Digital asset taxation involves unique challenges due to the dynamic nature of cryptocurrencies and blockchain-based tokens, requiring specific compliance with IRS guidelines on capital gains and income recognition. Collectible asset taxation, on the other hand, focuses on tangible items like art, antiques, and rare coins, often subject to different capital gains rates and valuation methods. Explore the distinct tax implications and reporting requirements of both to optimize your accounting strategy.

Why it is important

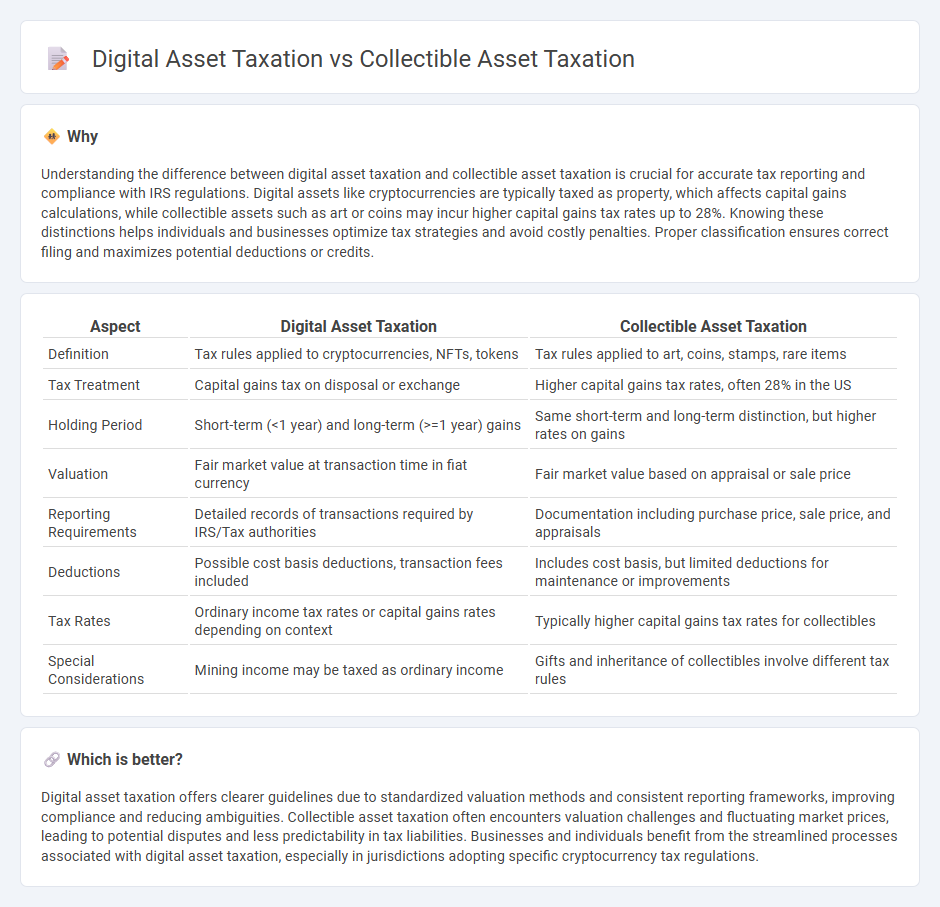

Understanding the difference between digital asset taxation and collectible asset taxation is crucial for accurate tax reporting and compliance with IRS regulations. Digital assets like cryptocurrencies are typically taxed as property, which affects capital gains calculations, while collectible assets such as art or coins may incur higher capital gains tax rates up to 28%. Knowing these distinctions helps individuals and businesses optimize tax strategies and avoid costly penalties. Proper classification ensures correct filing and maximizes potential deductions or credits.

Comparison Table

| Aspect | Digital Asset Taxation | Collectible Asset Taxation |

|---|---|---|

| Definition | Tax rules applied to cryptocurrencies, NFTs, tokens | Tax rules applied to art, coins, stamps, rare items |

| Tax Treatment | Capital gains tax on disposal or exchange | Higher capital gains tax rates, often 28% in the US |

| Holding Period | Short-term (<1 year) and long-term (>=1 year) gains | Same short-term and long-term distinction, but higher rates on gains |

| Valuation | Fair market value at transaction time in fiat currency | Fair market value based on appraisal or sale price |

| Reporting Requirements | Detailed records of transactions required by IRS/Tax authorities | Documentation including purchase price, sale price, and appraisals |

| Deductions | Possible cost basis deductions, transaction fees included | Includes cost basis, but limited deductions for maintenance or improvements |

| Tax Rates | Ordinary income tax rates or capital gains rates depending on context | Typically higher capital gains tax rates for collectibles |

| Special Considerations | Mining income may be taxed as ordinary income | Gifts and inheritance of collectibles involve different tax rules |

Which is better?

Digital asset taxation offers clearer guidelines due to standardized valuation methods and consistent reporting frameworks, improving compliance and reducing ambiguities. Collectible asset taxation often encounters valuation challenges and fluctuating market prices, leading to potential disputes and less predictability in tax liabilities. Businesses and individuals benefit from the streamlined processes associated with digital asset taxation, especially in jurisdictions adopting specific cryptocurrency tax regulations.

Connection

Digital asset taxation and collectible asset taxation intersect through the classification of certain digital assets, such as non-fungible tokens (NFTs), which are considered collectibles under tax regulations. Both tax frameworks require reporting capital gains or losses upon the sale or exchange of these assets, with specific IRS guidelines dictating tax rates and holding periods. Understanding this connection is essential for accurate tax compliance, as misclassifying digital collectibles can lead to incorrect tax liabilities and penalties.

Key Terms

Capital Gains Tax

Capital Gains Tax on collectible assets, such as artwork or rare coins, often applies at higher or special rates, reflecting their unique valuation challenges and market fluctuations. Digital assets, including cryptocurrencies and NFTs, are typically taxed under standard capital gains frameworks, with rates depending on holding periods and jurisdiction-specific regulations. Explore further to understand tax implications and planning strategies tailored to collectible and digital asset investments.

Holding Period

Collectible asset taxation generally applies a higher capital gains tax rate up to 28% for assets held over one year, while digital assets, such as cryptocurrencies, are typically subject to standard long-term capital gains rates that max out at 20%. The holding period for collectibles like art or rare coins is crucial because short-term gains are taxed as ordinary income, which can be significantly higher. Explore detailed differences in tax implications influenced by holding periods for each asset type to optimize your investment strategy.

Source and External Links

How Collectibles Are Taxed: A Closer Look at Capital Gains Rules - Long-term capital gains on collectibles (held more than one year) are taxed at a maximum federal rate of 28%, higher than standard long-term rates, while short-term gains are taxed as ordinary income.

IRS Releases Notice on the Taxation of NFTs as Collectibles - The IRS classifies certain tangible personal property, including art, coins, gems, and potentially NFTs, as collectibles subject to a maximum 28% long-term capital gains rate if held over one year.

Understanding the Tax Implications of Collectibles - Collectible capital gains may also be subject to the 3.8% net investment income tax, potentially bringing the total federal tax rate on these assets to 31.8% for certain taxpayers.

dowidth.com

dowidth.com