Embedded finance accounting integrates financial services directly within non-financial platforms, streamlining transactions and improving real-time financial data tracking for businesses. Platform-based accounting focuses on centralized financial management through dedicated software platforms that aggregate accounting activities across various channels and subsidiaries. Explore in-depth differences and advantages of each approach to optimize your financial strategy.

Why it is important

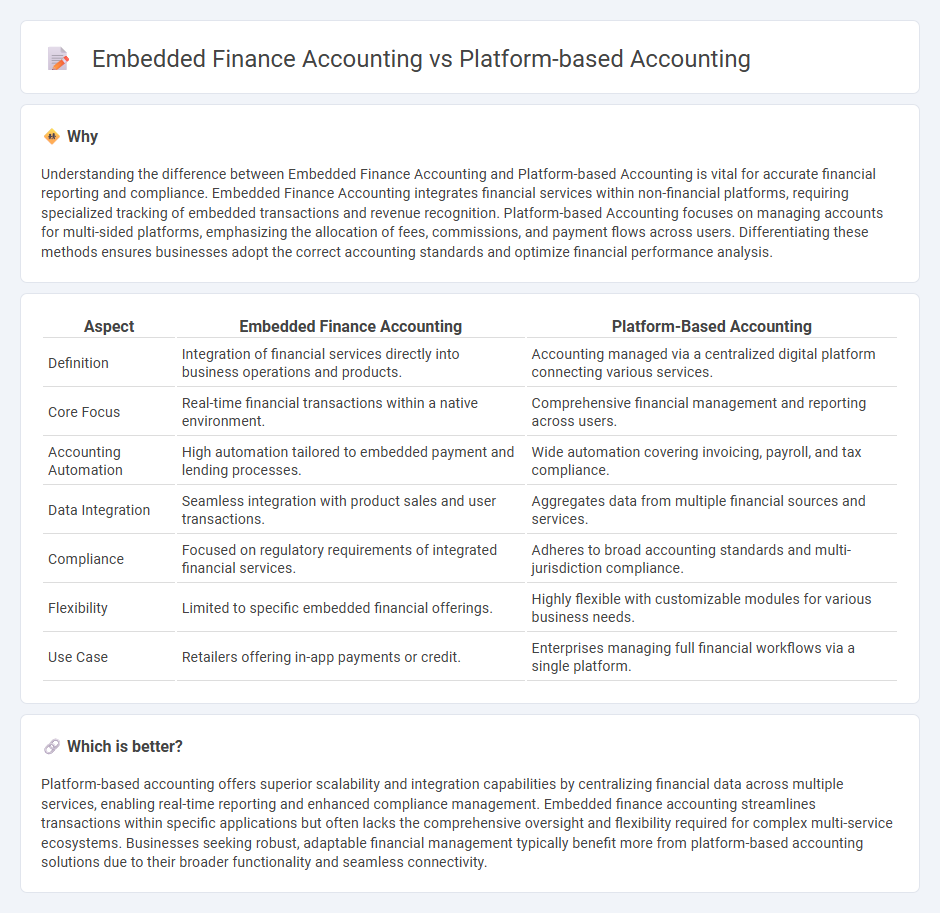

Understanding the difference between Embedded Finance Accounting and Platform-based Accounting is vital for accurate financial reporting and compliance. Embedded Finance Accounting integrates financial services within non-financial platforms, requiring specialized tracking of embedded transactions and revenue recognition. Platform-based Accounting focuses on managing accounts for multi-sided platforms, emphasizing the allocation of fees, commissions, and payment flows across users. Differentiating these methods ensures businesses adopt the correct accounting standards and optimize financial performance analysis.

Comparison Table

| Aspect | Embedded Finance Accounting | Platform-Based Accounting |

|---|---|---|

| Definition | Integration of financial services directly into business operations and products. | Accounting managed via a centralized digital platform connecting various services. |

| Core Focus | Real-time financial transactions within a native environment. | Comprehensive financial management and reporting across users. |

| Accounting Automation | High automation tailored to embedded payment and lending processes. | Wide automation covering invoicing, payroll, and tax compliance. |

| Data Integration | Seamless integration with product sales and user transactions. | Aggregates data from multiple financial sources and services. |

| Compliance | Focused on regulatory requirements of integrated financial services. | Adheres to broad accounting standards and multi-jurisdiction compliance. |

| Flexibility | Limited to specific embedded financial offerings. | Highly flexible with customizable modules for various business needs. |

| Use Case | Retailers offering in-app payments or credit. | Enterprises managing full financial workflows via a single platform. |

Which is better?

Platform-based accounting offers superior scalability and integration capabilities by centralizing financial data across multiple services, enabling real-time reporting and enhanced compliance management. Embedded finance accounting streamlines transactions within specific applications but often lacks the comprehensive oversight and flexibility required for complex multi-service ecosystems. Businesses seeking robust, adaptable financial management typically benefit more from platform-based accounting solutions due to their broader functionality and seamless connectivity.

Connection

Embedded finance accounting integrates financial services directly within non-financial platforms, streamlining transaction recording and reconciliation processes for businesses. Platform-based accounting manages financial data generated from digital platforms, enabling real-time reporting and enhanced accuracy in revenue recognition. Both systems converge by utilizing automated data flows and APIs to ensure seamless financial tracking and compliance across integrated services.

Key Terms

Revenue Recognition

Platform-based accounting centralizes revenue recognition through integrated invoicing and transaction tracking, ensuring compliance with ASC 606 by recognizing revenue when control transfers to the customer. Embedded finance accounting involves recognizing revenue from financial services, such as lending or payments, within non-financial platforms, requiring adjustments for regulatory and risk considerations unique to these services. Explore detailed frameworks and best practices for accurate revenue recognition in both models to optimize financial reporting and compliance.

API Integration

Platform-based accounting leverages APIs to connect disparate financial tools, enabling seamless data synchronization and real-time transaction tracking across multiple systems. Embedded finance accounting integrates financial services directly within platforms through APIs, offering streamlined payment processing, lending, and reconciliation without switching applications. Explore the nuances and benefits of each approach to optimize your financial operations through advanced API integration.

Compliance Regulations

Platform-based accounting integrates financial processes within digital platforms, ensuring compliance with standards like GAAP and IFRS by automating transaction tracking and reporting. Embedded finance accounting, tightly woven into non-financial platforms, requires adherence to specific regulatory frameworks such as PSD2 in Europe or the OCC guidelines in the US to maintain compliance. Explore how these accounting approaches align with evolving compliance regulations to optimize financial integrity and operational efficiency.

Source and External Links

Cloud Based Accounting: What is It and Why You Need It - Certinia - Cloud-based accounting platforms provide real-time updates, scalability, and integration with CRM and other business systems, enhancing financial processes within a unified ecosystem such as Salesforce.

Why is SME Cloud-Based Accounting the Future? - Cloud-based accounting platforms support growing businesses with scalable solutions that integrate with payroll, inventory, and e-commerce, offering cost-effective, real-time financial management.

Traditional vs. Platform-Based Business Models: 4 Key Differences - A platform-based business model creates value by facilitating interactions between user groups through digital infrastructure, enabling scalability and network effects rather than producing goods or services directly.

dowidth.com

dowidth.com