On-demand accruals record expenses or revenues precisely when they occur, ensuring accurate financial reporting without waiting for periodic adjustments. Adjusting entries, made at the end of an accounting period, correct and update account balances for accrued or deferred transactions to comply with the matching principle. Explore how these methods impact financial statements and improve accounting accuracy.

Why it is important

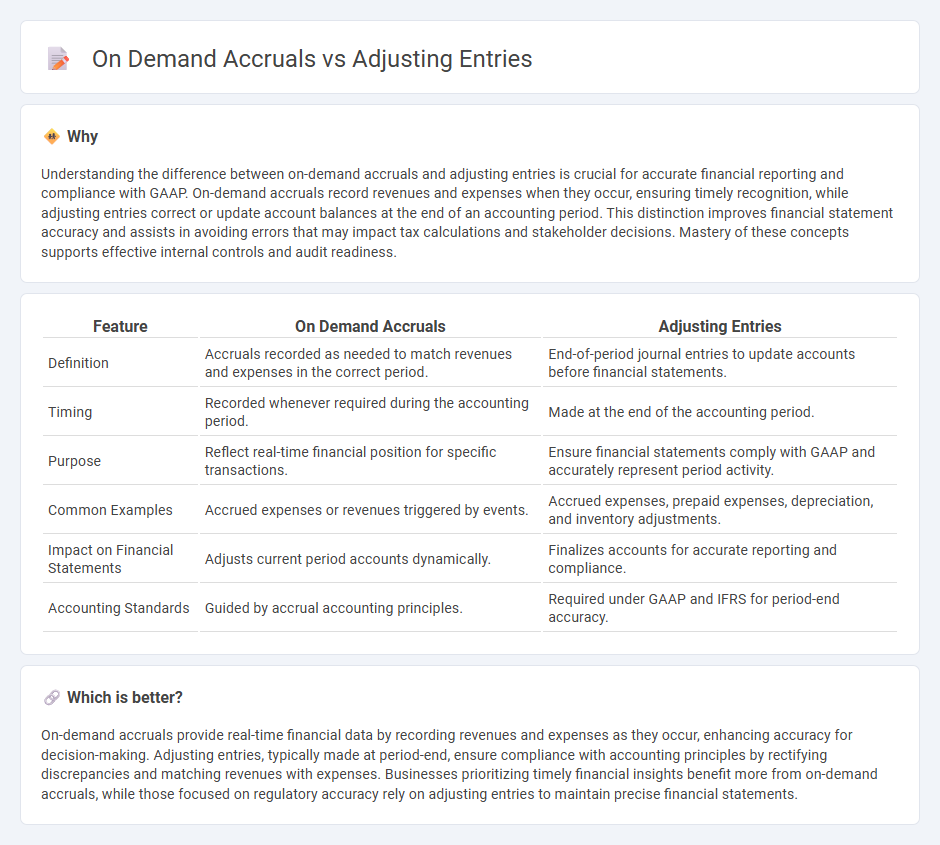

Understanding the difference between on-demand accruals and adjusting entries is crucial for accurate financial reporting and compliance with GAAP. On-demand accruals record revenues and expenses when they occur, ensuring timely recognition, while adjusting entries correct or update account balances at the end of an accounting period. This distinction improves financial statement accuracy and assists in avoiding errors that may impact tax calculations and stakeholder decisions. Mastery of these concepts supports effective internal controls and audit readiness.

Comparison Table

| Feature | On Demand Accruals | Adjusting Entries |

|---|---|---|

| Definition | Accruals recorded as needed to match revenues and expenses in the correct period. | End-of-period journal entries to update accounts before financial statements. |

| Timing | Recorded whenever required during the accounting period. | Made at the end of the accounting period. |

| Purpose | Reflect real-time financial position for specific transactions. | Ensure financial statements comply with GAAP and accurately represent period activity. |

| Common Examples | Accrued expenses or revenues triggered by events. | Accrued expenses, prepaid expenses, depreciation, and inventory adjustments. |

| Impact on Financial Statements | Adjusts current period accounts dynamically. | Finalizes accounts for accurate reporting and compliance. |

| Accounting Standards | Guided by accrual accounting principles. | Required under GAAP and IFRS for period-end accuracy. |

Which is better?

On-demand accruals provide real-time financial data by recording revenues and expenses as they occur, enhancing accuracy for decision-making. Adjusting entries, typically made at period-end, ensure compliance with accounting principles by rectifying discrepancies and matching revenues with expenses. Businesses prioritizing timely financial insights benefit more from on-demand accruals, while those focused on regulatory accuracy rely on adjusting entries to maintain precise financial statements.

Connection

On-demand accruals and adjusting entries are closely linked in accounting as both ensure financial statements accurately reflect a company's financial position at period-end. On-demand accruals capture expenses or revenues incurred but not yet recorded, while adjusting entries update these amounts to comply with the matching principle. Together, they improve the accuracy of financial reporting by aligning income and expenses to the correct accounting period.

Key Terms

Timing

Adjusting entries are recorded at the end of an accounting period to allocate revenues and expenses to the correct period, ensuring accurate financial statements. On-demand accruals are made as needed during the period to capture expenses or revenues as they occur, improving real-time financial tracking. Discover more about how timing impacts financial accuracy and reporting precision.

Matching Principle

Adjusting entries are journal entries made at the end of an accounting period to allocate revenues and expenses to the period in which they actually occur, ensuring compliance with the Matching Principle. On-demand accruals involve recognizing expenses or revenues as they are identified throughout the period, providing real-time adherence to the Matching Principle by matching costs with related revenues. Discover how these methods enhance financial accuracy and reporting by exploring their applications in various accounting contexts.

Revenue Recognition

Adjusting entries ensure revenues are recorded in the period earned, aligning with the accrual accounting principle for accurate financial statements. On demand accruals recognize revenue when it is earned but not yet billed, allowing companies to match revenue with expenses precisely. Explore how these methods impact compliance with revenue recognition standards like ASC 606 for comprehensive financial accuracy.

Source and External Links

Adjusting entries: Definition, examples, and basics - Adjusting entries are journal entries made at the end of an accounting period to accurately recognize revenues and expenses in the proper period, involving accruals, prepayments, depreciation, and other adjustments to reflect the company's true financial position.

Adjusting entries definition - Adjusting entries alter ending balances in general ledger accounts, commonly including depreciation, allowance for bad debts, accrued revenues, accrued expenses, and prepaid assets, and are often designed as reversing entries in the following period.

How to Adjust Entries in Accounting - Adjusting entries are made after the unadjusted trial balance to record unrecognized transactions, ensuring revenues and expenses are recorded in the period earned or incurred, and include accruals, deferrals, and estimates such as depreciation and inventory reserves.

dowidth.com

dowidth.com