Integrated reporting combines financial, environmental, social, and governance data into a single comprehensive framework, enhancing transparency and decision-making for investors and stakeholders. Environmental, social, and governance (ESG) reporting specifically focuses on non-financial performance related to sustainability and ethical impacts, reflecting a company's commitment to responsible practices. Explore the distinctions and benefits of these reporting approaches to better understand their role in modern accounting.

Why it is important

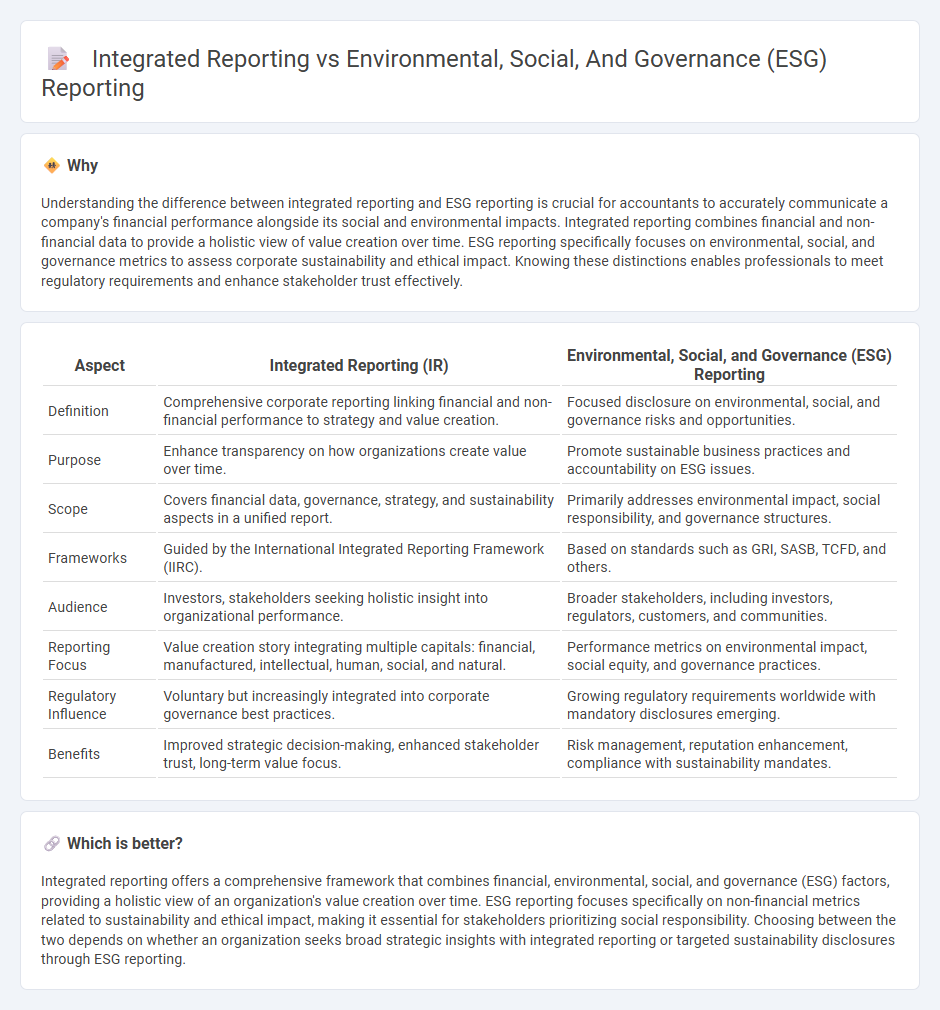

Understanding the difference between integrated reporting and ESG reporting is crucial for accountants to accurately communicate a company's financial performance alongside its social and environmental impacts. Integrated reporting combines financial and non-financial data to provide a holistic view of value creation over time. ESG reporting specifically focuses on environmental, social, and governance metrics to assess corporate sustainability and ethical impact. Knowing these distinctions enables professionals to meet regulatory requirements and enhance stakeholder trust effectively.

Comparison Table

| Aspect | Integrated Reporting (IR) | Environmental, Social, and Governance (ESG) Reporting |

|---|---|---|

| Definition | Comprehensive corporate reporting linking financial and non-financial performance to strategy and value creation. | Focused disclosure on environmental, social, and governance risks and opportunities. |

| Purpose | Enhance transparency on how organizations create value over time. | Promote sustainable business practices and accountability on ESG issues. |

| Scope | Covers financial data, governance, strategy, and sustainability aspects in a unified report. | Primarily addresses environmental impact, social responsibility, and governance structures. |

| Frameworks | Guided by the International Integrated Reporting Framework (IIRC). | Based on standards such as GRI, SASB, TCFD, and others. |

| Audience | Investors, stakeholders seeking holistic insight into organizational performance. | Broader stakeholders, including investors, regulators, customers, and communities. |

| Reporting Focus | Value creation story integrating multiple capitals: financial, manufactured, intellectual, human, social, and natural. | Performance metrics on environmental impact, social equity, and governance practices. |

| Regulatory Influence | Voluntary but increasingly integrated into corporate governance best practices. | Growing regulatory requirements worldwide with mandatory disclosures emerging. |

| Benefits | Improved strategic decision-making, enhanced stakeholder trust, long-term value focus. | Risk management, reputation enhancement, compliance with sustainability mandates. |

Which is better?

Integrated reporting offers a comprehensive framework that combines financial, environmental, social, and governance (ESG) factors, providing a holistic view of an organization's value creation over time. ESG reporting focuses specifically on non-financial metrics related to sustainability and ethical impact, making it essential for stakeholders prioritizing social responsibility. Choosing between the two depends on whether an organization seeks broad strategic insights with integrated reporting or targeted sustainability disclosures through ESG reporting.

Connection

Integrated reporting combines financial data with environmental, social, and governance (ESG) metrics to provide a holistic view of an organization's value creation over time. ESG reporting feeds critical non-financial insights into integrated reports, highlighting sustainability practices, ethical governance, and social impact. This connection enhances transparency and supports informed decision-making for investors and stakeholders focused on long-term performance and risk management.

Key Terms

Materiality

ESG reporting emphasizes disclosure of environmental, social, and governance factors based on their material impact on financial performance and stakeholder interests, while integrated reporting offers a broader view by connecting financial and non-financial information to demonstrate how value is created over time. Materiality in ESG reporting is often narrower, highlighting specific sustainability risks and opportunities, whereas integrated reporting adopts a more holistic approach, considering diverse capitals such as financial, manufactured, intellectual, human, social, and natural capital. Explore the nuances of materiality in both frameworks to enhance your sustainability communication strategy.

Stakeholder Engagement

Environmental, social, and governance (ESG) reporting emphasizes detailed disclosure of sustainability metrics to meet investor and regulatory expectations, primarily focusing on transparency and risk management. Integrated reporting combines financial and non-financial information into a cohesive narrative that highlights value creation for a broader range of stakeholders, fostering deeper stakeholder engagement and strategic decision-making. Explore further insights on how these reporting frameworks enhance stakeholder relationships and corporate accountability.

Value Creation

Environmental, Social, and Governance (ESG) reporting centers on quantifying a company's sustainability practices and ethical impacts, emphasizing transparency in environmental stewardship, social responsibility, and corporate governance. Integrated reporting combines financial data with ESG metrics to provide a comprehensive view of how value is created over time, revealing the interconnectedness of financial performance and sustainability. Discover how integrated reporting enhances strategic decision-making by portraying holistic value creation beyond traditional financial results.

Source and External Links

What Is ESG Reporting? - ESG reporting is the disclosure of business operations data related to environmental, social, and governance areas, aiming to measure a company's ESG initiatives against industry benchmarks and provide stakeholders valuable insights for decision-making.

ESG Reporting: A Complete Guide - AuditBoard - ESG reporting involves disclosures on environmental impacts like carbon emissions, social factors like diversity and human rights, and governance issues such as board management practices, with a trend toward integrating ESG data into audited financial reports.

What is ESG reporting, and should you be doing it? - ESG reporting is a process where companies publicly disclose performance related to environmental, social, and governance factors, often regulated by frameworks and standards to ensure transparency and combat greenwashing.

dowidth.com

dowidth.com