Carbon footprint accounting measures the environmental impact of an organization's activities by quantifying greenhouse gas emissions, while financial accounting focuses on recording and reporting monetary transactions according to standardized principles. Both accounting types provide essential insights for sustainable business decisions and compliance with regulatory frameworks. Explore how integrating carbon footprint accounting enhances corporate responsibility and financial transparency.

Why it is important

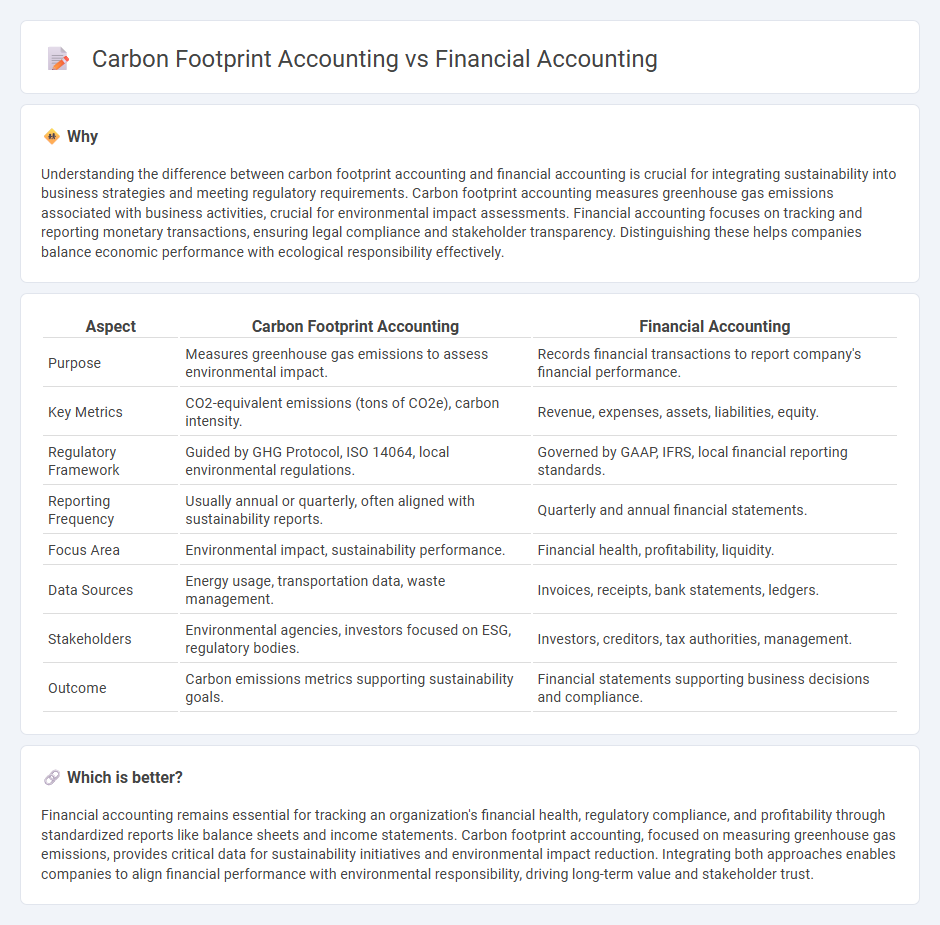

Understanding the difference between carbon footprint accounting and financial accounting is crucial for integrating sustainability into business strategies and meeting regulatory requirements. Carbon footprint accounting measures greenhouse gas emissions associated with business activities, crucial for environmental impact assessments. Financial accounting focuses on tracking and reporting monetary transactions, ensuring legal compliance and stakeholder transparency. Distinguishing these helps companies balance economic performance with ecological responsibility effectively.

Comparison Table

| Aspect | Carbon Footprint Accounting | Financial Accounting |

|---|---|---|

| Purpose | Measures greenhouse gas emissions to assess environmental impact. | Records financial transactions to report company's financial performance. |

| Key Metrics | CO2-equivalent emissions (tons of CO2e), carbon intensity. | Revenue, expenses, assets, liabilities, equity. |

| Regulatory Framework | Guided by GHG Protocol, ISO 14064, local environmental regulations. | Governed by GAAP, IFRS, local financial reporting standards. |

| Reporting Frequency | Usually annual or quarterly, often aligned with sustainability reports. | Quarterly and annual financial statements. |

| Focus Area | Environmental impact, sustainability performance. | Financial health, profitability, liquidity. |

| Data Sources | Energy usage, transportation data, waste management. | Invoices, receipts, bank statements, ledgers. |

| Stakeholders | Environmental agencies, investors focused on ESG, regulatory bodies. | Investors, creditors, tax authorities, management. |

| Outcome | Carbon emissions metrics supporting sustainability goals. | Financial statements supporting business decisions and compliance. |

Which is better?

Financial accounting remains essential for tracking an organization's financial health, regulatory compliance, and profitability through standardized reports like balance sheets and income statements. Carbon footprint accounting, focused on measuring greenhouse gas emissions, provides critical data for sustainability initiatives and environmental impact reduction. Integrating both approaches enables companies to align financial performance with environmental responsibility, driving long-term value and stakeholder trust.

Connection

Carbon footprint accounting integrates with financial accounting by quantifying greenhouse gas emissions in monetary terms, enabling businesses to include environmental costs in financial statements. This connection supports better investment decisions and regulatory compliance by aligning sustainability metrics with financial performance indicators like cost of capital and asset valuation. Accurate carbon accounting drives transparency and risk management, impacting financial disclosures and long-term economic sustainability.

Key Terms

Financial Statements

Financial accounting focuses on recording, summarizing, and reporting a company's financial transactions to provide accurate financial statements such as the balance sheet, income statement, and cash flow statement. Carbon footprint accounting measures and tracks the environmental impact of business operations, specifically greenhouse gas emissions, but these results are not yet standard components of traditional financial statements. Explore the integration of carbon footprint data into financial reporting to better understand how sustainability metrics are shaping corporate accountability.

Double-Entry Bookkeeping

Double-entry bookkeeping is the foundation of financial accounting, ensuring accuracy by recording each transaction as debits and credits across accounts. Carbon footprint accounting, while emerging, adapts this principle by tracking emissions data as entries, facilitating transparent environmental impact reporting. Explore the integration of conventional bookkeeping with sustainable practices to enhance corporate accountability.

Emissions Reporting

Financial accounting records monetary transactions to provide an accurate representation of a company's economic performance, while carbon footprint accounting quantifies greenhouse gas emissions to assess environmental impact. Emissions reporting, a key component of carbon footprint accounting, involves measuring, verifying, and disclosing data related to Scope 1, Scope 2, and Scope 3 emissions in accordance with standards such as the Greenhouse Gas Protocol. Explore detailed methodologies and compliance requirements to enhance your understanding of emissions reporting in a corporate context.

Source and External Links

What Is Financial Accounting? Key Principles, Careers & ... - Financial accounting is focused on recording and summarizing business transactions to prepare financial statements that provide a clear picture of a company's financial health, following principles like GAAP or IFRS to ensure transparency and comparability across companies.

Financial Accounting: Meaning, Principles, and Importance - Financial accounting involves recording, summarizing, and reporting business transactions through key financial statements such as income statements, balance sheets, cash flow statements, and follows GAAP standards to ensure accuracy and consistency in public reporting.

Financial accounting - It is the systematic process of recording, classifying, summarizing financial transactions and preparing financial statements to ascertain business results, financial position, solvency, and to support rational decision-making for stakeholders.

dowidth.com

dowidth.com