Blockchain-based accounting enhances transparency by recording transactions in a decentralized, immutable ledger, reducing the risk of errors and fraud compared to traditional ledger accounting that relies on centralized and manually updated books. This technology supports real-time auditing and seamless integration across multiple parties, improving efficiency and trust in financial data management. Explore how blockchain is transforming accounting practices for greater accuracy and security.

Why it is important

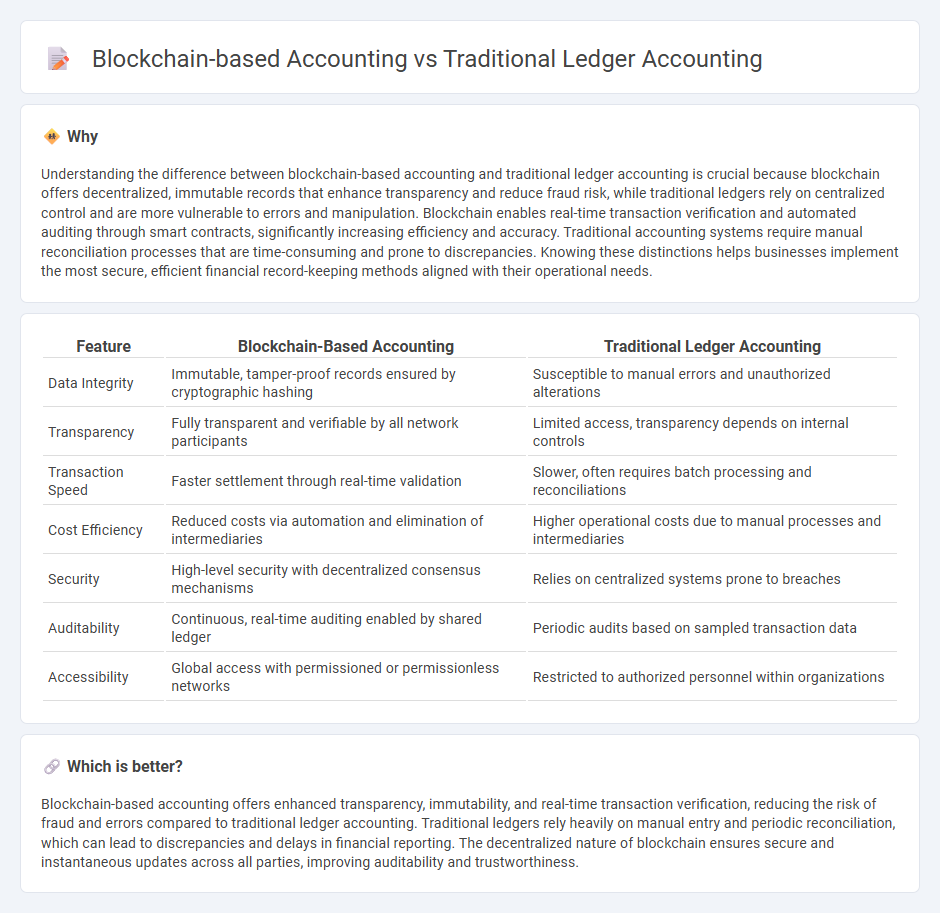

Understanding the difference between blockchain-based accounting and traditional ledger accounting is crucial because blockchain offers decentralized, immutable records that enhance transparency and reduce fraud risk, while traditional ledgers rely on centralized control and are more vulnerable to errors and manipulation. Blockchain enables real-time transaction verification and automated auditing through smart contracts, significantly increasing efficiency and accuracy. Traditional accounting systems require manual reconciliation processes that are time-consuming and prone to discrepancies. Knowing these distinctions helps businesses implement the most secure, efficient financial record-keeping methods aligned with their operational needs.

Comparison Table

| Feature | Blockchain-Based Accounting | Traditional Ledger Accounting |

|---|---|---|

| Data Integrity | Immutable, tamper-proof records ensured by cryptographic hashing | Susceptible to manual errors and unauthorized alterations |

| Transparency | Fully transparent and verifiable by all network participants | Limited access, transparency depends on internal controls |

| Transaction Speed | Faster settlement through real-time validation | Slower, often requires batch processing and reconciliations |

| Cost Efficiency | Reduced costs via automation and elimination of intermediaries | Higher operational costs due to manual processes and intermediaries |

| Security | High-level security with decentralized consensus mechanisms | Relies on centralized systems prone to breaches |

| Auditability | Continuous, real-time auditing enabled by shared ledger | Periodic audits based on sampled transaction data |

| Accessibility | Global access with permissioned or permissionless networks | Restricted to authorized personnel within organizations |

Which is better?

Blockchain-based accounting offers enhanced transparency, immutability, and real-time transaction verification, reducing the risk of fraud and errors compared to traditional ledger accounting. Traditional ledgers rely heavily on manual entry and periodic reconciliation, which can lead to discrepancies and delays in financial reporting. The decentralized nature of blockchain ensures secure and instantaneous updates across all parties, improving auditability and trustworthiness.

Connection

Blockchain-based accounting enhances traditional ledger accounting by providing a decentralized, immutable record of transactions that increases transparency and reduces fraud risk. Both systems categorize financial data systematically, but blockchain improves auditability with real-time, encrypted entries accessible across multiple parties. Integration of blockchain technology into traditional accounting frameworks supports accuracy, efficiency, and regulatory compliance in financial reporting.

Key Terms

Double-entry bookkeeping

Traditional ledger accounting employs double-entry bookkeeping to systematically record debits and credits, ensuring accuracy and financial balance across accounts. Blockchain-based accounting enhances this by recording transactions in an immutable, distributed ledger, increasing transparency and reducing reconciliation errors. Explore further how blockchain transforms the reliability and efficiency of double-entry bookkeeping in modern financial systems.

Decentralized ledger

Traditional ledger accounting relies on centralized control, where a single authority manages and verifies financial records, increasing the risk of errors and fraud. Blockchain-based accounting uses a decentralized ledger distributed across multiple nodes, ensuring enhanced transparency, immutability, and real-time verification of transactions. Explore how decentralized ledgers revolutionize accuracy and trust in financial record-keeping.

Immutability

Traditional ledger accounting relies on centralized systems where entries can be altered or deleted by authorized personnel, posing risks to data integrity and audit trails. Blockchain-based accounting enhances immutability by recording transactions on a decentralized, cryptographically secured ledger that prevents tampering and ensures transparent, permanent records. Explore how blockchain technology transforms accounting practices by guaranteeing an unalterable financial history.

Source and External Links

Understanding the Role of Ledgers in Accounting - Traditional ledger accounting organizes financial transactions chronologically in debit and credit columns within ledgers such as the general ledger (for all accounts), sales ledger (for customer receivables), and purchases ledger (for supplier payables).

Ledgers - Financial Accounting - In traditional ledger accounting, each financial transaction is recorded in individual accounts within the general ledger, which may be a physical book or digital system, with accounts numbered systematically (e.g., assets 1000-1999, liabilities 2000-2999) for easy reference and double-entry tracking.

A Beginners Guide to Accounting Ledgers - Traditional ledger accounting requires manual entry of transactions into columns for date, description, debit, credit, and balance, forming a complete record of assets, liabilities, equity, revenue, and expenses, even if now often automated by software.

dowidth.com

dowidth.com