Revenue recognition automation streamlines the process of identifying, recording, and reporting income in compliance with accounting standards such as ASC 606 or IFRS 15, enhancing accuracy and reducing manual errors. Statutory reporting automation focuses on generating financial statements and disclosures required by regulatory authorities, ensuring timely adherence to legal compliance and jurisdiction-specific regulations. Explore how these automation solutions transform financial operations and compliance efficiency.

Why it is important

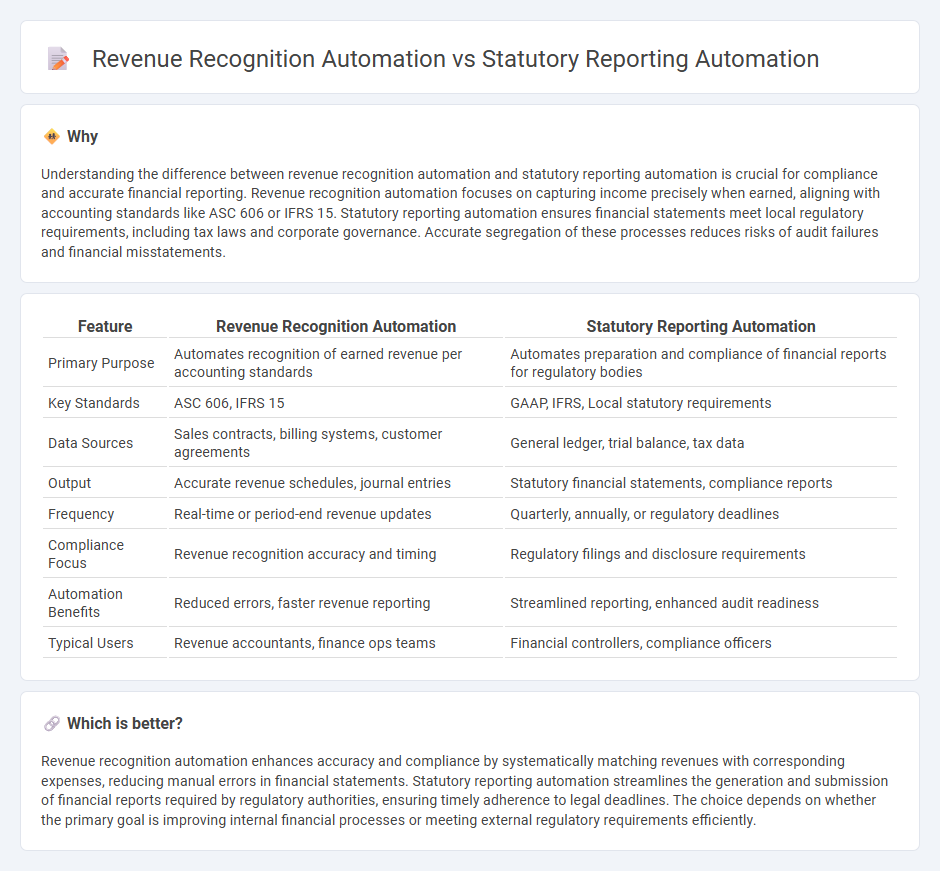

Understanding the difference between revenue recognition automation and statutory reporting automation is crucial for compliance and accurate financial reporting. Revenue recognition automation focuses on capturing income precisely when earned, aligning with accounting standards like ASC 606 or IFRS 15. Statutory reporting automation ensures financial statements meet local regulatory requirements, including tax laws and corporate governance. Accurate segregation of these processes reduces risks of audit failures and financial misstatements.

Comparison Table

| Feature | Revenue Recognition Automation | Statutory Reporting Automation |

|---|---|---|

| Primary Purpose | Automates recognition of earned revenue per accounting standards | Automates preparation and compliance of financial reports for regulatory bodies |

| Key Standards | ASC 606, IFRS 15 | GAAP, IFRS, Local statutory requirements |

| Data Sources | Sales contracts, billing systems, customer agreements | General ledger, trial balance, tax data |

| Output | Accurate revenue schedules, journal entries | Statutory financial statements, compliance reports |

| Frequency | Real-time or period-end revenue updates | Quarterly, annually, or regulatory deadlines |

| Compliance Focus | Revenue recognition accuracy and timing | Regulatory filings and disclosure requirements |

| Automation Benefits | Reduced errors, faster revenue reporting | Streamlined reporting, enhanced audit readiness |

| Typical Users | Revenue accountants, finance ops teams | Financial controllers, compliance officers |

Which is better?

Revenue recognition automation enhances accuracy and compliance by systematically matching revenues with corresponding expenses, reducing manual errors in financial statements. Statutory reporting automation streamlines the generation and submission of financial reports required by regulatory authorities, ensuring timely adherence to legal deadlines. The choice depends on whether the primary goal is improving internal financial processes or meeting external regulatory requirements efficiently.

Connection

Revenue recognition automation enhances accuracy and efficiency in capturing sales data, directly feeding into statutory reporting automation by providing real-time, compliant financial information. Integration between these systems reduces manual errors and accelerates the preparation of regulatory reports, ensuring adherence to accounting standards like ASC 606 and IFRS 15. This connection streamlines the audit process and improves overall financial transparency within organizations.

Key Terms

**Statutory Reporting Automation:**

Statutory reporting automation streamlines compliance by automatically generating accurate financial statements in line with regulatory standards such as IFRS and GAAP, reducing manual errors and saving significant time for finance teams. It integrates with enterprise resource planning (ERP) systems to ensure real-time data accuracy and supports multi-jurisdictional reporting requirements, enhancing transparency and audit readiness. Explore how statutory reporting automation can transform your financial compliance processes.

Compliance

Statutory reporting automation ensures compliance by streamlining data aggregation and generating accurate financial statements aligned with regulatory standards such as IFRS and GAAP. Revenue recognition automation addresses compliance by applying ASC 606 and IFRS 15 guidelines to record income precisely at transaction milestones, minimizing errors and audit risks. Explore how these automation solutions enhance regulatory adherence and operational efficiency in your finance processes.

Regulatory Filings

Statutory reporting automation streamlines the preparation and submission of regulatory filings by ensuring compliance with government-mandated financial disclosures, reducing errors, and accelerating reporting timelines. Revenue recognition automation focuses on accurately capturing and reporting revenue in accordance with accounting standards like ASC 606 or IFRS 15, enhancing precision in financial statements but with less emphasis on regulatory deadlines. Explore how integrating regulatory filings automation can optimize compliance and reporting efficiency in your organization.

Source and External Links

Statutory Reporting Overview for Finance Teams - This article discusses how modern finance teams automate statutory reporting to ensure speed, accuracy, and audit-readiness.

Automated Regulatory Reporting Explained - This blog post highlights the benefits and best practices of automating regulatory reporting, reducing complexity and improving compliance.

Thomson Reuters ONESOURCE Statutory Reporting - This software automates formatting and review processes, providing consistency and efficiency in statutory reporting across multiple jurisdictions.

dowidth.com

dowidth.com