Real-time auditing leverages advanced technology to continuously monitor financial transactions, enabling immediate detection of discrepancies and fraud. Internal auditing, conducted periodically, focuses on evaluating the effectiveness of internal controls and compliance with company policies. Explore the key differences and benefits of real-time auditing versus internal auditing to enhance your organization's financial integrity.

Why it is important

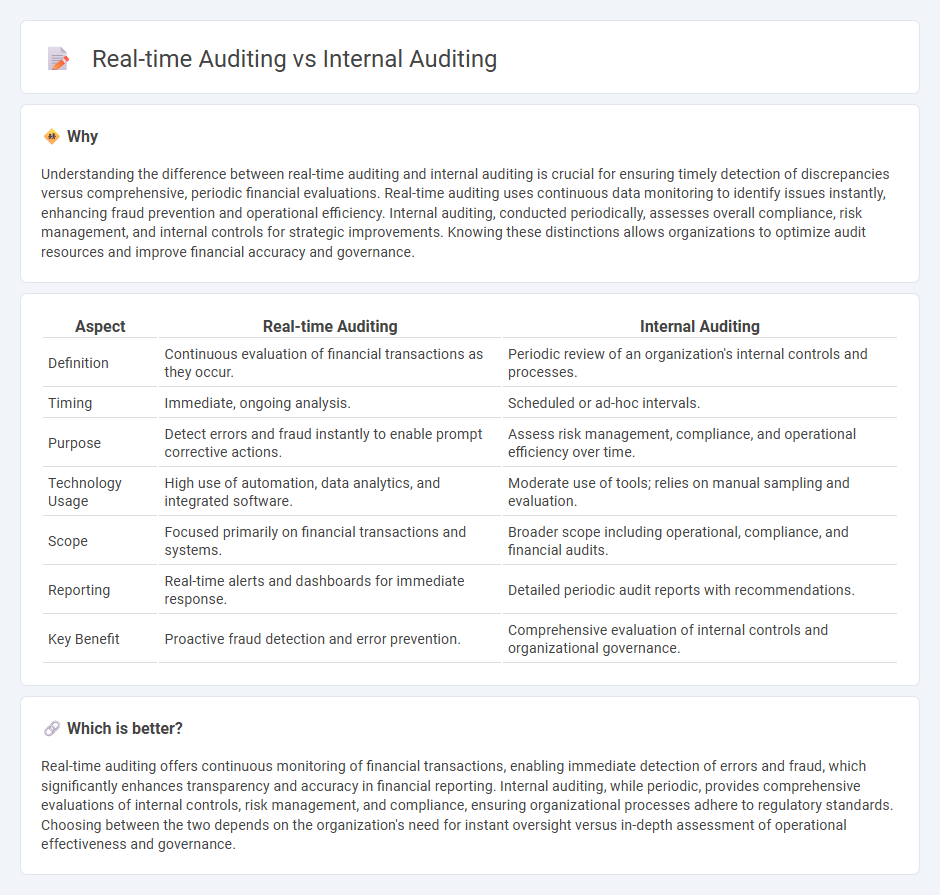

Understanding the difference between real-time auditing and internal auditing is crucial for ensuring timely detection of discrepancies versus comprehensive, periodic financial evaluations. Real-time auditing uses continuous data monitoring to identify issues instantly, enhancing fraud prevention and operational efficiency. Internal auditing, conducted periodically, assesses overall compliance, risk management, and internal controls for strategic improvements. Knowing these distinctions allows organizations to optimize audit resources and improve financial accuracy and governance.

Comparison Table

| Aspect | Real-time Auditing | Internal Auditing |

|---|---|---|

| Definition | Continuous evaluation of financial transactions as they occur. | Periodic review of an organization's internal controls and processes. |

| Timing | Immediate, ongoing analysis. | Scheduled or ad-hoc intervals. |

| Purpose | Detect errors and fraud instantly to enable prompt corrective actions. | Assess risk management, compliance, and operational efficiency over time. |

| Technology Usage | High use of automation, data analytics, and integrated software. | Moderate use of tools; relies on manual sampling and evaluation. |

| Scope | Focused primarily on financial transactions and systems. | Broader scope including operational, compliance, and financial audits. |

| Reporting | Real-time alerts and dashboards for immediate response. | Detailed periodic audit reports with recommendations. |

| Key Benefit | Proactive fraud detection and error prevention. | Comprehensive evaluation of internal controls and organizational governance. |

Which is better?

Real-time auditing offers continuous monitoring of financial transactions, enabling immediate detection of errors and fraud, which significantly enhances transparency and accuracy in financial reporting. Internal auditing, while periodic, provides comprehensive evaluations of internal controls, risk management, and compliance, ensuring organizational processes adhere to regulatory standards. Choosing between the two depends on the organization's need for instant oversight versus in-depth assessment of operational effectiveness and governance.

Connection

Real-time auditing leverages continuous data monitoring to provide immediate insights into financial transactions, enhancing the effectiveness of internal auditing processes. Internal auditing uses these real-time data streams to identify discrepancies, assess risk, and ensure compliance quicker than traditional methods. Integrating real-time auditing technology significantly improves the accuracy and responsiveness of internal audit functions in maintaining financial integrity.

Key Terms

Internal auditing:

Internal auditing involves systematically evaluating an organization's internal controls, risk management, and governance processes to ensure compliance and operational efficiency. It typically follows a scheduled, periodic approach, providing retrospective insights based on past data and events. Discover how internal auditing strengthens organizational integrity and supports strategic decision-making.

Risk assessment

Internal auditing primarily centers on periodic risk assessment by examining historical data and compliance with established controls to identify potential vulnerabilities. Real-time auditing enhances risk management by continuously monitoring transactions and systems, enabling immediate detection and response to anomalies or high-risk activities. Explore the key differences and benefits of each approach to optimize your organization's risk assessment strategy.

Compliance

Internal auditing systematically evaluates an organization's compliance with regulatory standards and internal policies through periodic reviews, ensuring risk management and control effectiveness. Real-time auditing leverages advanced technology and continuous data monitoring to detect compliance issues instantly, allowing for immediate corrective actions and enhanced operational transparency. Explore how integrating these auditing approaches can strengthen your compliance framework and mitigate risks effectively.

Source and External Links

Internal Audit 101: Everything You Need to Know - This webpage provides a comprehensive overview of internal auditing, covering its fundamentals, types of audits, and best practices.

What is Internal Auditing? - This page explains internal auditing as an independent and objective activity that enhances organizational operations by evaluating risk management and control processes.

What is Internal Audit? - This article discusses the types, value, and process of internal audits, highlighting areas such as compliance, environmental, and IT audits.

dowidth.com

dowidth.com