Supply chain finance accounting focuses on managing payables and receivables to optimize cash flow within the supply chain, emphasizing early payments and extended payment terms. Accrual accounting records revenues and expenses when they are incurred regardless of cash movement, providing a more accurate financial picture for decision-making. Explore the differences and applications of these accounting methods to enhance financial strategy and reporting efficiency.

Why it is important

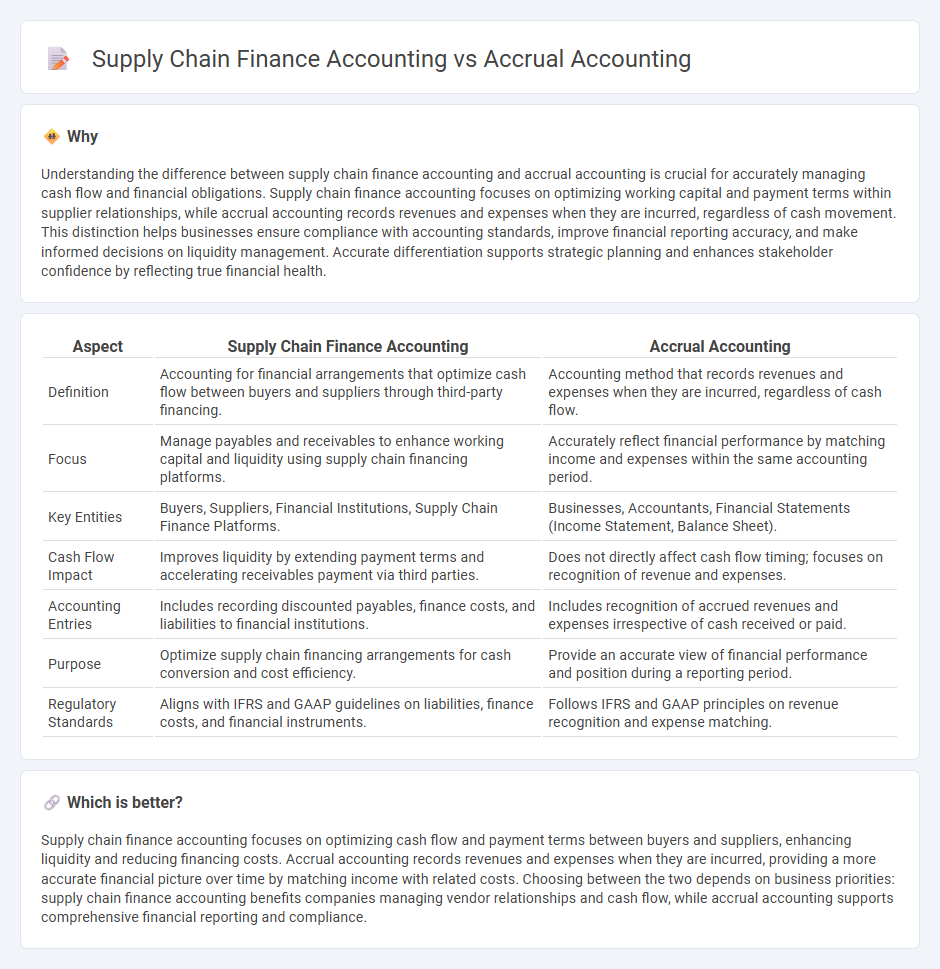

Understanding the difference between supply chain finance accounting and accrual accounting is crucial for accurately managing cash flow and financial obligations. Supply chain finance accounting focuses on optimizing working capital and payment terms within supplier relationships, while accrual accounting records revenues and expenses when they are incurred, regardless of cash movement. This distinction helps businesses ensure compliance with accounting standards, improve financial reporting accuracy, and make informed decisions on liquidity management. Accurate differentiation supports strategic planning and enhances stakeholder confidence by reflecting true financial health.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Accrual Accounting |

|---|---|---|

| Definition | Accounting for financial arrangements that optimize cash flow between buyers and suppliers through third-party financing. | Accounting method that records revenues and expenses when they are incurred, regardless of cash flow. |

| Focus | Manage payables and receivables to enhance working capital and liquidity using supply chain financing platforms. | Accurately reflect financial performance by matching income and expenses within the same accounting period. |

| Key Entities | Buyers, Suppliers, Financial Institutions, Supply Chain Finance Platforms. | Businesses, Accountants, Financial Statements (Income Statement, Balance Sheet). |

| Cash Flow Impact | Improves liquidity by extending payment terms and accelerating receivables payment via third parties. | Does not directly affect cash flow timing; focuses on recognition of revenue and expenses. |

| Accounting Entries | Includes recording discounted payables, finance costs, and liabilities to financial institutions. | Includes recognition of accrued revenues and expenses irrespective of cash received or paid. |

| Purpose | Optimize supply chain financing arrangements for cash conversion and cost efficiency. | Provide an accurate view of financial performance and position during a reporting period. |

| Regulatory Standards | Aligns with IFRS and GAAP guidelines on liabilities, finance costs, and financial instruments. | Follows IFRS and GAAP principles on revenue recognition and expense matching. |

Which is better?

Supply chain finance accounting focuses on optimizing cash flow and payment terms between buyers and suppliers, enhancing liquidity and reducing financing costs. Accrual accounting records revenues and expenses when they are incurred, providing a more accurate financial picture over time by matching income with related costs. Choosing between the two depends on business priorities: supply chain finance accounting benefits companies managing vendor relationships and cash flow, while accrual accounting supports comprehensive financial reporting and compliance.

Connection

Supply chain finance accounting and accrual accounting are connected through the recognition of financial transactions when goods and services are received, rather than when cash is exchanged, enhancing accuracy in working capital management. Supply chain finance leverages accrual accounting principles to record payables and receivables, ensuring precise tracking of liabilities and assets related to supply chain operations. This integration improves financial reporting, cash flow forecasting, and supports better decision-making in managing supplier financing and procurement costs.

Key Terms

Revenue Recognition

Accrual accounting records revenue when it is earned, regardless of cash receipt, ensuring compliance with GAAP and matching revenues with related expenses in the same period. Supply chain finance accounting emphasizes the timing of cash flows through payment terms and discounting mechanisms to optimize working capital without altering the fundamental revenue recognition principles. Explore the nuances of revenue recognition differences to enhance financial reporting accuracy and decision-making.

Accounts Payable

Accrual accounting records accounts payable when expenses are incurred, ensuring liabilities are recognized promptly to match revenues and provide accurate financial statements. Supply chain finance accounting optimizes accounts payable by extending payment terms and leveraging financing solutions to improve cash flow and supplier relationships. Explore how these approaches impact financial management and operational efficiency for deeper insights.

Working Capital

Accrual accounting records revenues and expenses when they are incurred, providing a precise view of working capital by matching costs to their related revenues. Supply chain finance accounting, however, emphasizes optimizing cash flow and liquidity by accelerating payments to suppliers and extending payables, thus improving working capital management without altering underlying accrual principles. Explore further to understand how integrating both approaches can enhance financial strategies and operational efficiency.

Source and External Links

Accrual-Based Accounting Explained - Accrual accounting recognizes revenue and expenses when they are generated, not when cash is received or paid, providing a more accurate financial picture by following the matching and revenue recognition principles and is required by GAAP and the SEC for public companies.

Accrual Accounting - Guide, How it Works, Definition - This accounting method records revenues earned and expenses incurred regardless of cash receipt or payment, aligning with the matching principle to accurately reflect financial performance over time.

What Is Accrual Accounting? - Accrual accounting records revenue when it is earned and expenses when they are recognized rather than when cash changes hands, ensuring income and expenses are matched to the correct accounting period for better profit measurement.

dowidth.com

dowidth.com