On-demand accruals represent expenses recognized when incurred but paid later, enhancing the accuracy of financial statements by matching costs to the period they relate to. Accounts receivable reflect the outstanding invoices a company expects to collect from customers, directly impacting cash flow management and working capital. Explore the differences between on-demand accruals and accounts receivable to optimize your accounting practices.

Why it is important

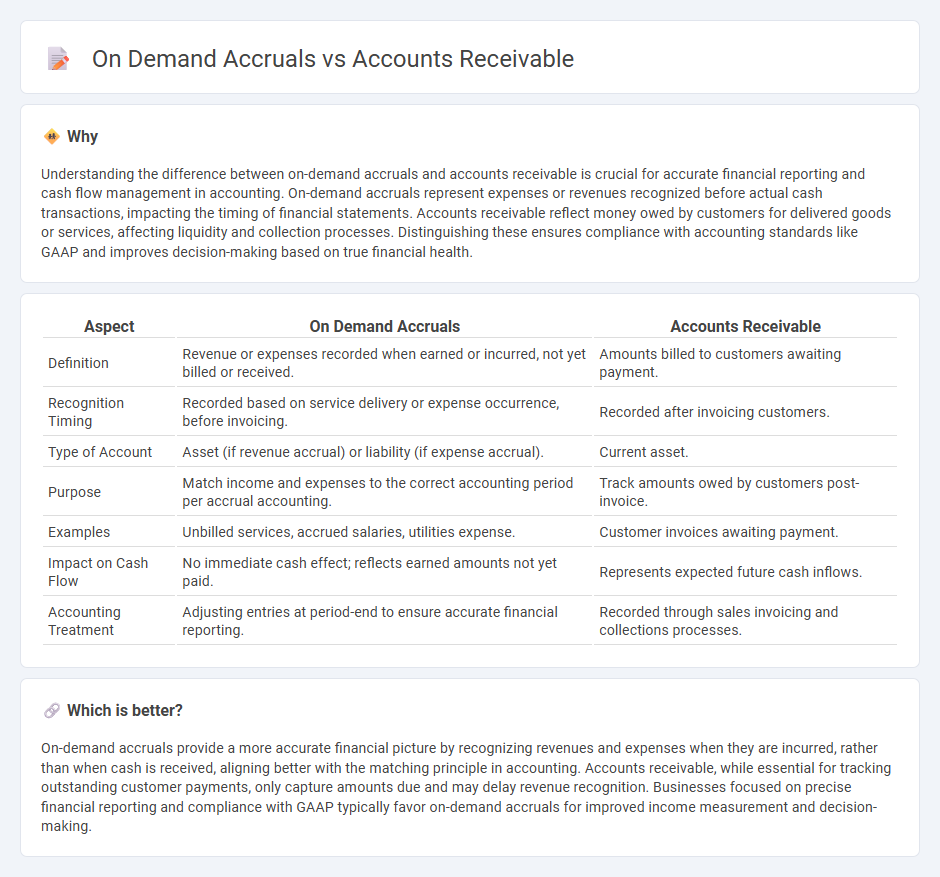

Understanding the difference between on-demand accruals and accounts receivable is crucial for accurate financial reporting and cash flow management in accounting. On-demand accruals represent expenses or revenues recognized before actual cash transactions, impacting the timing of financial statements. Accounts receivable reflect money owed by customers for delivered goods or services, affecting liquidity and collection processes. Distinguishing these ensures compliance with accounting standards like GAAP and improves decision-making based on true financial health.

Comparison Table

| Aspect | On Demand Accruals | Accounts Receivable |

|---|---|---|

| Definition | Revenue or expenses recorded when earned or incurred, not yet billed or received. | Amounts billed to customers awaiting payment. |

| Recognition Timing | Recorded based on service delivery or expense occurrence, before invoicing. | Recorded after invoicing customers. |

| Type of Account | Asset (if revenue accrual) or liability (if expense accrual). | Current asset. |

| Purpose | Match income and expenses to the correct accounting period per accrual accounting. | Track amounts owed by customers post-invoice. |

| Examples | Unbilled services, accrued salaries, utilities expense. | Customer invoices awaiting payment. |

| Impact on Cash Flow | No immediate cash effect; reflects earned amounts not yet paid. | Represents expected future cash inflows. |

| Accounting Treatment | Adjusting entries at period-end to ensure accurate financial reporting. | Recorded through sales invoicing and collections processes. |

Which is better?

On-demand accruals provide a more accurate financial picture by recognizing revenues and expenses when they are incurred, rather than when cash is received, aligning better with the matching principle in accounting. Accounts receivable, while essential for tracking outstanding customer payments, only capture amounts due and may delay revenue recognition. Businesses focused on precise financial reporting and compliance with GAAP typically favor on-demand accruals for improved income measurement and decision-making.

Connection

On-demand accruals directly impact accounts receivable by recognizing revenue at the point of service delivery before cash collection, ensuring accurate financial reporting. This method aligns revenue with earned work, improving the precision of accounts receivable balances and accelerating cash flow visibility. Accurate on-demand accrual tracking enhances credit management and reduces the risk of overdue receivables.

Key Terms

Revenue Recognition

Accounts receivable represents amounts billed to customers for goods or services delivered, recognized as revenue when earned under accrual accounting. On-demand accruals involve recognizing revenue or expenses before actual invoicing or payment, ensuring financial statements reflect earned revenues and incurred costs in the correct period. Explore our detailed analysis to understand how these concepts impact accurate revenue recognition and financial reporting.

Trade Debtors

Trade debtors represent amounts owed by customers from credit sales, classified under accounts receivable on the balance sheet. On demand accruals refer to accrued revenues that are recognized before actual payment, reflecting expected but yet unbilled income. Explore more to understand how these impact cash flow and financial reporting in business operations.

Accrual Basis

Accounts receivable represents amounts owed to a company by customers for goods or services delivered, recorded under the accrual basis when earned revenue is recognized before cash collection. On-demand accruals refer to expenses or revenues recorded as they are incurred or earned, despite actual cash transactions occurring later, ensuring financial statements reflect real-time economic activities. Explore more to understand how accrual basis accounting improves financial accuracy and decision-making.

Source and External Links

What Is Accounts Receivable? AR Explained - NetSuite - Accounts receivable (AR) is the amount of money owed to a company by clients for goods or services delivered, involving steps such as credit assessment, invoicing, recording, and collection processes with typical payment terms like net30 days.

Accounts receivable - Wikipedia - Accounts receivable are legally enforceable claims for payment held by a business for goods or services supplied, generally recorded as invoices to be paid within agreed timeframes and shown as an asset on the balance sheet.

REPORTING AND ACCOUNTS RECEIVABLE - Harper College - Accounts receivable represent amounts customers owe on account from sales or services, typically expected to be collected within 30 to 60 days, and can also include notes and other receivables.

dowidth.com

dowidth.com