Fractional CFO services provide strategic financial leadership, focusing on financial planning, analysis, and long-term growth, while payroll processing handles the accurate calculation and timely distribution of employee wages. Companies seeking expert financial guidance often choose Fractional CFOs for budget management and cash flow optimization, whereas payroll processing ensures compliance with tax regulations and employee benefit deductions. Explore how integrating both services can streamline your accounting operations and enhance business efficiency.

Why it is important

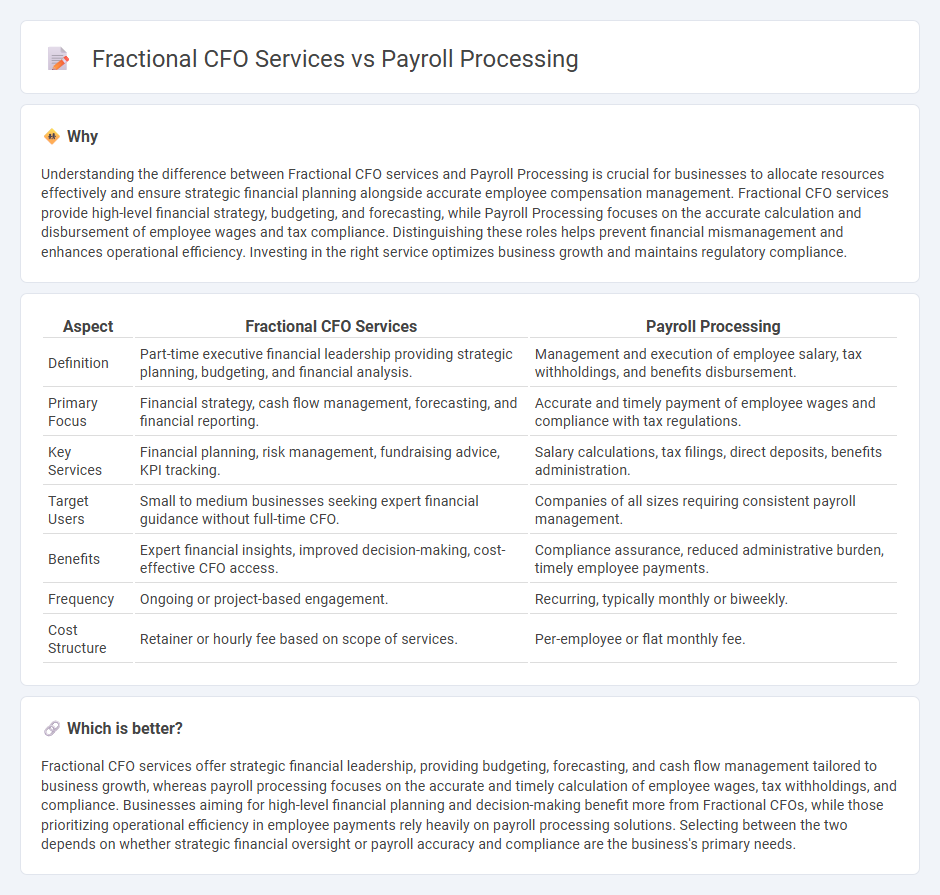

Understanding the difference between Fractional CFO services and Payroll Processing is crucial for businesses to allocate resources effectively and ensure strategic financial planning alongside accurate employee compensation management. Fractional CFO services provide high-level financial strategy, budgeting, and forecasting, while Payroll Processing focuses on the accurate calculation and disbursement of employee wages and tax compliance. Distinguishing these roles helps prevent financial mismanagement and enhances operational efficiency. Investing in the right service optimizes business growth and maintains regulatory compliance.

Comparison Table

| Aspect | Fractional CFO Services | Payroll Processing |

|---|---|---|

| Definition | Part-time executive financial leadership providing strategic planning, budgeting, and financial analysis. | Management and execution of employee salary, tax withholdings, and benefits disbursement. |

| Primary Focus | Financial strategy, cash flow management, forecasting, and financial reporting. | Accurate and timely payment of employee wages and compliance with tax regulations. |

| Key Services | Financial planning, risk management, fundraising advice, KPI tracking. | Salary calculations, tax filings, direct deposits, benefits administration. |

| Target Users | Small to medium businesses seeking expert financial guidance without full-time CFO. | Companies of all sizes requiring consistent payroll management. |

| Benefits | Expert financial insights, improved decision-making, cost-effective CFO access. | Compliance assurance, reduced administrative burden, timely employee payments. |

| Frequency | Ongoing or project-based engagement. | Recurring, typically monthly or biweekly. |

| Cost Structure | Retainer or hourly fee based on scope of services. | Per-employee or flat monthly fee. |

Which is better?

Fractional CFO services offer strategic financial leadership, providing budgeting, forecasting, and cash flow management tailored to business growth, whereas payroll processing focuses on the accurate and timely calculation of employee wages, tax withholdings, and compliance. Businesses aiming for high-level financial planning and decision-making benefit more from Fractional CFOs, while those prioritizing operational efficiency in employee payments rely heavily on payroll processing solutions. Selecting between the two depends on whether strategic financial oversight or payroll accuracy and compliance are the business's primary needs.

Connection

Fractional CFO services and payroll processing are connected through their mutual focus on financial accuracy and strategic management. Fractional CFOs oversee payroll processing to ensure compliance with tax regulations and optimize cash flow forecasting. Integrating payroll data allows CFOs to deliver precise financial reports and support informed decision-making.

Key Terms

**Payroll Processing:**

Payroll processing includes calculating employee wages, withholding taxes, and ensuring timely salary disbursements while maintaining compliance with federal and state regulations. Automating payroll tasks reduces errors and saves time for businesses of all sizes, from startups to large enterprises. Discover how professional payroll processing can streamline your financial operations and enhance accuracy.

Gross Wages

Payroll processing ensures accurate calculation and timely payment of gross wages, including deductions and tax withholdings, to maintain compliance and employee satisfaction. Fractional CFO services analyze gross wages in context with broader financial strategies, offering insights on cost management, budgeting, and forecasting to optimize labor expenses. Explore how combining payroll processing with fractional CFO expertise can enhance your company's financial health.

Tax Withholding

Payroll processing primarily handles timely and accurate tax withholding for employee wages, ensuring compliance with federal, state, and local tax regulations. Fractional CFO services provide strategic oversight of tax withholding policies, optimizing cash flow, minimizing tax liabilities, and aligning payroll practices with broader financial goals. Explore the detailed differences in tax withholding management between payroll processing and fractional CFO services to enhance your business strategy.

Source and External Links

What Is Payroll Processing? (And How To Do It Step by Step) - Indeed - Payroll processing involves managing all aspects of employee payment, including calculating, tracking, and distributing paychecks, starting with securing the company's EIN and gathering employee tax information, then setting pay schedules such as monthly or biweekly.

How to Process Payroll in 9 Easy Steps for 2025 - QuickBooks - Intuit - Payroll processing covers managing employee payments from entry into payroll systems to issuing paychecks, following a structured 9-step method including gathering employee info, establishing time tracking, processing payments, and updating records.

What is payroll processing? - Lano.io - Payroll processing is the full cycle of salary payment including calculating gross pay, deducting taxes and benefits, verifying accuracy, issuing payments, and completing post-payroll tasks, either manually or using payroll software.

dowidth.com

dowidth.com