Tokenized assets accounting involves recording and managing digital assets representing ownership rights on a blockchain, requiring specialized frameworks to address valuation, custody, and regulatory compliance. Impairment accounting focuses on adjusting the carrying value of assets when their recoverable amount falls below the book value, ensuring accurate financial reporting. Explore the key differences and implications of these accounting approaches to enhance your financial management strategy.

Why it is important

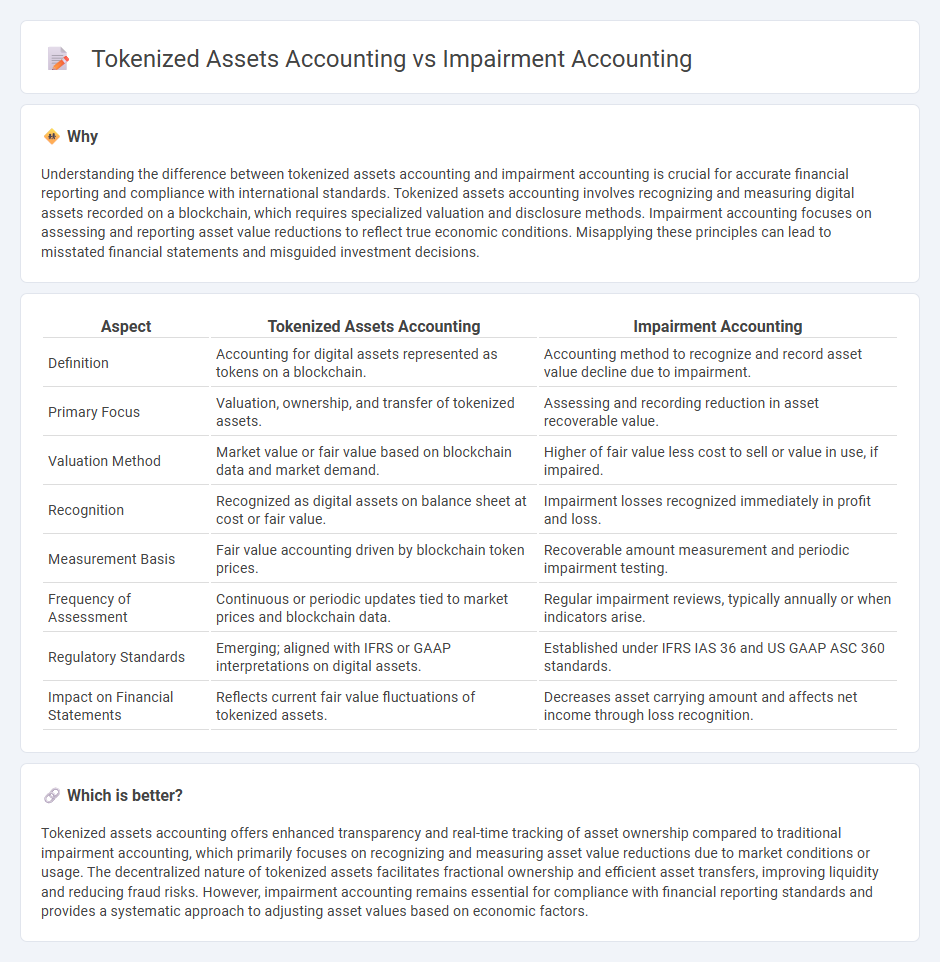

Understanding the difference between tokenized assets accounting and impairment accounting is crucial for accurate financial reporting and compliance with international standards. Tokenized assets accounting involves recognizing and measuring digital assets recorded on a blockchain, which requires specialized valuation and disclosure methods. Impairment accounting focuses on assessing and reporting asset value reductions to reflect true economic conditions. Misapplying these principles can lead to misstated financial statements and misguided investment decisions.

Comparison Table

| Aspect | Tokenized Assets Accounting | Impairment Accounting |

|---|---|---|

| Definition | Accounting for digital assets represented as tokens on a blockchain. | Accounting method to recognize and record asset value decline due to impairment. |

| Primary Focus | Valuation, ownership, and transfer of tokenized assets. | Assessing and recording reduction in asset recoverable value. |

| Valuation Method | Market value or fair value based on blockchain data and market demand. | Higher of fair value less cost to sell or value in use, if impaired. |

| Recognition | Recognized as digital assets on balance sheet at cost or fair value. | Impairment losses recognized immediately in profit and loss. |

| Measurement Basis | Fair value accounting driven by blockchain token prices. | Recoverable amount measurement and periodic impairment testing. |

| Frequency of Assessment | Continuous or periodic updates tied to market prices and blockchain data. | Regular impairment reviews, typically annually or when indicators arise. |

| Regulatory Standards | Emerging; aligned with IFRS or GAAP interpretations on digital assets. | Established under IFRS IAS 36 and US GAAP ASC 360 standards. |

| Impact on Financial Statements | Reflects current fair value fluctuations of tokenized assets. | Decreases asset carrying amount and affects net income through loss recognition. |

Which is better?

Tokenized assets accounting offers enhanced transparency and real-time tracking of asset ownership compared to traditional impairment accounting, which primarily focuses on recognizing and measuring asset value reductions due to market conditions or usage. The decentralized nature of tokenized assets facilitates fractional ownership and efficient asset transfers, improving liquidity and reducing fraud risks. However, impairment accounting remains essential for compliance with financial reporting standards and provides a systematic approach to adjusting asset values based on economic factors.

Connection

Tokenized assets accounting involves recording digital representations of assets on blockchain technology, requiring precise valuation methods to reflect their fluctuating market value. Impairment accounting plays a critical role by assessing and recognizing reductions in the recoverable amount of these tokenized assets when their carrying value exceeds the fair value. This connection ensures that financial statements accurately represent the impaired value of tokenized assets, maintaining transparency and compliance with accounting standards like IFRS 9 and ASC 360.

Key Terms

Carrying Amount

Impairment accounting for carrying amounts requires regularly assessing asset values to reflect reductions due to damage or obsolescence, following standards like IFRS or GAAP. Tokenized assets accounting introduces blockchain-based ledgers that enhance transparency and accuracy in tracking carrying amounts, reducing the subjective nature of impairment evaluations. Explore more to understand how emerging technologies reshape asset valuation frameworks.

Fair Value

Impairment accounting measures asset value declines based on incurred losses and historical cost, while tokenized assets accounting emphasizes real-time Fair Value assessments using blockchain-based market data and digital asset liquidity. Fair Value in tokenized assets leverages transparent, decentralized price discovery processes, enhancing valuation accuracy compared to traditional impairment models reliant on periodic reviews and subjective judgments. Explore the evolving methodologies to understand the impact of Fair Value on modern asset accounting frameworks.

Blockchain Ledger

Impairment accounting involves adjusting the book value of assets to reflect a decline in their recoverable amount, which can be complex for traditional financial instruments but even more challenging for tokenized assets on blockchain ledgers due to their unique nature and valuation volatility. Tokenized assets accounting leverages blockchain technology to provide transparent, immutable records and real-time tracking, facilitating enhanced verification and fractional ownership representation. Explore in-depth how blockchain ledgers reshape asset impairment and valuation methodologies for contemporary accounting practices.

Source and External Links

Impairment (financial reporting) - Wikipedia - Impairment accounting involves recognizing a reduction in the recoverable amount of an asset below its carrying value, calculated as the difference between the recoverable amount (higher of value in use or fair value less costs to sell) and carrying value, governed by IAS 36 standards.

10.3 Impairment - Intermediate Financial Accounting 1 - IFRS requires entities to assess impairment by comparing an asset's carrying value to its recoverable amount, defined as the greater of its value in use and fair value less costs to sell, and recognize impairment loss if carrying value exceeds recoverable amount.

How to Handle Impairment of Assets the Right Way - Patriot Software - Impairment accounting records an asset's loss in value when its market value falls below its book value (cost minus depreciation), requiring a write-down of the asset and adjustment to future depreciation, commonly applied to fixed and intangible assets.

dowidth.com

dowidth.com