Real-time expense recognition records costs as they occur, ensuring accurate financial reporting and enhanced cash flow management. Delayed expense recognition defers cost recording, potentially distorting financial statements and affecting decision-making processes. Explore the impact of these methods on financial accuracy and business strategy.

Why it is important

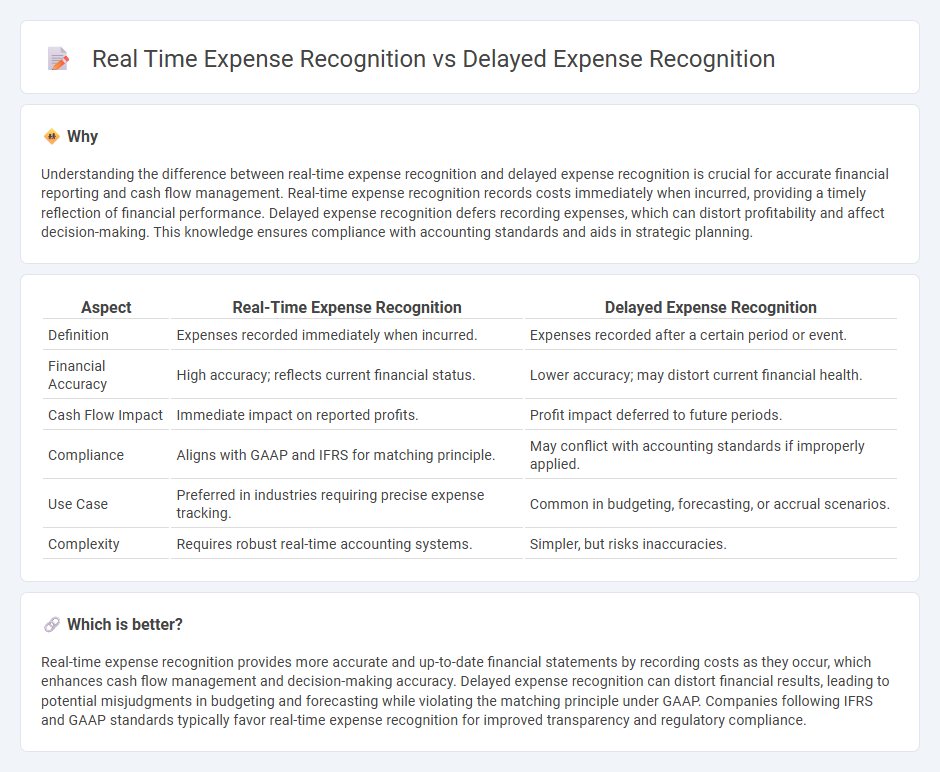

Understanding the difference between real-time expense recognition and delayed expense recognition is crucial for accurate financial reporting and cash flow management. Real-time expense recognition records costs immediately when incurred, providing a timely reflection of financial performance. Delayed expense recognition defers recording expenses, which can distort profitability and affect decision-making. This knowledge ensures compliance with accounting standards and aids in strategic planning.

Comparison Table

| Aspect | Real-Time Expense Recognition | Delayed Expense Recognition |

|---|---|---|

| Definition | Expenses recorded immediately when incurred. | Expenses recorded after a certain period or event. |

| Financial Accuracy | High accuracy; reflects current financial status. | Lower accuracy; may distort current financial health. |

| Cash Flow Impact | Immediate impact on reported profits. | Profit impact deferred to future periods. |

| Compliance | Aligns with GAAP and IFRS for matching principle. | May conflict with accounting standards if improperly applied. |

| Use Case | Preferred in industries requiring precise expense tracking. | Common in budgeting, forecasting, or accrual scenarios. |

| Complexity | Requires robust real-time accounting systems. | Simpler, but risks inaccuracies. |

Which is better?

Real-time expense recognition provides more accurate and up-to-date financial statements by recording costs as they occur, which enhances cash flow management and decision-making accuracy. Delayed expense recognition can distort financial results, leading to potential misjudgments in budgeting and forecasting while violating the matching principle under GAAP. Companies following IFRS and GAAP standards typically favor real-time expense recognition for improved transparency and regulatory compliance.

Connection

Real-time expense recognition records costs immediately as they occur, enhancing accurate financial reporting and cash flow management; delayed expense recognition postpones this recording, potentially leading to mismatched revenues and expenses in financial statements. Both methods affect timing in accrual accounting and influence tax planning strategies by altering expense deduction periods. Understanding their connection is crucial for maintaining compliance with accounting standards like GAAP and IFRS while optimizing financial performance.

Key Terms

Accrual Accounting

Delayed expense recognition under accrual accounting records expenses only when they are paid, potentially distorting financial performance by mismatching expenses with revenues. Real-time expense recognition ensures expenses are recorded immediately when incurred, providing a more accurate financial picture through timely matching of costs and revenues. Explore detailed comparisons of these methods to optimize accrual accounting practices.

Cash Basis Accounting

Cash basis accounting recognizes expenses only when cash is actually paid, leading to delayed expense recognition that may not match the period in which the expense is incurred. Real-time expense recognition, though less common in cash basis accounting, involves recording expenses immediately as they occur, providing more accurate financial insights. Explore the differences further to understand how each method impacts your financial reporting and decision-making.

Matching Principle

Delayed expense recognition postpones recording expenses until revenues are matched, aligning with the Matching Principle by ensuring expenses are reported in the same period as related revenues. Real-time expense recognition records expenses immediately when incurred, which may provide timely financial data but can misalign expenses and revenues. Explore how these approaches impact financial statements and compliance with accounting standards.

Source and External Links

Understanding Deferred Revenue and Expense Accounting - Delayed expense recognition, or deferred expense accounting, involves initially recording payments made in advance as assets, then recognizing these expenses gradually over the periods when the related benefits are received, following the matching principle to align expenses with generated revenues.

Expense recognition definition - Expense recognition can be delayed under the cash basis of accounting, where expenses are recorded when invoices are paid rather than when incurred, and improper delay of expense recognition can be a form of financial statement manipulation.

Deferral in Accounting Defined: What Is It? Why Use It? - Expense deferrals delay expense recognition to match expenses with the related revenues in the same period, ensuring accurate financial reporting by pushing recognition of expenses to future fiscal periods when benefits occur.

dowidth.com

dowidth.com