Tokenized assets accounting involves recording and managing ownership of real-world assets represented on a blockchain, emphasizing legal compliance and valuation of underlying assets. Digital asset accounting focuses on cryptocurrencies and virtual currencies, prioritizing transaction tracking, portfolio valuation, and regulatory reporting. Discover detailed comparisons to optimize your financial management strategies.

Why it is important

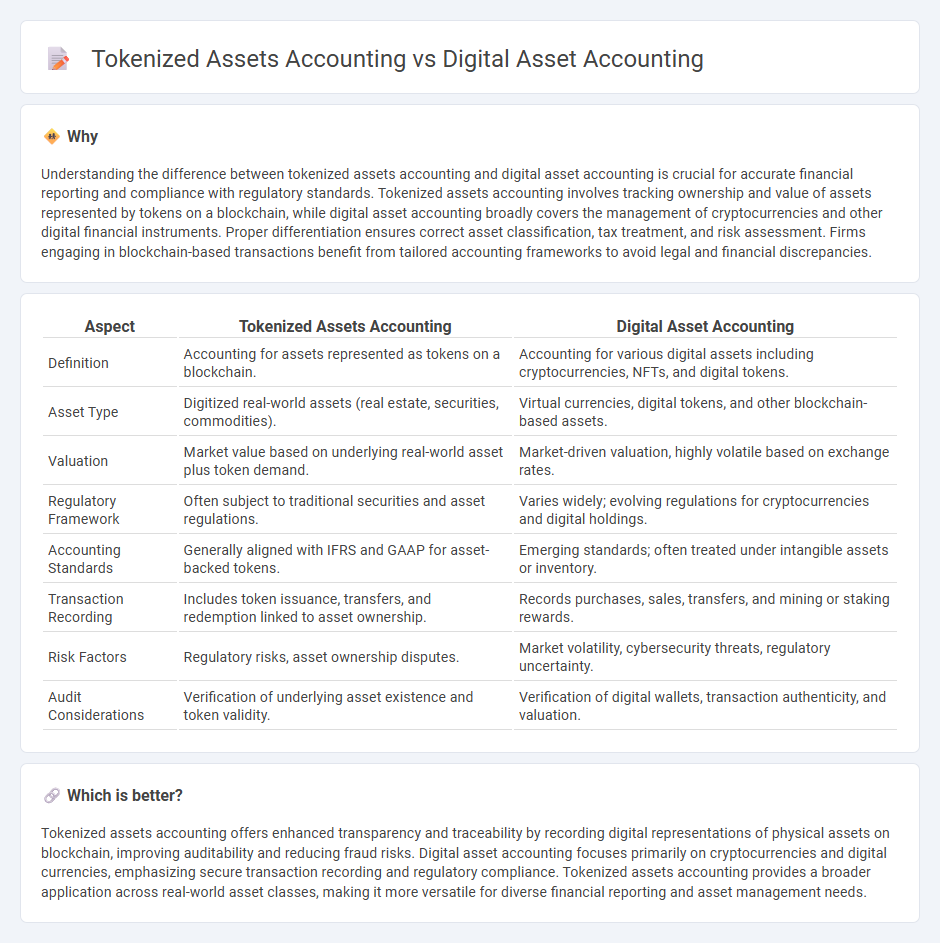

Understanding the difference between tokenized assets accounting and digital asset accounting is crucial for accurate financial reporting and compliance with regulatory standards. Tokenized assets accounting involves tracking ownership and value of assets represented by tokens on a blockchain, while digital asset accounting broadly covers the management of cryptocurrencies and other digital financial instruments. Proper differentiation ensures correct asset classification, tax treatment, and risk assessment. Firms engaging in blockchain-based transactions benefit from tailored accounting frameworks to avoid legal and financial discrepancies.

Comparison Table

| Aspect | Tokenized Assets Accounting | Digital Asset Accounting |

|---|---|---|

| Definition | Accounting for assets represented as tokens on a blockchain. | Accounting for various digital assets including cryptocurrencies, NFTs, and digital tokens. |

| Asset Type | Digitized real-world assets (real estate, securities, commodities). | Virtual currencies, digital tokens, and other blockchain-based assets. |

| Valuation | Market value based on underlying real-world asset plus token demand. | Market-driven valuation, highly volatile based on exchange rates. |

| Regulatory Framework | Often subject to traditional securities and asset regulations. | Varies widely; evolving regulations for cryptocurrencies and digital holdings. |

| Accounting Standards | Generally aligned with IFRS and GAAP for asset-backed tokens. | Emerging standards; often treated under intangible assets or inventory. |

| Transaction Recording | Includes token issuance, transfers, and redemption linked to asset ownership. | Records purchases, sales, transfers, and mining or staking rewards. |

| Risk Factors | Regulatory risks, asset ownership disputes. | Market volatility, cybersecurity threats, regulatory uncertainty. |

| Audit Considerations | Verification of underlying asset existence and token validity. | Verification of digital wallets, transaction authenticity, and valuation. |

Which is better?

Tokenized assets accounting offers enhanced transparency and traceability by recording digital representations of physical assets on blockchain, improving auditability and reducing fraud risks. Digital asset accounting focuses primarily on cryptocurrencies and digital currencies, emphasizing secure transaction recording and regulatory compliance. Tokenized assets accounting provides a broader application across real-world asset classes, making it more versatile for diverse financial reporting and asset management needs.

Connection

Tokenized assets accounting and digital asset accounting intersect through blockchain technology, facilitating transparent recording and tracking of asset ownership and transactions. Both require specialized frameworks to address unique valuation, auditing, and regulatory challenges posed by digital tokens as financial instruments. Integration of these accounting practices enhances accuracy in financial reporting and compliance within decentralized finance ecosystems.

Key Terms

Valuation Methods

Digital asset accounting employs traditional valuation methods such as cost basis, fair value, and market price referencing for cryptocurrencies like Bitcoin or Ethereum. Tokenized assets accounting integrates blockchain technology, necessitating dynamic valuation models that account for the asset's underlying tangible value, token liquidity, and smart contract conditions. Explore more about how emerging valuation techniques optimize accuracy and compliance in both accounting frameworks.

Ownership Verification

Digital asset accounting relies on traditional ledgers and centralized verification methods, often leading to slower ownership confirmation and potential reconciliation issues. Tokenized assets accounting uses blockchain technology to provide immutable, transparent, and real-time ownership verification through smart contracts, enhancing trust and reducing fraud risk. Explore the benefits of blockchain-based ownership verification to optimize your asset management processes.

Regulatory Compliance

Digital asset accounting involves tracking cryptocurrencies and digital tokens under existing financial regulations, emphasizing transparency and accurate valuation. Tokenized assets accounting requires adherence to both traditional asset regulations and blockchain-specific compliance standards, ensuring legal ownership and anti-money laundering (AML) measures. Explore the detailed differences and regulatory frameworks governing these accounting approaches to enhance compliance strategies.

Source and External Links

Accounting treatments for your digital assets - Provides detailed guidance on accounting for digital assets under IFRS, distinguishing between inventory and intangible asset treatment and explaining cost and revaluation models including impairment and amortization considerations.

The United States' First Digital Asset Accounting Rules - Reviews the new U.S. FASB guidelines mandating fair value accounting for cryptocurrencies, enabling companies to report unrealized gains and losses annually for greater financial transparency.

Digital assets | Internal Revenue Service - Explains U.S. tax reporting requirements for digital asset transactions, including recordkeeping and calculating capital gains or losses when disposing of digital assets.

dowidth.com

dowidth.com