Real-time expense reconciliation improves financial accuracy and cash flow management by instantly matching transactions with budgets and receipts. Expense report auditing focuses on verifying historical expense data to ensure compliance and detect fraud. Explore how integrating both methods can enhance your organization's financial controls.

Why it is important

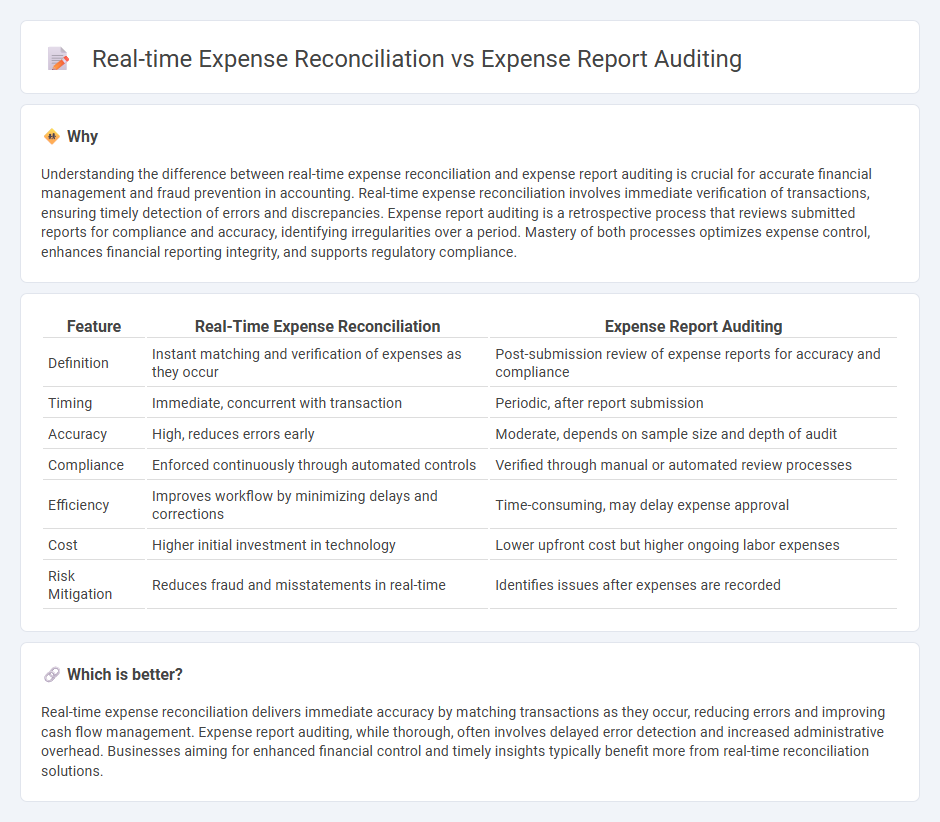

Understanding the difference between real-time expense reconciliation and expense report auditing is crucial for accurate financial management and fraud prevention in accounting. Real-time expense reconciliation involves immediate verification of transactions, ensuring timely detection of errors and discrepancies. Expense report auditing is a retrospective process that reviews submitted reports for compliance and accuracy, identifying irregularities over a period. Mastery of both processes optimizes expense control, enhances financial reporting integrity, and supports regulatory compliance.

Comparison Table

| Feature | Real-Time Expense Reconciliation | Expense Report Auditing |

|---|---|---|

| Definition | Instant matching and verification of expenses as they occur | Post-submission review of expense reports for accuracy and compliance |

| Timing | Immediate, concurrent with transaction | Periodic, after report submission |

| Accuracy | High, reduces errors early | Moderate, depends on sample size and depth of audit |

| Compliance | Enforced continuously through automated controls | Verified through manual or automated review processes |

| Efficiency | Improves workflow by minimizing delays and corrections | Time-consuming, may delay expense approval |

| Cost | Higher initial investment in technology | Lower upfront cost but higher ongoing labor expenses |

| Risk Mitigation | Reduces fraud and misstatements in real-time | Identifies issues after expenses are recorded |

Which is better?

Real-time expense reconciliation delivers immediate accuracy by matching transactions as they occur, reducing errors and improving cash flow management. Expense report auditing, while thorough, often involves delayed error detection and increased administrative overhead. Businesses aiming for enhanced financial control and timely insights typically benefit more from real-time reconciliation solutions.

Connection

Real-time expense reconciliation and expense report auditing are connected through their joint role in enhancing financial accuracy and compliance within organizations. Real-time expense reconciliation ensures immediate matching of transaction data with expense reports, reducing errors and discrepancies. Expense report auditing then systematically verifies these reconciliations, identifying any irregularities or fraudulent activity to maintain financial integrity.

Key Terms

Compliance verification

Expense report auditing involves a thorough post-submission examination of employee expenses to ensure adherence to company policies and regulatory standards, focusing primarily on compliance verification through manual or automated reviews. Real-time expense reconciliation integrates expense tracking with company accounts instantly, enabling immediate detection and correction of discrepancies during the transaction process, which enhances compliance by preventing policy breaches as expenses occur. Explore advanced solutions in expense management to optimize compliance verification and financial accuracy in your organization.

Automated data matching

Automated data matching streamlines both expense report auditing and real-time expense reconciliation by instantly cross-referencing transaction details with predefined criteria to detect discrepancies. Expense report auditing benefits from automated systems by reducing manual errors and accelerating the verification process, while real-time reconciliation ensures continuous accuracy and compliance by updating records immediately as expenses occur. Explore how advanced automated data matching technologies can enhance financial accuracy and operational efficiency.

Fraud detection

Expense report auditing involves retrospective examination of submitted expenses to identify irregularities and potential fraud by comparing receipts and policies. Real-time expense reconciliation leverages automated systems and AI to instantly cross-check transactions against spending rules, enabling immediate fraud detection and prevention. Explore our services to enhance your organization's financial security with cutting-edge fraud detection solutions.

Source and External Links

A Guide to Expense Auditing Procedures - Happay - Expense auditing includes procedures such as completeness checks, occurrence checks, classification, accuracy checks, and cut-off assertion to ensure expenses comply with company policies and to detect fraud like inflated claims.

An Accountant's Guide to Auditing Expense Reports I T&E I - Fyle - Best practices for auditing expense reports involve setting clear guidelines, validating submitted expenses with invoices and receipts, scheduling regular audits, and documenting every action related to expense submissions for accuracy and compliance.

How to Automate Expense Audits - Ramp - Expense audits review company spending against policies to identify inefficiencies, and automation tools can streamline this process, reducing manual workload while increasing audit frequency and effectiveness.

dowidth.com

dowidth.com