Fair value measurement represents the estimated market price at which an asset could be exchanged between knowledgeable, willing parties, reflecting current market conditions. Carrying value, also known as book value, is the original cost of an asset adjusted for depreciation, amortization, or impairment, recorded on the balance sheet. Explore the key differences and implications of these valuation methods in financial reporting.

Why it is important

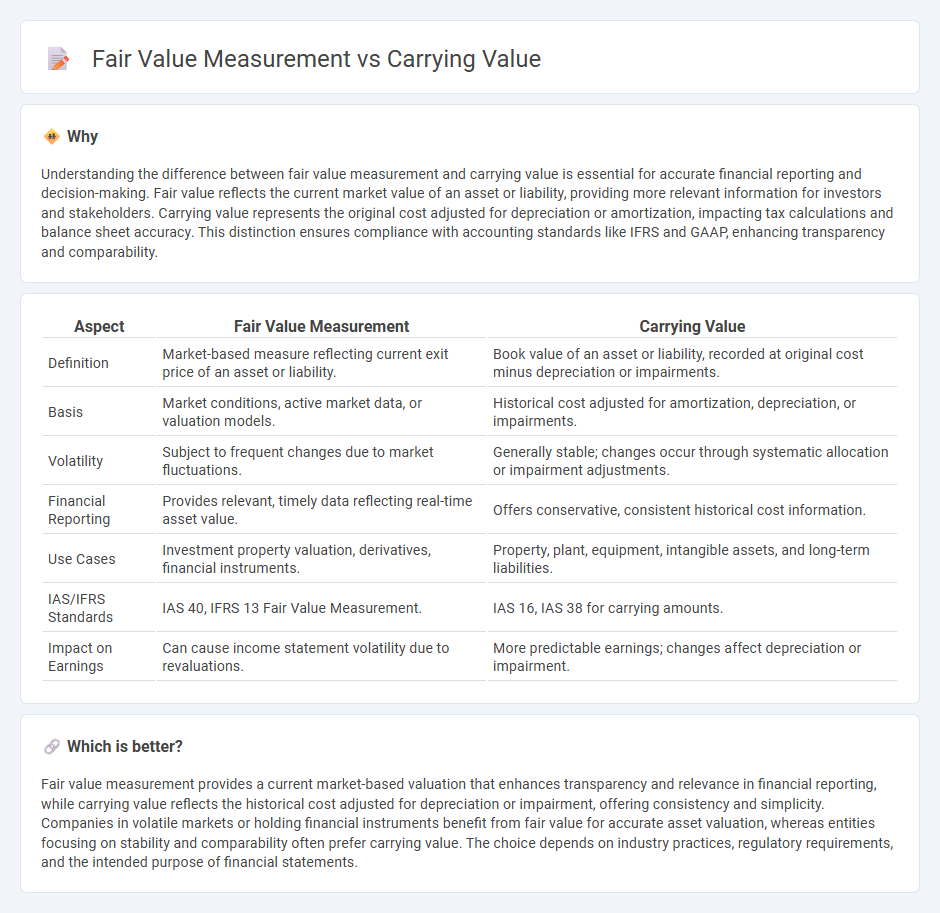

Understanding the difference between fair value measurement and carrying value is essential for accurate financial reporting and decision-making. Fair value reflects the current market value of an asset or liability, providing more relevant information for investors and stakeholders. Carrying value represents the original cost adjusted for depreciation or amortization, impacting tax calculations and balance sheet accuracy. This distinction ensures compliance with accounting standards like IFRS and GAAP, enhancing transparency and comparability.

Comparison Table

| Aspect | Fair Value Measurement | Carrying Value |

|---|---|---|

| Definition | Market-based measure reflecting current exit price of an asset or liability. | Book value of an asset or liability, recorded at original cost minus depreciation or impairments. |

| Basis | Market conditions, active market data, or valuation models. | Historical cost adjusted for amortization, depreciation, or impairments. |

| Volatility | Subject to frequent changes due to market fluctuations. | Generally stable; changes occur through systematic allocation or impairment adjustments. |

| Financial Reporting | Provides relevant, timely data reflecting real-time asset value. | Offers conservative, consistent historical cost information. |

| Use Cases | Investment property valuation, derivatives, financial instruments. | Property, plant, equipment, intangible assets, and long-term liabilities. |

| IAS/IFRS Standards | IAS 40, IFRS 13 Fair Value Measurement. | IAS 16, IAS 38 for carrying amounts. |

| Impact on Earnings | Can cause income statement volatility due to revaluations. | More predictable earnings; changes affect depreciation or impairment. |

Which is better?

Fair value measurement provides a current market-based valuation that enhances transparency and relevance in financial reporting, while carrying value reflects the historical cost adjusted for depreciation or impairment, offering consistency and simplicity. Companies in volatile markets or holding financial instruments benefit from fair value for accurate asset valuation, whereas entities focusing on stability and comparability often prefer carrying value. The choice depends on industry practices, regulatory requirements, and the intended purpose of financial statements.

Connection

Fair value measurement determines the estimated market price of an asset or liability, directly influencing its carrying value reported on financial statements. The carrying value reflects the asset's book value, adjusted for fair value changes in accordance with accounting standards like IFRS 13 or ASC 820. Accurate fair value measurement ensures that carrying values represent current economic conditions, enhancing financial statement reliability and decision-making.

Key Terms

Historical Cost

Carrying value, also known as book value, represents the historical cost of an asset minus any accumulated depreciation or impairment, reflecting the asset's recorded value on financial statements. In contrast, fair value measurement estimates the asset's current market value, incorporating factors such as market conditions and potential selling prices. Explore the nuances of historical cost accounting versus fair value assessment to deepen your understanding of asset valuation.

Market Value

Market value reflects the price at which an asset or liability can be exchanged in an orderly transaction between market participants at the measurement date, serving as the basis for fair value measurement under IFRS and GAAP. Carrying value represents the book value of the asset or liability recorded on the balance sheet, often adjusted for depreciation, amortization, or impairment, and may differ significantly from market value due to historical cost accounting. Explore how these valuation methods impact financial reporting and investment decisions in greater detail.

Impairment

Carrying value represents the book value of an asset after adjusting for depreciation and impairment, reflecting its net amount on the balance sheet. Fair value measurement estimates the asset's market value, which is crucial in impairment testing to determine if the carrying value exceeds recoverable amounts, triggering write-downs. Explore deeper insights on impairment and valuation frameworks for accurate financial reporting.

Source and External Links

Carrying Value: Definition, Comparisons and Examples | Indeed.com - Carrying value (or carrying amount) is an accounting measure of an asset's current value calculated as original cost minus accumulated depreciation or amortization and differs from fair value, which reflects market conditions and buyer-seller agreement.

Carrying Amount - Definition, Example, Calculate - The carrying amount is the asset's original cost minus depreciation recorded in the books; it represents the book value, which may differ from the market or fair value depending on demand and other factors.

Carrying value definition - AccountingTools - Carrying value is the amount at which an asset is recorded on the balance sheet, defined as original cost less accumulated depreciation, amortization, and impairments; it is synonymous with book value or carrying amount.

dowidth.com

dowidth.com