Outcome-based budgeting focuses on allocating resources according to the results achieved, driving efficiency through performance measurement and goal alignment. Zero-based budgeting requires justifying all expenses from scratch each period, emphasizing cost control and resource optimization by challenging existing budget assumptions. Explore the fundamental differences and benefits of these budgeting approaches to improve your organizational financial strategy.

Why it is important

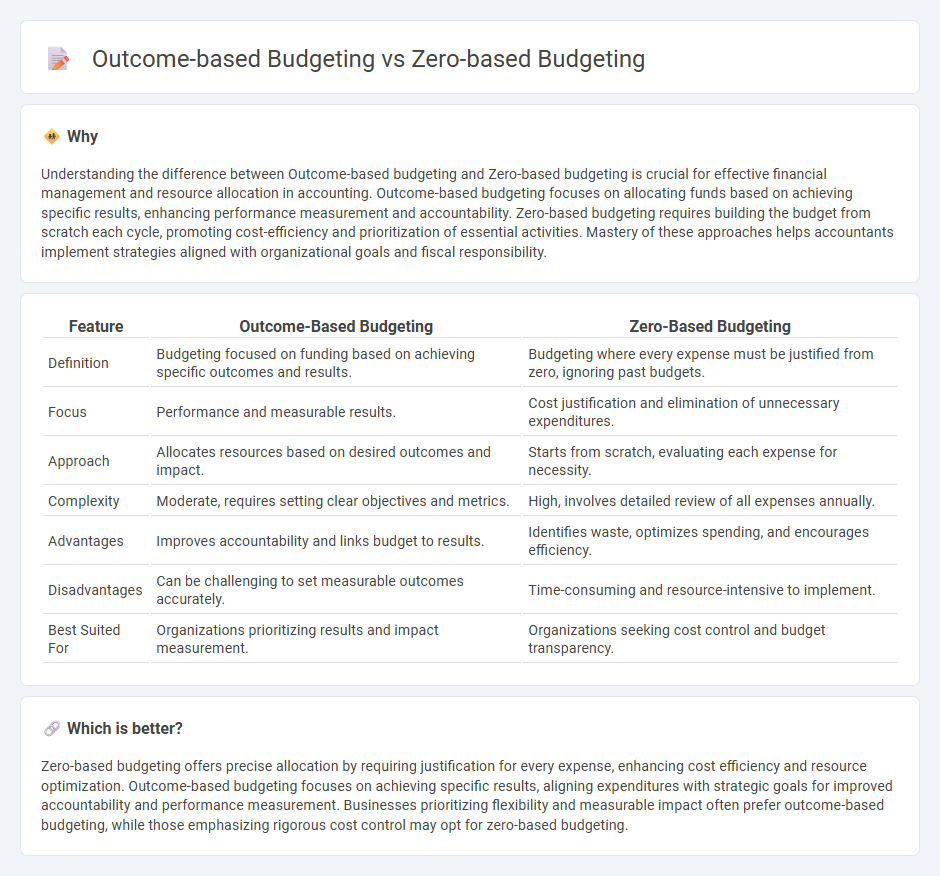

Understanding the difference between Outcome-based budgeting and Zero-based budgeting is crucial for effective financial management and resource allocation in accounting. Outcome-based budgeting focuses on allocating funds based on achieving specific results, enhancing performance measurement and accountability. Zero-based budgeting requires building the budget from scratch each cycle, promoting cost-efficiency and prioritization of essential activities. Mastery of these approaches helps accountants implement strategies aligned with organizational goals and fiscal responsibility.

Comparison Table

| Feature | Outcome-Based Budgeting | Zero-Based Budgeting |

|---|---|---|

| Definition | Budgeting focused on funding based on achieving specific outcomes and results. | Budgeting where every expense must be justified from zero, ignoring past budgets. |

| Focus | Performance and measurable results. | Cost justification and elimination of unnecessary expenditures. |

| Approach | Allocates resources based on desired outcomes and impact. | Starts from scratch, evaluating each expense for necessity. |

| Complexity | Moderate, requires setting clear objectives and metrics. | High, involves detailed review of all expenses annually. |

| Advantages | Improves accountability and links budget to results. | Identifies waste, optimizes spending, and encourages efficiency. |

| Disadvantages | Can be challenging to set measurable outcomes accurately. | Time-consuming and resource-intensive to implement. |

| Best Suited For | Organizations prioritizing results and impact measurement. | Organizations seeking cost control and budget transparency. |

Which is better?

Zero-based budgeting offers precise allocation by requiring justification for every expense, enhancing cost efficiency and resource optimization. Outcome-based budgeting focuses on achieving specific results, aligning expenditures with strategic goals for improved accountability and performance measurement. Businesses prioritizing flexibility and measurable impact often prefer outcome-based budgeting, while those emphasizing rigorous cost control may opt for zero-based budgeting.

Connection

Outcome-based budgeting and zero-based budgeting are connected through their focus on resource allocation efficiency and accountability. Both methods require detailed justification of expenses: outcome-based budgeting links funds to specific results, while zero-based budgeting mandates starting from a "zero base" to evaluate every expenditure's necessity. This connection enables organizations to optimize budget planning by aligning financial resources with strategic outcomes and eliminating redundant costs.

Key Terms

Resource Allocation

Zero-based budgeting allocates resources by justifying every expense from scratch, ensuring all expenditures align with organizational priorities and eliminating unnecessary costs. Outcome-based budgeting directs funds towards programs demonstrating measurable results, prioritizing efficiency and impact for achieving strategic goals. Explore how each budgeting method enhances resource allocation to drive optimal financial management.

Performance Metrics

Zero-based budgeting requires each expense to be justified from scratch, promoting cost efficiency by scrutinizing every dollar allocated, whereas outcome-based budgeting prioritizes the measurement of actual results against predefined performance metrics to ensure funds drive tangible impact. Performance metrics in outcome-based budgeting include key indicators such as service quality, customer satisfaction, and goal attainment rates, offering a direct link between budget allocation and organizational outcomes. Explore how integrating both budgeting methods can optimize financial management and accountability.

Expense Justification

Zero-based budgeting requires each expense to be justified from scratch, promoting cost efficiency by aligning expenditures directly with organizational goals. Outcome-based budgeting allocates resources based on expected results, emphasizing accountability and measurable impacts on performance. Explore these budgeting strategies further to optimize financial planning and resource management.

Source and External Links

What is Zero-Based Budgeting (ZBB)? - Oracle - Zero-based budgeting is a technique where all expenses must be justified starting from zero each period, unlike traditional budgeting which adjusts from the prior budget, helping organizations eliminate unnecessary costs and focus spending on priorities with clear accountability.

Advantages and disadvantages of zero-based budgeting | Prophix - Zero-based budgeting involves defining objectives, identifying cost drivers, classifying expenses into categories like essential or discretionary, allocating resources with justification, and monitoring actuals versus plan for improved agility and optimized finance operations.

Zero-Based Budgeting: What It Is And How It Works - NerdWallet - Zero-based budgeting allocates every dollar of income to specific expenses, savings, and debt payments to ensure that income minus expenditures equals zero by month's end, giving every cent a defined purpose.

dowidth.com

dowidth.com