Embedded finance reconciliation integrates payment data directly within business platforms, enabling seamless tracking of transactions and reducing manual errors. Peer-to-peer payment reconciliation focuses on verifying individual transfers between users, often requiring real-time matching and fraud prevention measures. Explore detailed differences and best practices to optimize your financial workflows.

Why it is important

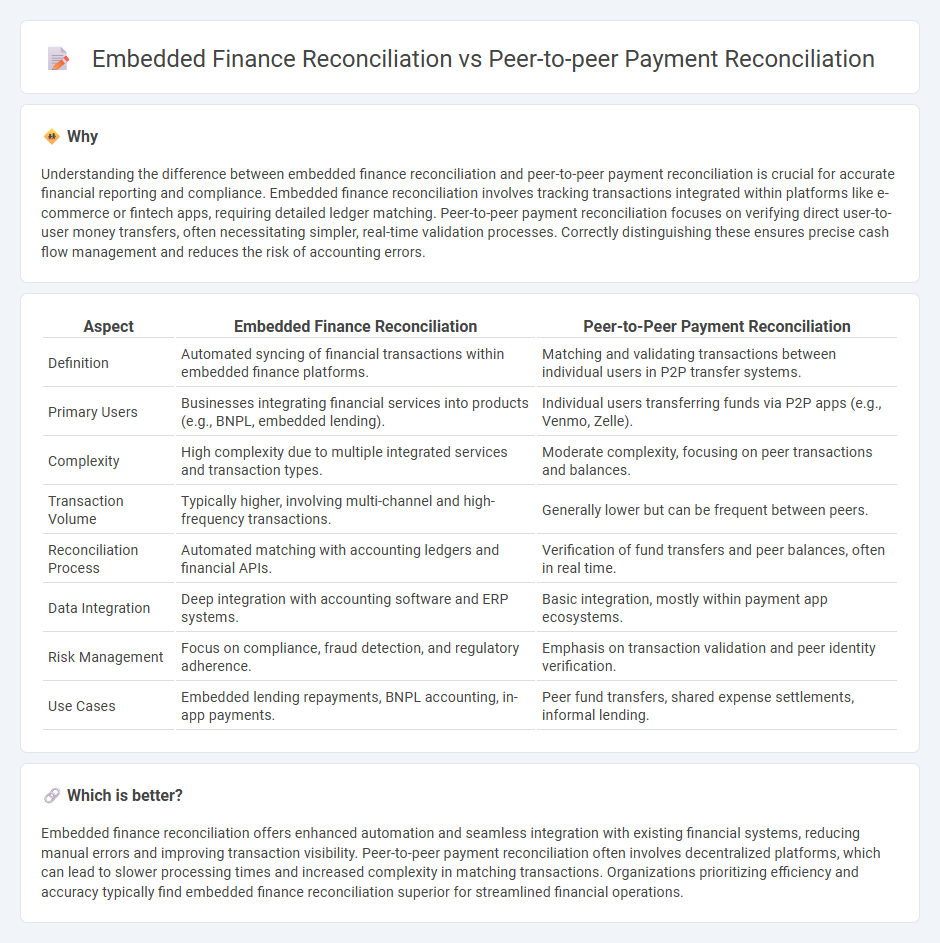

Understanding the difference between embedded finance reconciliation and peer-to-peer payment reconciliation is crucial for accurate financial reporting and compliance. Embedded finance reconciliation involves tracking transactions integrated within platforms like e-commerce or fintech apps, requiring detailed ledger matching. Peer-to-peer payment reconciliation focuses on verifying direct user-to-user money transfers, often necessitating simpler, real-time validation processes. Correctly distinguishing these ensures precise cash flow management and reduces the risk of accounting errors.

Comparison Table

| Aspect | Embedded Finance Reconciliation | Peer-to-Peer Payment Reconciliation |

|---|---|---|

| Definition | Automated syncing of financial transactions within embedded finance platforms. | Matching and validating transactions between individual users in P2P transfer systems. |

| Primary Users | Businesses integrating financial services into products (e.g., BNPL, embedded lending). | Individual users transferring funds via P2P apps (e.g., Venmo, Zelle). |

| Complexity | High complexity due to multiple integrated services and transaction types. | Moderate complexity, focusing on peer transactions and balances. |

| Transaction Volume | Typically higher, involving multi-channel and high-frequency transactions. | Generally lower but can be frequent between peers. |

| Reconciliation Process | Automated matching with accounting ledgers and financial APIs. | Verification of fund transfers and peer balances, often in real time. |

| Data Integration | Deep integration with accounting software and ERP systems. | Basic integration, mostly within payment app ecosystems. |

| Risk Management | Focus on compliance, fraud detection, and regulatory adherence. | Emphasis on transaction validation and peer identity verification. |

| Use Cases | Embedded lending repayments, BNPL accounting, in-app payments. | Peer fund transfers, shared expense settlements, informal lending. |

Which is better?

Embedded finance reconciliation offers enhanced automation and seamless integration with existing financial systems, reducing manual errors and improving transaction visibility. Peer-to-peer payment reconciliation often involves decentralized platforms, which can lead to slower processing times and increased complexity in matching transactions. Organizations prioritizing efficiency and accuracy typically find embedded finance reconciliation superior for streamlined financial operations.

Connection

Embedded finance reconciliation and peer-to-peer payment reconciliation are connected through their shared reliance on automated transaction matching and data integration to ensure accuracy in financial records. Both processes streamline the verification of payment flows by utilizing real-time data exchange and reconciliation algorithms, reducing errors and operational costs. This integration enhances transparency and compliance across decentralized payment networks and embedded financial services.

Key Terms

**Peer-to-peer payment reconciliation:**

Peer-to-peer payment reconciliation involves verifying and matching transactions directly between individuals or businesses without intermediaries, ensuring accuracy in user-to-user fund transfers. This process requires robust verification of payment details, timestamps, and amounts to prevent errors or fraud in decentralized payment networks. Explore the nuances and best practices for optimizing peer-to-peer payment reconciliation systems.

Transaction Matching

Peer-to-peer payment reconciliation centers on matching individual transactions directly between users, emphasizing real-time verification and accuracy to ensure seamless fund transfers. Embedded finance reconciliation integrates payment matching within broader financial services platforms, requiring sophisticated algorithms to handle complex transaction flows across multiple channels and accounts. Explore deeper insights into how transaction matching optimizes financial operations in both contexts.

User Authentication

Peer-to-peer payment reconciliation relies heavily on robust user authentication methods such as two-factor authentication and biometric verification to ensure secure fund transfers directly between individuals. Embedded finance reconciliation incorporates authentication processes within third-party platforms, leveraging APIs and OAuth protocols to seamlessly verify user identity during financial transactions. Explore further to understand key authentication differences and their impact on reconciliation efficiency.

Source and External Links

What is payment reconciliation & how does it work? - Ledge - Payment reconciliation involves cross-checking and verifying P2P payment transactions between internal records and external sources like banks and payment processors to ensure accurate, up-to-date financial reporting.

Rise in Person-to-Person Payments Causes Reconciliation Challenges - Fiserv - The surge in P2P payments, especially after 2020, complicates reconciliation for finance teams due to increased transaction volume and multiple payment channels to track and match.

Peer-to-peer (P2P) payments system meaning & trends - DashDevs - P2P payment reconciliation updates both parties' transaction records to ensure their account balances match the completed transfer and includes notifications to sender and receiver confirming transaction completion.

dowidth.com

dowidth.com