Crypto tax management involves specialized accounting practices to track, report, and comply with tax regulations on cryptocurrency transactions, which differ significantly from traditional tax compliance. Tax compliance ensures adherence to local, state, and federal tax laws for all financial activities, requiring accurate record-keeping and timely filing. Discover more about how these intersecting fields impact your financial responsibilities.

Why it is important

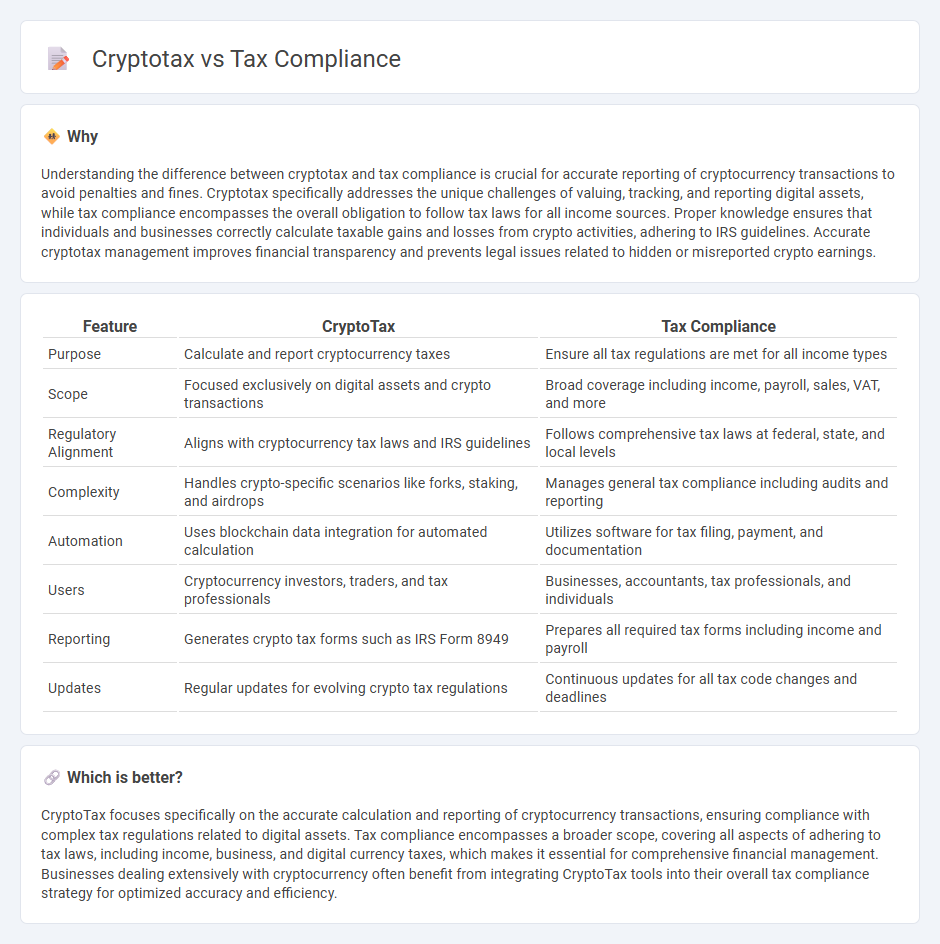

Understanding the difference between cryptotax and tax compliance is crucial for accurate reporting of cryptocurrency transactions to avoid penalties and fines. Cryptotax specifically addresses the unique challenges of valuing, tracking, and reporting digital assets, while tax compliance encompasses the overall obligation to follow tax laws for all income sources. Proper knowledge ensures that individuals and businesses correctly calculate taxable gains and losses from crypto activities, adhering to IRS guidelines. Accurate cryptotax management improves financial transparency and prevents legal issues related to hidden or misreported crypto earnings.

Comparison Table

| Feature | CryptoTax | Tax Compliance |

|---|---|---|

| Purpose | Calculate and report cryptocurrency taxes | Ensure all tax regulations are met for all income types |

| Scope | Focused exclusively on digital assets and crypto transactions | Broad coverage including income, payroll, sales, VAT, and more |

| Regulatory Alignment | Aligns with cryptocurrency tax laws and IRS guidelines | Follows comprehensive tax laws at federal, state, and local levels |

| Complexity | Handles crypto-specific scenarios like forks, staking, and airdrops | Manages general tax compliance including audits and reporting |

| Automation | Uses blockchain data integration for automated calculation | Utilizes software for tax filing, payment, and documentation |

| Users | Cryptocurrency investors, traders, and tax professionals | Businesses, accountants, tax professionals, and individuals |

| Reporting | Generates crypto tax forms such as IRS Form 8949 | Prepares all required tax forms including income and payroll |

| Updates | Regular updates for evolving crypto tax regulations | Continuous updates for all tax code changes and deadlines |

Which is better?

CryptoTax focuses specifically on the accurate calculation and reporting of cryptocurrency transactions, ensuring compliance with complex tax regulations related to digital assets. Tax compliance encompasses a broader scope, covering all aspects of adhering to tax laws, including income, business, and digital currency taxes, which makes it essential for comprehensive financial management. Businesses dealing extensively with cryptocurrency often benefit from integrating CryptoTax tools into their overall tax compliance strategy for optimized accuracy and efficiency.

Connection

Cryptotax directly impacts tax compliance by ensuring accurate reporting of cryptocurrency transactions, which are subject to specific tax regulations. Proper cryptotax calculations help taxpayers avoid penalties and meet legal obligations related to capital gains, income, and transaction disclosures. Integrating cryptotax tools with accounting systems enhances transparency and streamlines compliance with evolving tax laws.

Key Terms

Reporting Requirements

Tax compliance mandates accurate documentation and timely reporting of income, expenses, and gains in accordance with governmental tax codes. Crypto tax reporting requires detailed records of blockchain transactions, including trades, transfers, and crypto-to-crypto conversions, often using specialized software to comply with jurisdiction-specific guidelines. Explore in-depth comparisons and best practices for meeting complex crypto tax reporting demands effectively.

Taxable Events

Taxable events in tax compliance include income, sales, and capital gains, each triggering specific reporting and payment obligations under standard tax laws. In crypto tax, taxable events extend to activities such as token trades, staking rewards, and airdrops, requiring detailed transaction tracking on blockchain platforms. Explore comprehensive guides to fully understand the nuances of taxable events in both traditional and cryptocurrency tax frameworks.

Recordkeeping

Tax compliance requires accurate and organized recordkeeping of all financial transactions, including income, expenses, and asset acquisitions. Cryptotax demands meticulous tracking of every cryptocurrency transaction, such as buys, sells, trades, and staking rewards, to calculate capital gains accurately and avoid penalties. Explore detailed strategies to streamline crypto recordkeeping and ensure comprehensive tax compliance.

Source and External Links

What is Tax Compliance? - This page explains tax compliance as adhering to tax laws, avoiding penalties, and maintaining a positive reputation by disclosing financial information honestly and filing accurate tax returns.

What is Tax Compliance? - It refers to the legal obligation to report income accurately, file tax returns on time, and maintain financial records, ensuring operational resilience and financial credibility.

Tax Compliance Report | Internal Revenue Service - This page provides information on tax compliance reports, which show if tax returns have been filed and taxes paid on time, and how to obtain these reports.

dowidth.com

dowidth.com