Digital asset taxation involves the classification, valuation, and reporting of cryptocurrencies, NFTs, and other blockchain-based assets for compliance with IRS guidelines. Intangible asset taxation focuses on non-physical assets such as patents, trademarks, and goodwill, emphasizing amortization and impairment rules under GAAP. Explore how evolving regulations impact both digital and intangible asset taxation to optimize accounting strategies.

Why it is important

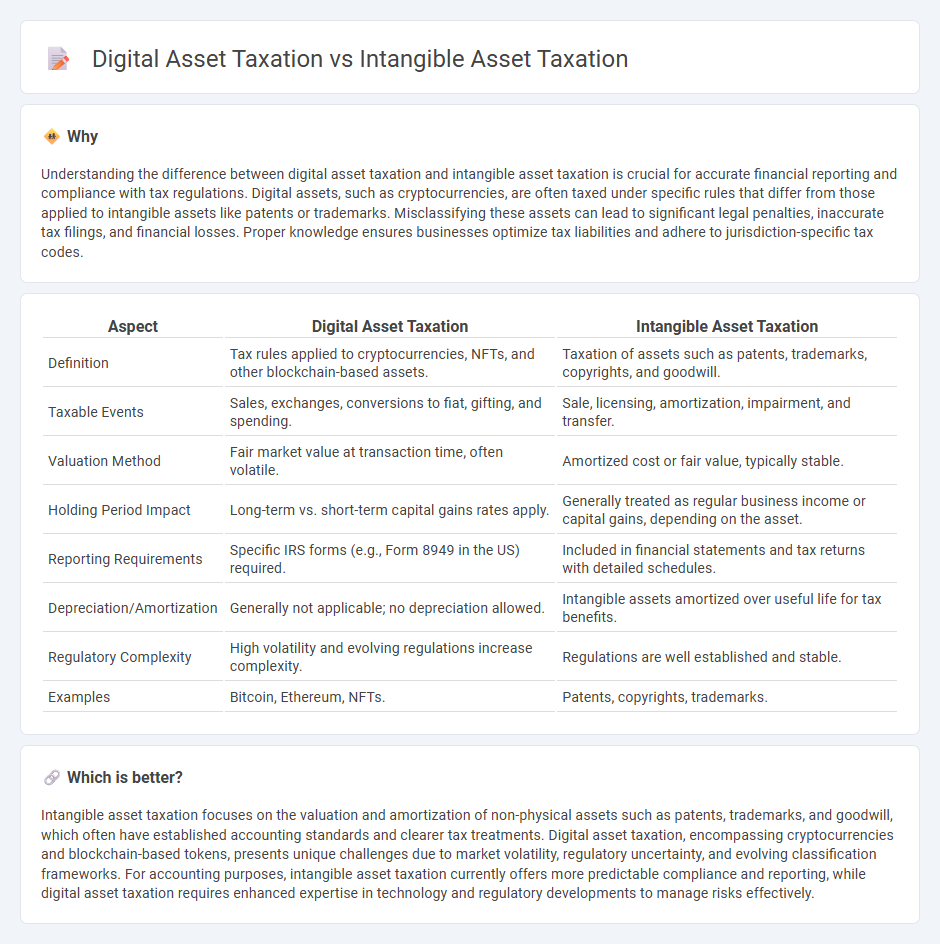

Understanding the difference between digital asset taxation and intangible asset taxation is crucial for accurate financial reporting and compliance with tax regulations. Digital assets, such as cryptocurrencies, are often taxed under specific rules that differ from those applied to intangible assets like patents or trademarks. Misclassifying these assets can lead to significant legal penalties, inaccurate tax filings, and financial losses. Proper knowledge ensures businesses optimize tax liabilities and adhere to jurisdiction-specific tax codes.

Comparison Table

| Aspect | Digital Asset Taxation | Intangible Asset Taxation |

|---|---|---|

| Definition | Tax rules applied to cryptocurrencies, NFTs, and other blockchain-based assets. | Taxation of assets such as patents, trademarks, copyrights, and goodwill. |

| Taxable Events | Sales, exchanges, conversions to fiat, gifting, and spending. | Sale, licensing, amortization, impairment, and transfer. |

| Valuation Method | Fair market value at transaction time, often volatile. | Amortized cost or fair value, typically stable. |

| Holding Period Impact | Long-term vs. short-term capital gains rates apply. | Generally treated as regular business income or capital gains, depending on the asset. |

| Reporting Requirements | Specific IRS forms (e.g., Form 8949 in the US) required. | Included in financial statements and tax returns with detailed schedules. |

| Depreciation/Amortization | Generally not applicable; no depreciation allowed. | Intangible assets amortized over useful life for tax benefits. |

| Regulatory Complexity | High volatility and evolving regulations increase complexity. | Regulations are well established and stable. |

| Examples | Bitcoin, Ethereum, NFTs. | Patents, copyrights, trademarks. |

Which is better?

Intangible asset taxation focuses on the valuation and amortization of non-physical assets such as patents, trademarks, and goodwill, which often have established accounting standards and clearer tax treatments. Digital asset taxation, encompassing cryptocurrencies and blockchain-based tokens, presents unique challenges due to market volatility, regulatory uncertainty, and evolving classification frameworks. For accounting purposes, intangible asset taxation currently offers more predictable compliance and reporting, while digital asset taxation requires enhanced expertise in technology and regulatory developments to manage risks effectively.

Connection

Digital asset taxation and intangible asset taxation are connected through their shared focus on non-physical assets that require specialized valuation methods and regulatory compliance under accounting standards such as IFRS and GAAP. Both involve challenges in determining fair market value, recognition, and reporting for tax purposes, given the fluctuating nature of cryptocurrencies and intellectual property rights. Proper integration of these tax frameworks helps businesses ensure accurate financial reporting and effective tax planning.

Key Terms

Amortization (Intangible Asset Taxation)

Amortization in intangible asset taxation allows businesses to systematically expense the cost of non-physical assets, such as patents and trademarks, over their useful lives, reducing taxable income annually. In contrast, digital asset taxation often treats assets like cryptocurrencies or NFTs primarily as property, leading to capital gains taxation upon sale rather than amortization. Explore more about how amortization impacts tax strategies for intangible versus digital assets.

Fair Market Value (Digital Asset Taxation)

Intangible asset taxation typically involves valuing assets like patents or trademarks based on historical cost or income approaches, whereas digital asset taxation heavily relies on Fair Market Value (FMV) at the time of each transaction or reporting period. FMV plays a crucial role in digital asset taxation because the highly volatile nature of cryptocurrencies and digital tokens demands accurate real-time valuation for tax compliance. Explore detailed guidelines and valuation methods to fully understand digital asset tax obligations.

Capital Gains (Both)

Capital gains taxation on intangible assets involves assessing profits from the sale or exchange of non-physical property such as patents, trademarks, and copyrights, typically taxed based on holding period and jurisdiction-specific rates. Digital asset capital gains taxation focuses on cryptocurrencies, NFTs, and other blockchain-based tokens, where gains are calculated from the difference between purchase and sale prices, often subject to complex regulatory guidelines and reporting requirements. Explore the nuances of capital gains taxation on intangible and digital assets to optimize your tax strategy and compliance.

Source and External Links

A Complete Guide on Section 197 Intangibles: Types and ... - Intangible assets acquired must be amortized evenly over 15 years under IRC Section 197, allowing businesses to claim annual tax deductions but preventing loss deductions if sold early.

A Guide to Taxing Intangible Assets - Income from the sale of intangible assets is typically subject to capital gains tax, with rates depending on holding period, while royalties are treated as business income.

The Tax Treatment of Intangible Assets - Intangible assets like patents, trademarks, and goodwill involve complex tax treatment, including capitalization of acquisition and defense costs, requiring careful management to maximize tax benefits.

dowidth.com

dowidth.com