Payroll automation streamlines salary calculations, tax deductions, and compliance processes, reducing manual errors and saving time for accounting departments. Employee self-service payroll portals empower staff to access pay stubs, tax documents, and benefits information directly, enhancing transparency and personal control. Discover how integrating these systems can optimize payroll management efficiency and employee satisfaction.

Why it is important

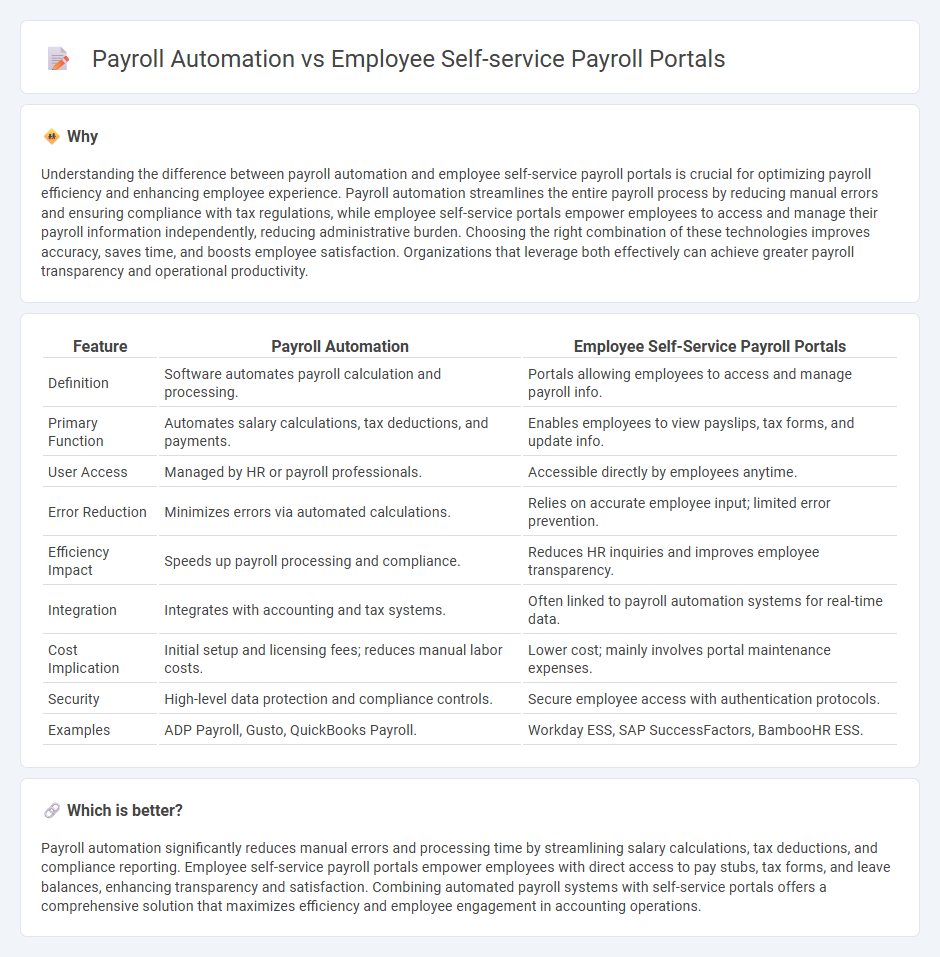

Understanding the difference between payroll automation and employee self-service payroll portals is crucial for optimizing payroll efficiency and enhancing employee experience. Payroll automation streamlines the entire payroll process by reducing manual errors and ensuring compliance with tax regulations, while employee self-service portals empower employees to access and manage their payroll information independently, reducing administrative burden. Choosing the right combination of these technologies improves accuracy, saves time, and boosts employee satisfaction. Organizations that leverage both effectively can achieve greater payroll transparency and operational productivity.

Comparison Table

| Feature | Payroll Automation | Employee Self-Service Payroll Portals |

|---|---|---|

| Definition | Software automates payroll calculation and processing. | Portals allowing employees to access and manage payroll info. |

| Primary Function | Automates salary calculations, tax deductions, and payments. | Enables employees to view payslips, tax forms, and update info. |

| User Access | Managed by HR or payroll professionals. | Accessible directly by employees anytime. |

| Error Reduction | Minimizes errors via automated calculations. | Relies on accurate employee input; limited error prevention. |

| Efficiency Impact | Speeds up payroll processing and compliance. | Reduces HR inquiries and improves employee transparency. |

| Integration | Integrates with accounting and tax systems. | Often linked to payroll automation systems for real-time data. |

| Cost Implication | Initial setup and licensing fees; reduces manual labor costs. | Lower cost; mainly involves portal maintenance expenses. |

| Security | High-level data protection and compliance controls. | Secure employee access with authentication protocols. |

| Examples | ADP Payroll, Gusto, QuickBooks Payroll. | Workday ESS, SAP SuccessFactors, BambooHR ESS. |

Which is better?

Payroll automation significantly reduces manual errors and processing time by streamlining salary calculations, tax deductions, and compliance reporting. Employee self-service payroll portals empower employees with direct access to pay stubs, tax forms, and leave balances, enhancing transparency and satisfaction. Combining automated payroll systems with self-service portals offers a comprehensive solution that maximizes efficiency and employee engagement in accounting operations.

Connection

Payroll automation streamlines wage calculations, tax deductions, and compliance by integrating directly with employee self-service payroll portals, allowing real-time access to pay stubs, tax documents, and benefits information. This connection reduces manual errors and accelerates payroll processing times while empowering employees with autonomous control over their payroll data. Enhanced transparency and efficiency in payroll operations result from the seamless interaction between automated systems and user-friendly portals.

Key Terms

Time Tracking

Employee self-service payroll portals streamline time tracking by allowing employees to log hours directly, reducing errors and manual input. Payroll automation integrates these time tracking entries with payroll processing, ensuring accurate and timely wage calculations while minimizing administrative burden. Discover how combining these tools can optimize payroll efficiency and accuracy.

Pay Stub Access

Employee self-service payroll portals provide direct access to pay stubs, allowing employees to view and download their payment records anytime, enhancing transparency and convenience. Payroll automation streamlines the generation and distribution of pay stubs, reducing errors and administrative workload while ensuring timely delivery. Explore how integrating payroll automation with self-service portals can optimize pay stub access for your workforce.

Automated Payroll Processing

Automated payroll processing leverages advanced software to streamline salary calculations, tax deductions, and compliance, reducing manual errors and processing time compared to traditional employee self-service payroll portals. While employee self-service portals empower staff to access pay stubs and update personal information, automation ensures end-to-end efficiency by integrating time tracking, benefits management, and direct deposit functionalities. Explore how automated payroll processing can enhance accuracy, compliance, and overall payroll management for your organization.

Source and External Links

Employee Self-Service(r) Payroll and HR Software - This software allows employees to manage their HR and payroll information through a mobile app, enhancing efficiency and security through automation and user access controls.

Employee Self-Service Payroll and HR Software - Employees can access pay statements, manage direct deposit, and control benefits through an ESS portal, improving self-service capabilities and reducing manual errors.

Employee Self-Service Software - This platform provides 24/7 access for employees to view paychecks, request time off, manage personal details, and access benefits, with features like AI assistance and financial flexibility.

dowidth.com

dowidth.com