility due to speculative trading and market sentiment | Relatively stable, influenced by location and market conditions |

| Regulation | Less regulated, varying by jurisdiction | Heavily regulated, compliance with local property laws |

| Liquidity | High liquidity on crypto exchanges | Low liquidity; time-consuming sale process |

| Valuation Frequency | Real-time valuation on exchanges | Periodic appraisal, usually annually or biannually |

| Income Generation | Typically none; value depends on capital gains | Rental income and capital appreciation |

| Depreciation | No depreciation | Subject to depreciation for accounting purposes |

| Valuation Challenges | Price manipulation, regulatory uncertainty | Market fluctuations, property condition assessment |

Which is better?

Cryptocurrency valuation relies heavily on market volatility, demand-supply dynamics, and blockchain adoption metrics, making it highly speculative and less predictable. Investment property valuation depends on tangible factors such as location, rental income, market trends, and comparable sales, providing more stable and reliable appraisal metrics. Financial professionals often prefer investment property valuation for accuracy and long-term investment planning due to its grounded asset-based approach.

Connection

Cryptocurrency valuation and investment property valuation both rely on market dynamics, risk assessment, and asset liquidity to determine fair value. They each require analyzing external economic factors, historical data trends, and investor demand to estimate potential returns. Understanding these valuation methodologies enhances financial decision-making and portfolio diversification strategies in accounting practice.

Key Terms

Fair Value

Fair value in investment property valuation relies on comparable market sales, income potential, and replacement costs to determine an asset's true worth. Cryptocurrency valuation emphasizes market demand, liquidity, technological utility, and network activity to assess its fair value. Explore deeper insights into how fair value shapes investment decisions across these asset classes.

Volatility

Investment property valuation relies on factors such as location, rental income, and market trends, offering relatively stable asset value due to lower price fluctuations. Cryptocurrency valuation is highly volatile, driven by market sentiment, regulatory news, and technological developments, causing rapid and significant price changes. Explore further to understand how volatility impacts investment strategies in both asset classes.

Market Liquidity

Market liquidity plays a crucial role in investment property valuation, where real estate assets often exhibit lower liquidity due to longer transaction times and fewer buyers, impacting accurate price discovery. In contrast, cryptocurrency valuation benefits from high market liquidity, enabled by 24/7 global exchanges that facilitate rapid trading and price adjustments. Explore deeper insights into how market liquidity differentials shape asset valuation strategies in real estate and digital currencies.

Source and External Links

Investment Property Appraisals Made Simple - Investment property valuation often uses the income approach, which bases value on net operating income (NOI) divided by the capitalization rate (cap rate), factoring in rental income, expenses, and comparable market data.

How to calculate property value based on rental income - Stessa - Property value can be estimated by dividing net operating income (NOI) by the market cap rate, for example, a $9,720 NOI divided by a 6% cap rate results in a property value of $162,000, with methods like the gross rent multiplier (GRM) used as simpler estimates.

Property Valuation: Tips for Buying an Investment Property - REI Hub - Property valuation methods include the income capitalization approach, using NOI divided by the capitalization rate, and the cost approach, which calculates value based on construction cost, depreciation, and land value, suitable for different property types and purposes.

dowidth.com

dowidth.com