Continuous assurance integrates real-time monitoring and automated data analysis to enhance financial accuracy and compliance, leveraging advanced technologies such as AI and machine learning. Internal review involves periodic evaluations by auditors or internal teams to assess financial records and controls, focusing on identifying discrepancies and ensuring adherence to regulations. Explore the key differences and advantages of continuous assurance versus traditional internal review to optimize your accounting processes.

Why it is important

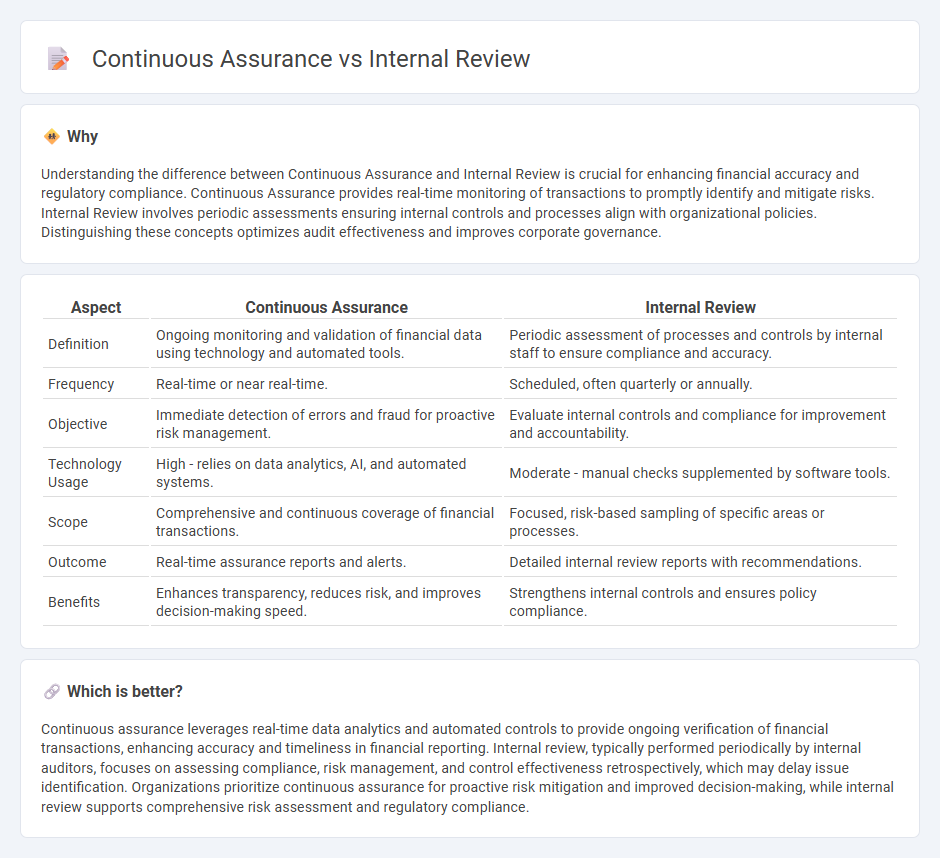

Understanding the difference between Continuous Assurance and Internal Review is crucial for enhancing financial accuracy and regulatory compliance. Continuous Assurance provides real-time monitoring of transactions to promptly identify and mitigate risks. Internal Review involves periodic assessments ensuring internal controls and processes align with organizational policies. Distinguishing these concepts optimizes audit effectiveness and improves corporate governance.

Comparison Table

| Aspect | Continuous Assurance | Internal Review |

|---|---|---|

| Definition | Ongoing monitoring and validation of financial data using technology and automated tools. | Periodic assessment of processes and controls by internal staff to ensure compliance and accuracy. |

| Frequency | Real-time or near real-time. | Scheduled, often quarterly or annually. |

| Objective | Immediate detection of errors and fraud for proactive risk management. | Evaluate internal controls and compliance for improvement and accountability. |

| Technology Usage | High - relies on data analytics, AI, and automated systems. | Moderate - manual checks supplemented by software tools. |

| Scope | Comprehensive and continuous coverage of financial transactions. | Focused, risk-based sampling of specific areas or processes. |

| Outcome | Real-time assurance reports and alerts. | Detailed internal review reports with recommendations. |

| Benefits | Enhances transparency, reduces risk, and improves decision-making speed. | Strengthens internal controls and ensures policy compliance. |

Which is better?

Continuous assurance leverages real-time data analytics and automated controls to provide ongoing verification of financial transactions, enhancing accuracy and timeliness in financial reporting. Internal review, typically performed periodically by internal auditors, focuses on assessing compliance, risk management, and control effectiveness retrospectively, which may delay issue identification. Organizations prioritize continuous assurance for proactive risk mitigation and improved decision-making, while internal review supports comprehensive risk assessment and regulatory compliance.

Connection

Continuous assurance uses real-time data monitoring to detect anomalies and ensure financial accuracy, which supports the internal review process by providing up-to-date, reliable information. Internal review leverages insights from continuous assurance systems to enhance risk assessment and compliance checks throughout accounting cycles. This integration strengthens overall audit quality and promotes proactive identification of discrepancies in financial reporting.

Key Terms

Audit trail

Internal review emphasizes thorough evaluation of audit trails to ensure accuracy and compliance with regulatory standards, focusing on detecting inconsistencies or irregularities within financial records. Continuous assurance integrates real-time monitoring technologies, enabling ongoing verification of audit trails and immediate identification of discrepancies to enhance transparency and risk management. Explore how these approaches optimize audit trail integrity and support organizational governance.

Real-time monitoring

Internal review processes provide periodic evaluations of financial and operational controls, ensuring compliance and risk management at predetermined intervals. Continuous assurance employs real-time monitoring technologies to deliver instantaneous data validation and control assessments, enhancing transparency and prompt issue detection. Explore how integrating continuous assurance can transform your organization's internal review mechanisms for improved accuracy and efficiency.

Risk assessment

Internal review involves periodic evaluations of organizational processes to identify risks and ensure compliance, primarily focusing on historical data analysis. Continuous assurance employs real-time monitoring and automated data analytics to assess risks dynamically, allowing for immediate detection and mitigation. Explore how integrating these approaches can enhance risk management effectiveness in your organization.

Source and External Links

Fort Benning Internal Review - Army Garrisons - Internal review is an independent, objective activity designed to improve operations by evaluating financial integrity, compliance, asset safeguarding, efficiency, and the achievement of objectives within an organization.

Office of Internal Review and Audit Compliance - Internal reviews identify problems, their causes and impacts on operations, and provide recommendations, focusing on compliance, financial operations, economy, efficiency, and program results.

Internal review process - Office of the Australian Information Commissioner - Internal review is a merit-based reconsideration of decisions within an agency, providing a fresh look and often quicker resolution before any external review, determining the correct or preferable decision with full powers similar to the original decision maker.

dowidth.com

dowidth.com