Fair value measurement reflects the estimated price at which an asset or liability could be exchanged in an orderly transaction between market participants at the measurement date, emphasizing current market conditions. Intrinsic value calculates the true, inherent worth of an asset based on fundamental analysis, including discounted future cash flows and risk factors. Explore detailed comparisons to understand their distinct roles in financial reporting and investment decisions.

Why it is important

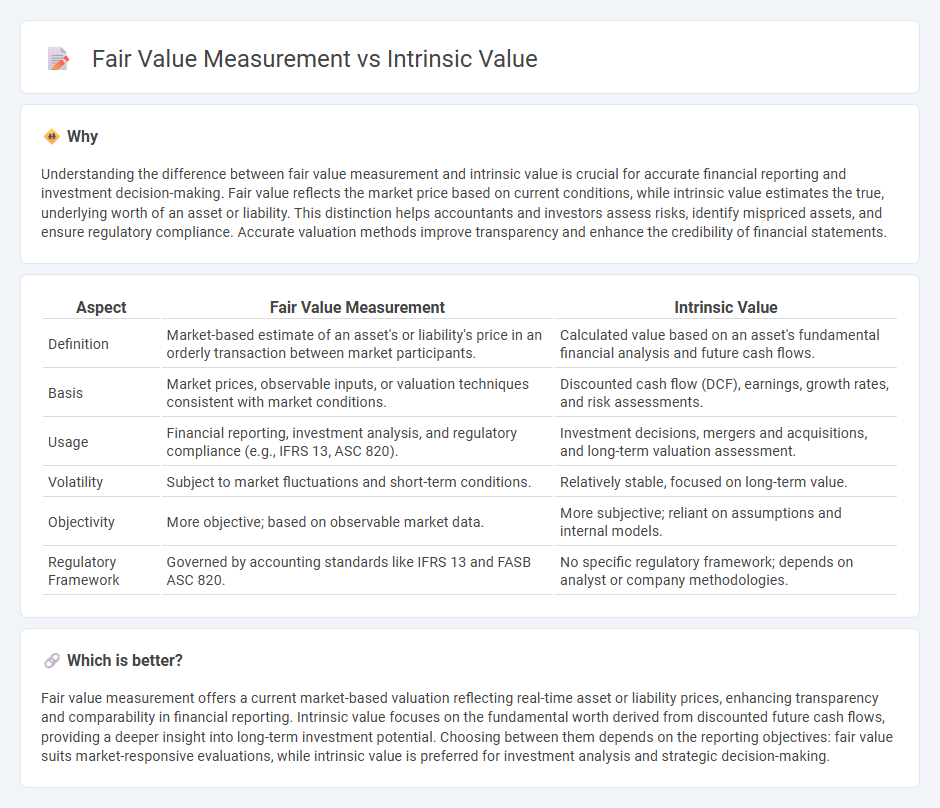

Understanding the difference between fair value measurement and intrinsic value is crucial for accurate financial reporting and investment decision-making. Fair value reflects the market price based on current conditions, while intrinsic value estimates the true, underlying worth of an asset or liability. This distinction helps accountants and investors assess risks, identify mispriced assets, and ensure regulatory compliance. Accurate valuation methods improve transparency and enhance the credibility of financial statements.

Comparison Table

| Aspect | Fair Value Measurement | Intrinsic Value |

|---|---|---|

| Definition | Market-based estimate of an asset's or liability's price in an orderly transaction between market participants. | Calculated value based on an asset's fundamental financial analysis and future cash flows. |

| Basis | Market prices, observable inputs, or valuation techniques consistent with market conditions. | Discounted cash flow (DCF), earnings, growth rates, and risk assessments. |

| Usage | Financial reporting, investment analysis, and regulatory compliance (e.g., IFRS 13, ASC 820). | Investment decisions, mergers and acquisitions, and long-term valuation assessment. |

| Volatility | Subject to market fluctuations and short-term conditions. | Relatively stable, focused on long-term value. |

| Objectivity | More objective; based on observable market data. | More subjective; reliant on assumptions and internal models. |

| Regulatory Framework | Governed by accounting standards like IFRS 13 and FASB ASC 820. | No specific regulatory framework; depends on analyst or company methodologies. |

Which is better?

Fair value measurement offers a current market-based valuation reflecting real-time asset or liability prices, enhancing transparency and comparability in financial reporting. Intrinsic value focuses on the fundamental worth derived from discounted future cash flows, providing a deeper insight into long-term investment potential. Choosing between them depends on the reporting objectives: fair value suits market-responsive evaluations, while intrinsic value is preferred for investment analysis and strategic decision-making.

Connection

Fair value measurement reflects an asset's current market price based on observable inputs, providing a snapshot of its economic worth. Intrinsic value represents the fundamental, discounted cash flow-based valuation that estimates an asset's true long-term worth. Both concepts interconnect by offering complementary perspectives: fair value captures market sentiment, while intrinsic value focuses on underlying financial performance and future cash flow projections.

Key Terms

Present Value

Intrinsic value measurement calculates an asset's worth based on its fundamental characteristics, often using discounted cash flow models to estimate the present value of expected future cash flows. Fair value measurement represents the price at which an asset could be traded in an orderly transaction between market participants at the measurement date, frequently reflecting market conditions rather than solely the asset's inherent attributes. Explore more about how present value techniques influence financial decision-making and asset valuation frameworks.

Market Price

Market price plays a crucial role in fair value measurement, representing the price at which an asset can be bought or sold in an orderly transaction between market participants. Intrinsic value, in contrast, is a fundamental estimate based on an asset's inherent qualities and expected future cash flows, independent of the current market price. Explore the detailed distinctions between intrinsic and fair value measurements to enhance your financial analysis skills.

Discounted Cash Flows

Intrinsic value represents the true economic worth of an asset, calculated using Discounted Cash Flows (DCF) by projecting future cash flows and discounting them to present value. Fair value measurement reflects the estimated market price at which an asset can be exchanged, often influenced by current market conditions and inputs, which may not align with DCF assessments. Explore detailed methodologies and practical applications of DCF in intrinsic and fair value measurements to enhance valuation accuracy.

Source and External Links

What is the Intrinsic Value of a Stock? | Trading Lesson - Intrinsic value is the perceived true worth of a stock independent of its market price, often calculated using the Dividend Discount Model considering expected dividends, required rate of return, and growth rate.

Intrinsic value (ethics) - Wikipedia - In ethics, intrinsic value refers to the inherent worth of something valued for itself rather than for its utility or relation to something else, often considered an end-in-itself.

Learn How to Calculate Intrinsic Value of a Business - The intrinsic value of a business is the present value of all expected future cash flows discounted at an appropriate rate, representing the price a rational investor is willing to pay based on risk and fundamentals.

dowidth.com

dowidth.com