Blockchain reconciliation leverages distributed ledger technology to provide transparent, real-time verification of transactions across multiple parties, minimizing errors and fraud. Intercompany reconciliation involves aligning financial records between different entities within the same organization to ensure consistency and accuracy in consolidated financial statements. Explore the distinct processes and benefits of blockchain reconciliation compared to traditional intercompany reconciliation for enhanced financial management.

Why it is important

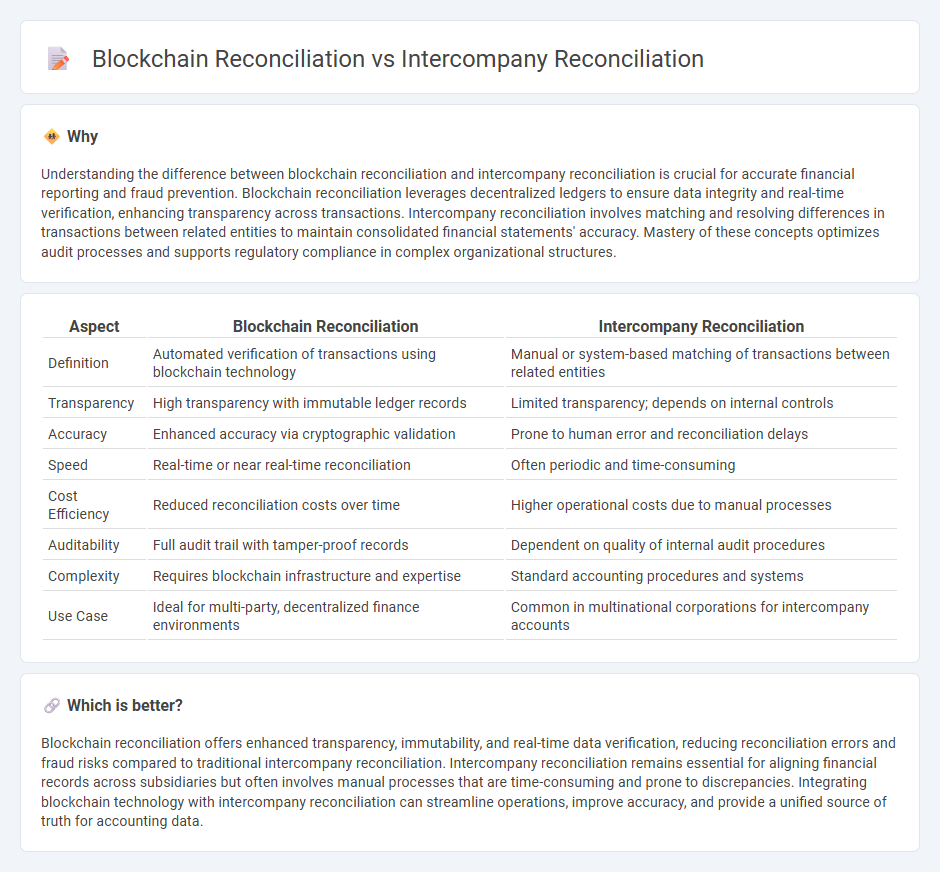

Understanding the difference between blockchain reconciliation and intercompany reconciliation is crucial for accurate financial reporting and fraud prevention. Blockchain reconciliation leverages decentralized ledgers to ensure data integrity and real-time verification, enhancing transparency across transactions. Intercompany reconciliation involves matching and resolving differences in transactions between related entities to maintain consolidated financial statements' accuracy. Mastery of these concepts optimizes audit processes and supports regulatory compliance in complex organizational structures.

Comparison Table

| Aspect | Blockchain Reconciliation | Intercompany Reconciliation |

|---|---|---|

| Definition | Automated verification of transactions using blockchain technology | Manual or system-based matching of transactions between related entities |

| Transparency | High transparency with immutable ledger records | Limited transparency; depends on internal controls |

| Accuracy | Enhanced accuracy via cryptographic validation | Prone to human error and reconciliation delays |

| Speed | Real-time or near real-time reconciliation | Often periodic and time-consuming |

| Cost Efficiency | Reduced reconciliation costs over time | Higher operational costs due to manual processes |

| Auditability | Full audit trail with tamper-proof records | Dependent on quality of internal audit procedures |

| Complexity | Requires blockchain infrastructure and expertise | Standard accounting procedures and systems |

| Use Case | Ideal for multi-party, decentralized finance environments | Common in multinational corporations for intercompany accounts |

Which is better?

Blockchain reconciliation offers enhanced transparency, immutability, and real-time data verification, reducing reconciliation errors and fraud risks compared to traditional intercompany reconciliation. Intercompany reconciliation remains essential for aligning financial records across subsidiaries but often involves manual processes that are time-consuming and prone to discrepancies. Integrating blockchain technology with intercompany reconciliation can streamline operations, improve accuracy, and provide a unified source of truth for accounting data.

Connection

Blockchain reconciliation enhances intercompany reconciliation by providing an immutable ledger that ensures transparency and accuracy in recording transactions across subsidiaries. The decentralized nature of blockchain reduces discrepancies and streamlines the verification process, making intercompany financial data more reliable. This integration minimizes manual errors and accelerates the reconciliation cycle, improving overall accounting efficiency.

Key Terms

**Intercompany Reconciliation:**

Intercompany reconciliation involves verifying and matching transactions between different subsidiaries or departments within the same organization to ensure financial consistency and accuracy. It typically relies on manual processes or traditional accounting software to identify discrepancies in intercompany invoices, payments, and balances. Explore how advanced technologies like blockchain reconciliation can enhance transparency and efficiency in intercompany processes.

Intercompany Transactions

Intercompany reconciliation involves matching and verifying financial transactions between different entities within the same organization to ensure consistency and accuracy in accounting records. Blockchain reconciliation leverages a decentralized ledger to automate and secure the verification of intercompany transactions, reducing errors and increasing transparency through real-time data sharing. Explore how blockchain technology can transform intercompany reconciliation processes and enhance financial integrity.

Consolidation

Intercompany reconciliation traditionally involves matching and eliminating transactions between subsidiaries to ensure accurate consolidated financial statements, often relying on manual processes and spreadsheet reviews. Blockchain reconciliation automates this through a shared, immutable ledger that records transactions in real-time, enhancing transparency and reducing errors during the consolidation phase. Discover how blockchain technology transforms consolidation by streamlining intercompany reconciliation processes.

Source and External Links

What is Intercompany Reconciliation - Intercompany reconciliation ensures that financial transactions between different entities within the same corporate group are accurately recorded and balanced.

Intercompany Reconciliation Guide With Examples - This guide outlines the intercompany reconciliation process, highlighting its complexity and the importance of automation in multi-entity organizations.

Intercompany Reconciliation: Examples, Processes - This resource provides a step-by-step guide to intercompany reconciliation, emphasizing best practices for accuracy and efficiency in multi-entity businesses.

dowidth.com

dowidth.com